Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowCredit unions last year posted record earnings, thanks largely to lower loan-loss reserves, as well as to growing memberships, growing debit cards, selling off mortgages and stealing business loans away from banks, their arch rivals.

But keeping up the scorching comeback will be difficult, and some small credit unions might merge to cut costs.

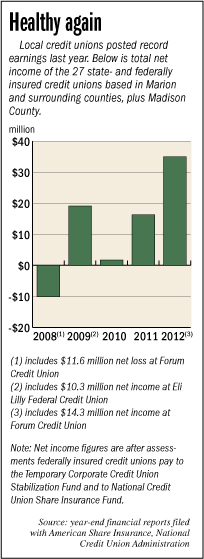

Preliminary data from the Indiana Department of Financial Institutions shows the 27 credit unions in the metro area enjoyed a whopping 128-percent earnings gain—to $33.8 million in 2012.

Statewide, net income rose 45 percent, to $133 million, and the National Credit Union Administration said credit union earnings nationwide rose 36 percent, to $8.5 billion—the highest ever for the industry.

Statewide, net income rose 45 percent, to $133 million, and the National Credit Union Administration said credit union earnings nationwide rose 36 percent, to $8.5 billion—the highest ever for the industry.

Banks saw profits rise to their second-highest level, also due to the government’s requiring less money in reserves to hedge against bad loans.

“We expect net income to

increase for credit unions in the next few years. However, the rate at which it increases is likely to slow,” said Andrew Bolton, a senior analyst at Washington, D.C.–based Callahan & Associates, which consults for credit unions.

Federal Deposit Insurance Corp. Chairman Martin Gruenberg said recently that the lower provisions accounted for more than 90 percent of the improvement in the banking industry’s pretax income.

“While further reductions in loss provisions are possible, most of the benefits to earnings from lower provisions have already been realized,” Gruenberg said.

“Earnings” is a bit of a misnomer for the not-for-profit credit unions. Rather than flowing to shareholders, as at a bank, net income is used to build capital reserves and generally flows back to members in the form of better deals on loans and savings accounts, for example.

Credit unions pay sales, property and employment taxes. But they’re exempt from paying corporate taxes, unlike banks. As a result, credit unions as such often beat commercial banks with more consumer-friendly interest rates.

Loss reserves

Since the financial meltdown in 2008-2009, credit unions have had to plow much of their earnings into increasing loan-loss reserves as more customers defaulted on loans.

Nationwide, the reserves soared from $3.2 billion in 2007 to $9.6 billion in 2009 and then back down to $3.6 million last year as credit quality improved.

The trend is mirrored among state-chartered credit unions in Indiana.

The institutions diverted earnings to sock away $59 million in reserves in 2009 and $46 million in 2010.

But with loan portfolios improving, they throttled back to $26 million by the end of 2011, according to the Indiana Department of Financial Institutions. Data for 2012 have not yet been published.

Business lending

Many credit unions have been growing revenue by stepping into bankers’ turf.

The 27 credit unions tracked by the Indiana Credit Union League that operate in the Indianapolis area—including some based outside the area—enjoyed a nearly 12-percent increase in business lending last year, said President John McKenzie.

The credit unions responded to increasing demand when commercial lenders were still digging out from the crash a few years ago.

More business lending—along with smaller allowances for loan losses, general loan growth and an uptick in membership—helped fuel an earnings boost last year at Indianapolis-based Financial Center Credit Union.

Among recent business loans made by the 57,000-member institution was one for the Pierogi Love food truck, a business recently launched by a member.

Under federal law, most credit unions are capped at lending no more than 12.25 percent of their assets.

“That’s an area where we continue to grow,” said Annette Roy, vice president of membership development at Financial Center, where earnings last year grew 40 percent, to $2.1 million.

Mortgage refinancing

Another big gainer last year was Eli Lilly Federal Credit Union, better known as Elfcu. The 42,546-member institution saw net income double to $8.9 million from $4.3 million in 2011.

Part of it came from refinancing $175.3 million in mortgages, which helped drive Elfcu’s second-biggest lending year in its 83-year history. It also put its sales acumen to work in acquiring 680 new credit card holders.

Many credit unions would kill for Elfcu’s member base, which includes stable Lilly employees earning above-average salaries. Elfcu sees opportunities in serving the more sophisticated financial needs of this member base.

The $1 billion-asset Elfcu frequently conducts financial seminars at the workplace, offering services such as the Pete the Planner program to help with retirement planning and wealth management.

The credit union has been able to plow much of its consistently positive earnings into deals for members. For example, there’s a high-interest checking option that pays 4-percent interest on a member’s first $1,000. It’s a king’s ransom in this era of microscopic savings rates.

“Our products are focused on saving members money. It’s typically a win-win,” said Joseph Hasto Jr., Elfcu’s chief financial officer.

Diversified membership

Elfcu has also grown by diversifying its member base beyond Lilly over the last five years. Now, employees of 40 companies, including Express Scripts and financial services company OneAmerica, are in its field of membership

Staying with a select group of employers, as opposed to becoming more of a community-based credit union where anyone with a heartbeat can join, has helped the credit union better zero in on its members’ needs, in addition to lowering risks.

For example, it knows when certain employers issue their annual employee bonuses. So the credit union can roll out a special savings deal just in time for members when those checks are handed out.

That phenomenon is a part of the huge increase in net income last year at the $969-million-asset Forum Credit Union—zooming to $14.3 million from $4.7 million in 2011.

Consider that in 2008, as the economy faltered, the region’s largest credit union recorded a net loss of $11.6 million.

The credit union also benefited last year from mortgage refinancing, said Andy Mattingly, chief operating officer at Fishers-based Forum.

McKenzie said the group of 27 credit unions he surveyed in central Indiana registered an 8-percent growth in auto loans and 3-percent jump in real estate loans last year.

And, oddly enough, the economic downturn to some extent actually helped pique interest in NorthPark and other credit unions.

Ill will toward big banks because of federal bailouts they received as they zealously foreclosed on homes helped drive some bank customers to the credit union. Its member base has roughly doubled since the late 2000s, to 6,800 members.

“There was a flight to integrity,” Robbins said of the migration.

Tightened belts

Unlike banks that have had to dig out of a mountain of collapsed commercial loans, credit unions are still focused mainly on the working class. They offer car loans, savings and sometimes products such as residential mortgages and student loans.

But even for credit unions whose members work at relatively stable employers, the atmosphere over the last five years has been challenging. Some of those members stopped borrowing money when the economy faltered, and investment yields often were unfavorable for financial institutions, said Mark Powell, credit union supervisor at the Indiana Department of Financial Institutions.

Indianapolis-based NorthPark Community Federal Credit Union, whose field of membership includes Dow Chemical Co. and affiliates, lost $705,413 in 2009.

Last year, however, net income rose to $218,290.

“Trust me. It feels better today than three or four years ago,” said NorthPark CEO Dan Robbins.

Like many other institutions, NorthPark management cut expenses. It conducted a thorough review of vendors and invested technology to make the credit union more efficient.

Staffing fell to 19 people from 23, and those who remained were cross-trained to perform dual roles that improved service.

Powell said credit unions “have tightened their belts considerably” in recent years. State-charted credit unions slashed expenses by $10 million in each of the last two years.

“It looks like they’ve taken to hearing what regulators have been telling them; that is, they have to become more efficient.”

Elfcu has also invested heavily in electronic banking options, such as those that work with smartphones, enabling remote deposit by taking a photo of a check.

Despite having 42,500 employees in virtually all 50 states, it has only seven branches. It’s teamed with other credit unions where members can share branches as part of the cost-savings strategy.

“We have a pretty low expense model. We rely on electronic [banking] when we can,” Elfcu’s Hasto said.

Mergers ahead

As for whether a leveling-off could even portend additional credit union mergers, “I think we’ll just see perhaps the pace pretty steady, maybe picking up slightly,” added Bolton, the consultant.

A number of smaller credit unions have been merging to take advantage of scale, or in response to job cuts at companies where most of their members work.

For example, Indianapolis-based Horizon One Federal Credit Union, a $64.5 million asset institution that served the now-closed General Motors Corp. metal stamping plant, merged into Financial Center Credit Union on April 1.

The number of Indiana-based federally chartered credit unions fell last year to 137 from 141 in 2011, according to the Department of Financial Institutions.•

Please enable JavaScript to view this content.