Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowAll parents hope to teach their kids the value of money. Few end up successfully investing hundreds of millions of dollars

together.

But for a handful of top local teams, wealth management is a family affair. Each began their financial

lessons at home around the dinner table. Once the children were grown, they all evolved parental relationships into professional

ones. And their success stories speak for themselves.

Locally based Cooke Financial Group of Wells Fargo &

Co., for example, was founded in 1969 by patriarch John Cooke, 70, who started out as a stockbroker. Today, he shares the

managing director title with sons Chris, 44, and Brian, 42. As a team, they manage $1 billion for wealthy individuals.

Another local financial advisory team involves 73-year-old Jack Klausner and his son, Jonathan, 42. Founded in 1958

as part of Thomson McKinnon, the team now manages about 500 accounts totaling $700 million under the moniker the Klausner

and Duffy Investment Group at UBS. Jonathan Klausner has been working alongside his father since 1992.

The Auer

Growth Fund was organized more recently, but father Bryan Auer, 73, and his sons Bob and Paul have been managing money together

with spectacular returns for more than two decades. Starting in 1987, they took $100,000 Bryan Auer had saved in his IRA and,

by 2007, grew it into $30 million. Using their same investment formula, two years ago they launched the Auer Growth Fund,

a locally based mutual fund. It now has assets topping $159 million.

Indianapolis boasts quite a few top father-son

money management teams. Dave Knall and his son Jamie lead the local office of St. Louis-based Stifel Nicolaus and Co. Don

Goelzer founded locally-based Goelzer Investment Management in 1969. Now his son Greg is CEO. William Salin II is chairman

and CEO of locally-based Salin Bank, which his father started in 1983.

It’s not uncommon for top money

managers to groom their children to take over the businesses, said Michael White, president of Radnor, Pa.-based financial

services consultancy Michael White Associates LLC. White’s dozens of well-known clients include American Express, Bank

of America, Fidelity, Merrill Lynch, Raymond James and Wachovia.

Lengthy transitions

But

a successful generational transition invariably takes years.

“Obviously, this isn’t something that

happens overnight. You don’t just bring your kids in, get ’em licensed and turn ’em loose,” White

said.

“You’re a bat boy, a second stringer sitting on the bench. Eventually, with practice and hard

work, you’re on the field playing.”

At all three local businesses, the father-to-son changeover is

decades in the making.

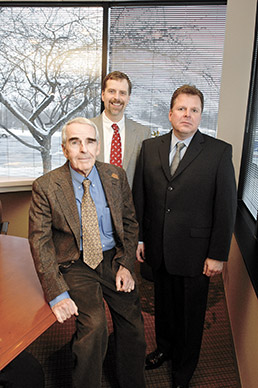

Bryan Auer, left, is passing decades of money management experiences to sons Bob Auer and Paul Auer. (IBJ Photo/Robin

Bryan Auer, left, is passing decades of money management experiences to sons Bob Auer and Paul Auer. (IBJ Photo/RobinJerstad)

“I attribute a ton of our family’s success to Dad’s willingness to be a great partner,

and not always be Dad,” Chris Cooke said. “And I always attribute a ton of our success to Dad’s inspiring

interest in investments from early on, and a work ethic as well.”

Chris Cooke remembers many mealtime discussions

growing up at home about complicated financial topics, like the difference between Ginnie Mae and Fannie Mae. And to this

day, he dreads yellow legal pads because that’s where his dad kept single-spaced lists of the chores planned for “every

Saturday of my life.”

“I woke up knowing these were the 15 things we’d do, and until they were

done, you didn’t visit your friends, watch TV or play video games. Friends would call the house to see if the chores

were done before they’d come over, or they’d be roped in,” Chris Cooke said. “You’d wake up

and learn, if I have a plan and accomplish it, there’s a reward for it. It’s a small life lesson, but life’s

like that.”

Chris Cooke began working with his father 17 years ago, after earning both a law degree and,

thanks to a stint at Ernst & Young, his CPA. His brother, a certified investment management analyst, followed about two

years later. At first, Chris Cooke remembers, his father took the lead in meetings with clients, then slowly swapped roles

until clients didn’t care which one was in the room anymore.

But to this day, Chris Cooke said, his father

provides the Cooke Financial Group an advantage many wealth managers lack: deep historical perspective. Chris Cooke can remember

running into his father’s office many times excited about a hot stock, only to be told to gather more research. After

all, who’s likely to know more about it, his father would ask, you or somebody who’s paid to spend his entire

career following the industry and regularly writes 30-page reports about it?

Jonathan Klausner recalls the day

his dad came to visit his elementary school classroom. The other kids were immediately impressed with the dads who worked

as policemen or firemen. But Jack Klausner, wearing his suit and tie, managed to equally wow them by talking about investments

in products they knew and loved, like Coca Cola. His birthday gifts would always include a couple of shares of stock, which

Jonathan Klausner then followed in the newspaper right along with the comics and the sports scores. During snow days and summer

breaks, he filed paperwork in his father’s office and played with the stock quoting machine.

Jonathan Klausner

Jonathan Klausner Jack Klausner

Jack KlausnerLike the

Cooke boys, Jonathan Klausner didn’t join his father straight out of school. Instead, he took a job in Atlanta with

Prudential Securities. It allowed him to develop his own work ethic and habits. The experience also taught Jonathan Klausner

the value of access to his father’s book of clients. To build his own book in Atlanta, he’d had to make cold calls

across the Southeast.

There have been plenty of reminders since. Jack Klausner’s half-century of knowledge

offers a calming presence both for clients and his team in any crisis. It was particularly helpful after 9/11, Jonathan Klausner

said, and at the height of the financial crisis last year.

“To have that anchor or safety net of a mature

business behind you, it’s invaluable,” Jonathan Klausner said.

It’s a resource Klausner and

Duffy likely will enjoy for many years to come.

“He still comes in every day. He must read at least two

newspapers and maybe more. He gets on the phone, talks to clients, eats his lunch at his desk as he has the last 50 years

running, and sometime during the afternoon he makes a decision to go home,” Jonathan Klausner said. “In the summertime,

the golf course calls his name a little more often. But I don’t foresee him ever completely hanging it up.”

Bryan Auer also still comes to the office every morning, said his son Bob. Their story is unusual in that the pair

built their $159 million in assets together starting toward the end of Bryan Auer’s first career as a self-employed

sales representative for health and beauty aids.

Back in 1987, Bob Auer was proud to be working as a broker for

Dean Witter. His dad had been personally investing with middling results for years. But when Bryan Auer brought his son $100,000

in retirement money to manage, he didn’t want to rely on Dean Witter’s research.

Instead, he planned

to divide the cash into 100 blocks of $1,000, then pick stocks exclusively based on three factors: each company’s sales

must be up at least 20 percent compared with the same quarter a year ago; its profits during the same period must be up 25

percent; but the price-to-equity ratio couldn’t rise above 12. At regular intervals, the worst performers that couldn’t

keep up those metrics were discarded.

The key was discipline about when to sell. As soon as a stock’s price

had doubled, Bob Auer said, it had to leave the portfolio—even if it was hot and on its way up. If, and only if, it

still fit the original investment parameters, it could be repurchased.

Using this methodology, eight of the

chains of buys and sells traceable back to the original 100 stocks made $1 million, and two chains made $2 million. Two years

ago, Bob Auer used his father’s technique to launch the Auer Growth Fund, one of just three mutual funds headquartered

in Indiana.

“I take no credit for the system. He developed it, the screening process,” Bob Auer said.

“People, when they hear what happened, they don’t believe it. They assume you bought Microsoft and got to be the

lucky monkey.”

Due diligence on children

White, the financial services consultant,

suggests a few standard litmus tests to verify money managers’ children are as strong as their well-known fathers tout.

Sharing a last name isn’t enough to prove a son is sharp at selecting stocks or bonds. Clients should feel no qualms

about expecting him to earn formal money management education and professional designations, like the CFP or CFA, before taking

over their account.

It’s perfectly OK, White said, to ask for client referrals, preferably accounts the

son attracted and serviced on his own. And it’s always important to understand how any money manager is compensated—whether

via portfolio management fees or through a commission percentage on the investment products he sells.

In some

cases, White said, the conversion from father to son can actually produce better results. He likened it to a dentist who practices

well for half a century, then sends his son off to dental school to learn all the most modern tools and techniques.

“You think sometimes there will be a lack of experience. Then you find out that the son … [knows] procedures

and medications that will take care of you better than his father, because his father couldn’t even keep up on the literature,”

White said. “You’re not necessarily going to find a clone of the father or the mother. Sometimes it can be an

improvement.•

Please enable JavaScript to view this content.