Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThree area hospital groups—St. Vincent Health, Community Health Network and Suburban Health Organization—have agreed to join forces to manage patients’ health and strike new kinds of contracts with employers and health insurers.

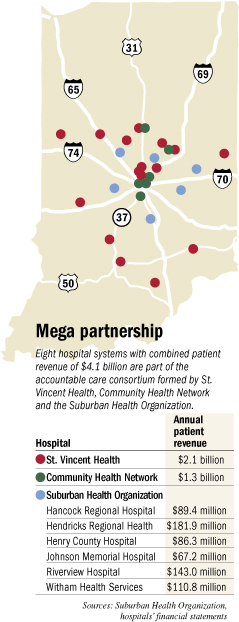

Their joint venture will be a contracting behemoth, second in size only to Indiana University Health, the state’s largest hospital system. Called an accountable care consortium, it includes 32 hospitals, numerous outpatient facilities and nearly 1,700 employed physicians.

Caponi

CaponiOver time, the hospital systems hope all their contracts—which last year brought in $4.1 billion in patient revenue—run through the new entity. And they hope those contracts are structured to financially reward the hospitals for keeping patients healthier so they spend less on health care.

The consortium is the most aggressive effort yet by Indianapolis hospitals to put three key strategies to work: contracting directly with employers rather than only through insurance companies, offering a narrow network of hospitals and doctors rather than the broad choices in most health insurers’ plans, and promising to be financially accountable for the health of an employer’s workers or an insurer’s patients.

“If you’re going to reduce that expense and have greater accountability, you’ve really got to limit it to a narrower network,” said Vince Caponi, CEO of Indianapolis-based St. Vincent Health, which brings 19 hospitals to the venture. “So I think this should be attractive to both employers and insurers.”

St. Vincent and Community are two of the eight hospital systems that own Indianapolis-based Suburban Health, a provider network that negotiates payment rates with health insurers on behalf of all the hospitals. But the new entity will bring the group of hospitals even more tightly together, including an integration of their clinical teams.

The fact that St. Vincent and Community are joining forces harkens back to 1994, when the two organizations formed a joint-operating agreement and started to integrate their operations.

Mills

Mills“It’s like déjà vu. I am having flashbacks,” said Sheri Alexander, senior vice president of employee benefits at the Indianapolis firm Gregory & Appel. Alexander helped St. Vincent and Community try to merge their employee health plans in the 1990s and now is helping them to use the new accountable care consortium as the network for their employee health plans.

But the marriage of the 1990s ended quickly. Many have said Bill Corley, then CEO of Community, bristled under the structure of shared power. Corley, for his part, has said St. Vincent’s CEO at the time, Doug French, tried to make Community into a Catholic hospital.

“Our board of directors basically said, ‘Hey, did you guys read the agreement?’” Corley said in a 2008 interview. “It basically said, in straightforward language, ‘Community is not going to try to make St. Vincent non-Catholic and St. Vincent is not going to try to make Community Catholic.’”

Neither Corley nor French is involved in either hospital system now. And Caponi and Bryan Mills, the CEO of Community Health Network, said the past played no role in forming the new joint venture.

“It was a non-issue,” Mills said. “This is a different time. These are different people.”

‘Meeting of the minds’

The latest agreement got started about a year ago when Caponi and his top managers traveled from their office near West 86th Street to visit Mills at his office on North Shadeland Avenue.

Both Caponi and Mills knew that the two other hospital systems in the city—Franciscan St. Francis Health and IU Health—already were building up accountable care organizations of their own.

Caponi and Mills were looking to see if they had enough in common to form a partnership. They quickly concluded they did.

“We didn’t go looking for others. I thought we had a meeting of the minds,” Mills said.

In early January, Julie Carmichael, president of Suburban Health, joined the discussions.

In early January, Julie Carmichael, president of Suburban Health, joined the discussions.

The other hospitals that own Suburban Health and are involved in the consortium are Hancock Regional Hospital, Hendricks Regional Health, Henry County Hospital, Johnson Memorial Hospital, Riverview Hospital and Witham Health Services. Community joined the organization last year via its acquisition of Indianapolis-based Westview Hospital.

In addition, Major Hospital in Shelbyville and Rush Memorial Hospital in Rushville could join the consortium if they choose to do so.

“Community’s very similar to Suburban and St. Vincent,” Carmichael said. “It just felt natural having them in the discussions.”

St. Vincent, Community and Suburban are looking to hire a CEO to run the consortium, which will have a small staff.

The trick for that person will be to get the shared vision of the leaders to permeate all three organizations, said Alex Slabosky, who retired as president of IU Health Plans last year after helping that hospital system launch its own employer health benefits product that was limited to IU Health doctors and hospitals.

“The issue is, can they deliver on savings to the customer?” he said. “And that requires changing philosophy, changing processes and procedures, changing a culture—a culture that has been around for decades. Changing it within one organization is difficult. Changing it in three organizations is more difficult.”

Shifting incentives

Currently, nearly all insurance contracts pay hospitals and doctors pre-negotiated fees for each service they perform, which gives them an incentive to do as many procedures as possible.

The theory behind accountable care organizations—putting doctors and hospitals at risk of losing money if they provide too much care or allowing them to earn a bonus if they reduce patients’ need for care—is intended to encourage them to cut out waste.

And the accountable care concept assumes that doctors can eliminate significant waste in health care by communicating better among themselves and agreeing to evidence-based practices of care.

Teams of doctors from St. Vincent, Community and Suburban are working to do just that. They have been meeting recently to hammer out common standards and procedures for the consortium.

Accountable care organizations received a big boost from the 2010 health reform law, which called for the federal Medicare program to sign “shared savings” contracts with groups of doctors and hospitals that agreed to be financially accountable for maintaining the health of a specific population of patients.

Franciscan and IU Health are participating in those Medicare programs, but the new consortium formed by St. Vincent, Community and Suburban has no plans to follow suit.

Mills said that the consortium might offer a Medicare Advantage health insurance plan for seniors down the road.

Eliminating waste would be attractive to self-funded employers, said Alexander, the health benefits broker, because they are fed up with ever-rising costs in their health plans.

But St. Vincent, Community and Suburban will have to be able to offer a price to employers competitive with the prices now offered by major health insurers like Anthem Blue Cross and Blue Shield, as well as promise the reduction of waste down the road.

“It needs to be competitively priced and with a value proposition,” Alexander said. “They need to have a compelling story.”

The consortium expects to sign contracts with employers next year for the employee benefits they offer in 2014. The group also has been having discussions with health insurers to see if they are interested in negotiating new kinds of contracts.

The consortium is open to different kinds of arrangements, so long as the contracts set goals for patient health outcomes and overall spending—then let the consortium share the savings or the losses.

The two largest health insurers in Indiana, Indianapolis-based Anthem and Minnesota-based UnitedHealthcare, both have said they are interested in forming contracts with accountable care organizations—which would be a major break from their recent practice of including as many hospitals and doctors as possible in their health plans.

The key to getting employers to limit their workers to a smaller selection of doctors and hospitals is having prices at least 10 percent lower than the prices of existing health plans that offer access to nearly all doctors and hospitals, said Dr. David Lee, Anthem’s vice president of health care management.

Alexander

AlexanderBut with hospitals generating profit from their operations of just 3 percent to 5 percent, they would have to find significant savings before they could produce that kind of price cut.

Vicki Perry, CEO of locally based Advantage Health Solutions Inc., said she’s skeptical that a significant number of employers will limit their workers’ choice of doctors and hospitals.

“The largest payer in Indiana markets on the fact that they have the broadest [options], and they have virtually everybody in their network,” she said, referring to Anthem. “And it is the preferred choice by most employers, because it reduces the noise of, ‘Well, my doctor’s not in the health plan, what are you doing to me?’”

Advantage, which is partly owned by St. Vincent, will lend its insurance expertise to the new consortium, but exactly how and in what ways is still being worked out, Perry said.

Ed Abel, a hospital accountant at Indianapolis-based Blue & Co., also is skeptical that hospitals—even a giant group of them like the St. Vincent-Community-Suburban consortium—will be able to secure direct contracts with large numbers of employers.

That’s because so many employers—including his own company—have workers in multiple cities, including outside of the state. Hospital systems will have a hard time being able to serve far-flung employees, even if they fully cover central Indiana.

“I don’t know a single hospital that doesn’t just salivate over the opportunity because they’re able to lock in a certain amount of business,” Abel said. But, he added, “What they run into time and time again is that, if you’ve got an employer that has multiple locations, you have to cross state lines in order to offer somebody a product. It gets very difficult.”•

Please enable JavaScript to view this content.