Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Five leaders in law, recycling, clean technology and public policy participated in IBJ’’s “Going

Green” Power Breakfast on Feb. 18 at The Marriott downtown.

The discussion came as Indiana considers economic opportunities in energy and climate change.

The panelists:

The panelists:

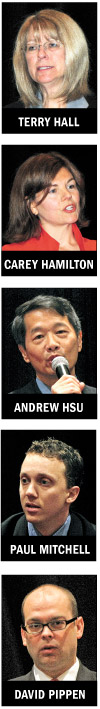

Terry Hall, head of the clean energy and carbon markets team at Indianapolis law firm Baker & Daniels.

Carey Hamilton, executive director of the Indiana Recycling Coalition.

Andrew Hsu, head of the Lugar Center for Renewable Energy at IUPUI.

Paul Mitchell, president and CEO of Indianapolis clean-tech consortium Energy Systems Network.

David Pippen, senior policy director (now general counsel) to Gov. Mitch Daniels.

Moderating the panel was IBJ reporter Chris O’Malley. The following transcript was edited for space.

————————————–

Corporate filings and litigation

IBJ: Terry Hall—tell us about the new Securities and Exchange Commission guidance on how companies

must disclose climate risk, and the litigation risk for high-emitting companies?

Hall: There’s been a disclosure requirement for public companies for quite some time related to their

10-Ks and 8-Ks, essentially describing risks the company sees and opportunities it sees. In January, the SEC announced it

was going to put in interpretive guidance to public companies related to encouraging them or requiring them to disclose risks

associated with climate change. In February it actually issued that guidance, a new section under the SEC guidelines. It essentially

tells public companies—but I would advise private companies to take this into consideration, too—to assess the

effect of domestic law and regulations, whether it’s actually existing or whether it’s pending.

And if you can’t make that determination, which is where we are right now, you have to assume in your disclosure that

the regulation or the law is going to be passed, and so you make a disclosure as far as what kind of effect that may have

on your business. Also in the management section you have to address how the risks and opportunities related to climate change

or global warming will affect your business.

That can be if you are a major manufacturer and you have a lot of facilities on the coastlines and the coastlines are expected

to see greater, more severe catastrophic climate events, then you’re supposed to take that into consideration. But it’s

not all gloom and doom. If you are a company that sees an opportunity in the changing industries and the changing markets

related to either pricing carbon or the renewable energy industry, then you are to disclose those opportunities as well.

Finally, if you are an international company and subject to international treaties or regulations or the laws of other countries,

you are supposed to make a disclosure related to the risks and opportunities as you operate overseas, and also for foreign

companies registered here in the United States, they also need to make the same kinds of disclosures.

————————————–

Cap-and-trade

IBJ: If Congress does not pass cap-and-trade legislation, what might the Environmental Protection

Agency try to accomplish in the form of regulation?

Hall: When my clients talk to me, either they’re in the renewable energy business or they’re

not in the renewable energy business, but they’re potentially a large carbon emitter or they are just concerned about

it. The advice that I give depends literally these days on the day as to what’s going on related to federal legislation,

or if they’re in a particular region. That uncertainty causes a lot of disruption in business, and the clients that

I’m talking to, whether they’re utilities or manufacturers, at some point we just need a resolution. We need some

kind of basis to make long-range and even short-range business decisions. One way to look at this is that a lot of the rest

of the industrial world is going forward with a price on carbon and a clean energy economy focused on renewables, focused

on reduction of emissions.

Here in the United States we are struggling through a conversation that democracies often have related to if we are, when

we are, what we are, when we’re going to do it.

In Congress, a bill passed in the House related to carbon regulation, and in the Senate there are two bills proposed and

they’re very different. The second one is getting a lot of traction. It’s not cap-and-trade, it’s called

cap-and-dividend. And then there’s the EPA.

The EPA has authority under the Clean Air Act to regulate air pollutants. Under the Bush Administration the EPA was asked

to determine whether greenhouse gases were a pollutant. The EPA made a determination that it was not. The Supreme Court in

2007 essentially overturned that regulatory decision and said, “No, you can go back and look at whether you can regulate

greenhouse gases under the Clean Air Act.” The EPA under the Obama Administration went back, looked at that, determined

that it did have the authority to regulate greenhouse gases under the Clean Air Act.

Beginning in January of this year, all businesses and industry that is emitting carbon dioxide or other greenhouse gases

have to start counting their emissions because they’re going to have to report to the EPA for the first time in March

2011. The EPA also made the determination that greenhouse gases posed an endangerment to society, and so it’s marching

forward with regulation. And if Congress doesn’t act, the EPA will begin to regulate under the Clean Air Act, which

unfortunately is not a very good mechanism for regulating.

Recycling

IBJ: Carey (Hamilton), why does this region seem to lag many other big metro areas as far as

rolling out a comprehensive recycling program?

Hamilton: We have not had the political will across party lines for decades in central Indiana to move the

ball forward. I do think that is changing. I know that our (city) Office of Sustainability is working proactively right now

to look for ideas, to solicit ideas from the private sector to figure out how we can advance recycling programs. In particular,

in Marion County, residential recycling is a big component of that, so we are excited about that. I can point to other communities

in Indiana that are doing much better than us.

For example, Valparaiso, a mid-size city in Porter County, has a 50-percent recycling rate. In Indianapolis, we’re

in the single digits by our own estimations. We don’t do a great job of collecting data in Indiana, so that’s

something we’re going to be working on. We’re also excited about new investments in recycling infrastructure,

certainly across the country, but also in central Indiana. All of our haulers, processors of recyclable material, are making

some sort of investment. Most recently Republic Services has put $7.3 million in trucks and other equipment at new facilities.

That’s just one example.

And last year, our Legislature passed a very progressive electronics recycling bill. House Enrolled Act 1589 asked manufacturers

of electronics to pay for a certain amount of recycling of those toxic materials in Indiana, so that’s a big step, really,

for when we look at our waste stream for the state of Indiana.

IBJ: Are there a couple of things you’re pushing to get done this year?

Hamilton: Broadly, we want to communicate a new and powerful message. There’s some very exciting research out of EPA

last year about recycling and energy efficiency and thus carbon emissions. EPA looked at U.S. greenhouse gas emissions in

a new way. Historically they had looked at sectors, for example the two biggest were transportation and electricity. They

took a new approach and said, “Let’s look at systems.” When they looked at materials management, including

food management, they found that 42 percent of U.S. carbon emissions come from those areas that can be reduced, reused, recycled

and composted.

So we are hopeful that in whatever of these complex dialogs that are going on Capitol Hill that the end result will be that

recycling programs and composting programs can get credit for their reductions in carbon emissions. This is pretty powerful

for Indiana where we’ve got a lot of room to improve.

Clean technology commercialization

IBJ: Paul Mitchell, could you give us an overview of what the Energy Systems Network is working

on these days?

Mitchell: ESN is a nonprofit consortium of large, Fortune 500 companies, emerging technology firms, universities,

research institutions that are working together to identify, launch and implement projects that will accelerate the path to

commercialization for new clean technologies.

We have three projects underway, all three are moving from the planning to the implementation phase in 2010 and 2011. One

that maybe is the most interesting is Project Plug-IN. It is an effort to make Indianapolis a leader in transportation electrification,

which is a term that’s becoming more of a buzzword in the clean tech industry. This means vehicles powered at least

in part by batteries and charging off the grid to power those vehicles.

We’ve been working now for a year with two utility companies here in the Indy metro area, Duke Energy and Indianapolis

Power & Light. I want to applaud the groundbreaking work that they’ve done to really become a leader in thinking

about how a utility can offer charging structure to consumers who want to buy these cars.

If I’m going to buy a car that I have to plug into the grid, I have to have places that I can plug in at home and work,

places that I might go and visit, like an airport or a Simon mall. In addition to our utility partners we’ve had several

auto companies that have joined Project Plug-IN. First and foremost I want to mention Think. This is a new company to Indiana

that’s looking to manufacture a full electric vehicle in Elkhart. It’s a Norwegian firm making its North American

operations here in the Hoosier state. Smart, which is the little, teeny car that you’ve seen driving around, (is) coming

out with an EV vehicle and they’ve made Indianapolis the launch market for that vehicle, their first launch market in

North America, as a part of Project Plug-IN.

And also Nissan. Some of you may have heard that Nissan is coming to market with a vehicle called LEAF. This also is a full

electric vehicle coming to market at the end of 2010 or beginning of 2011. Indianapolis will likely be a launch market for

that vehicle, as well. We’ll have more to say with the folks from Nissan in coming months about that vehicle and start

to introduce it to Hoosiers who hopefully will buy this car in the near future.

Also Navistar, a major truck manufacturer, is working on an electric vehicle truck.

So we have all the right players. What you’re going to see in Indianapolis in the next year, year-and-a-half, is initially

about a hundred vehicles coming to market as a demonstration, driving around, being used by the State of Indiana for fleet

operations, the City of Indianapolis perhaps for fleet operations.

Some of our partners like Simon are interested in using this in their operations. You’re also going to see about 500

charging sites around the city at different persons’ homes, parking facilities, airport, et cetera. So things are changing.

And that’s going to happen hopefully with our other two projects, Hoosier Heavy Hybrid Partnership and Micro-Grid Project.

————————————–

Manufacturing opportunities

IBJ: Paul, we hear a lot about companies, such as battery maker EnerDel, that hope to employ hundreds

making lithium-ion battery packs. But can you give us a little idea about how traditional manufacturers around the state have

responded to opportunities in the renewable energy or the hybrid markets? Are they waking up to this opportunity?

Mitchell: I think the answer is yes. They’re certainly waking up to the opportunity. It’s too

early to tell how many of them will actually benefit from this new clean tech economy. Indiana’s the most manufacturing-intensive

state in the union. As much as 30 percent of our gross state product is tied in some way to manufacturing. So the fact that

we make things and we make them well bodes well for our chances to be a leader in the clean tech space because clean technology

is mostly about manufacturing products, cars, batteries, smart meters, et cetera. We start from a good position in our manufacturing

know-how.

The challenge for your mom-and-pop machine shops across the state is that transitioning from perhaps making things for the

auto industry to making things for the wind industry, while it sounds like it may be a logical step, there are barriers to

entry. It can be very expensive to acquire the capital and tooling to upgrade your facilities to be even able to produce these

kinds of products.

One firm has spent as much as $50 million in Michigan to transition from the auto industry to the wind industry. Part of

that is just the scale and scope of the equipment. You think about an automobile. You’re making a gearbox for a car

and it may be this big and you’re making a gearbox for a wind turbine and it’s bigger than this whole stage. The

barriers to entry in terms of upfront costs are significant.

The other thing is, as Terry mentioned, the uncertainty in the market. While it’s a little easier for larger firms

to hedge their bets and think about putting one foot into the clean tech space, when you’re a small organization and

you’re living month to month or quarter to quarter and you’re thinking about spending millions of dollars to move

into a new industry, you want to have some certainty that those customers are going to be there.

So I think Indiana is as well positioned as any state in the country to be an absolute leader in the clean tech space. I

think the jobs can trickle down, investment can trickle down, not just from our large corporations that ESN often is known

for working with but down to smaller, Tier 2, Tier 3 suppliers. But it’s going to take a little more certainty in the

marketplace and some access to low-cost capital for them to really get into the business.

Promising technologies

IBJ: One of the best-kept secrets is the Lugar Center for Renewable Energy. Dr. Hsu, what are some of

the most promising technologies that you’re working on?

Hsu: The Lugar Center is a university research center on the IUPUI campus funded by the university. Its primary

mission is, of course, research. But it is also involved in education, public outreach, as well as technology transfer. In

terms of education we just had an energy engineering bachelor’s degree program approved by the Purdue Board of Trustees.

It’s going up for approval to the Indiana Higher Education Commission and it’s going to be one of the first energy

engineering degree programs from a major university.

And we’re working with several small companies trying to commercialize our technology. We’re involved in several

areas, the most popular one, of course, would be solar, wind and biofuels. And then there are areas that may not be considered

renewable energy, per se, but they’re related technology. Many of you probably have heard horror stories about lithium-ion

batteries catching on fire in people’s pockets or on the desktop or laptop. So one important project that we’re

working on, sponsored by the Navy, is to study the safety and how to prevent hazardous accidents with lithium-ion batteries.

Another area we’re active in is biofuels. The production of bio-ethanol we know is very controversial—food production

competition with fuel production. The use of corn as a source for fuel has been criticized by many. The faculty at IUPUI,

especially in this case, at the School of Medicine, is working on genetically-engineered yeast for the production of cellulosic

ethanol. So instead of use using corn seeds we could use cobs, stover, leaves or grass.

And one near-term application, a (bio-fuels) company, Poet, is interested in using the same yeast for current corn ethanol

production plants. So if you have an existing corn production, ethanol production plant and you use this yeast, it’ll

double the product or product rate right away.

Pragmatic entrepreneurship

IBJ: David Pippen, could you encapsulate some of the Governor’s ideas for what could be said is

pragmatic entrepreneurship involving clean energy?

Pippen: The focus right now is to create as business-positive an atmosphere as we can in the state—stable regulation,

low taxes, a business-friendly environment. You have to have the money to make the choices to spend the extra amounts to do

things the way we want to do them. We want clean air, land, and it takes effort and it takes investment in that. You have

to have a stable economy and a growing economy to be able to afford to do those things

IBJ: Are there any ideas in terms of helping incentivize companies, whether it be funneling

federal money to them or through tax breaks?

Pippen: Indiana Economic Development Corp. in 2009 did $770 million of projects in energy alone. I think it was ten projects

in energy alone, directing stimulus money to help foster some of these projects. But, understand, government’s really

bad at choosing winners. The best thing we can do is create an environment where everybody participates and works and grows

their businesses. And the market sorts all of that out better. So there’s a lot we can do in getting out of the way

of the entrepreneurs, there’s a lot we can do in incentivizing business investment so that decisions can be made. But

as far as choosing winners, that’s not going to be a focus because government’s just really not good at it. We’re

a state, we’re an automotive state, we’re a manufacturing state. We make things. That’s why you see the

Brevini’s (Italian wind turbine gear maker with U.S. offices in Muncie), the Thinks, the EnerDels. These folks that

are making things and looking at that clean tech next generation, they’re making investments where they’ve got

a stable work force, where they’ve got low taxes and where they can put investments and get returns on their investments.

————————————–

Coal gasification, carbon sequestration

IBJ: David, coal has been part of the administration’s energy policy—clean coal. This is

at a time when many environmentalists are critical of the cost-effectiveness of coal gasification plants and carbon sequestration

ideas that some utilities have for Indiana. A cynic would say “Well, there are political reasons: the coal lobby, the

utility lobby.” Why hasn’t the governor abandoned coal?

Pippen: Because the math doesn’t work. I mean, quite simply, we have a resource in this state that

is available. We have technologies that are developing and are in place that can use that coal much more cleanly. And it’s

necessary to keep the lights on. We’re an energy-intensive state because we make things. There are obviously political

sides to everything. But when you get down to the core of how we have reliable, low-cost electricity and our manufacturers

who are competing globally with countries that are burning coal, that are doing things without all of the environmental controls,

we’re trying to compete. But it goes back to our investment decision. Combined cycle gasification has 99 percent fewer

of the criteria pollutants. You’re using coal in a massively cleaner way. We are in a position to make an investment

for a cleaner economy and use a resource that we’ve got in this state. So to look at it and say, “Well, we’ve

just got to take that issue off of the table,” that’s where you start choosing winners and that’s where

it gets real dangerous.

Mitchell: I think it’s important also to get an industry perspective on this coal issue. The reality is, it’s

not just the coal producers or the utilities that are arguing for and pointing to clean coal technology as an opportunity

to reduce C02 emissions in a cost-effective way. You’ve got a lot of research going on at Purdue University in clean

coal technologies. You’ve got a number of technology companies that have an opportunity to bring new technologies to

market. What the industry wants is some certainty. Tell us what the playing field is going to be and we’ll provide solutions

in the area of coal, in the area of wind, in the area of solar, and then let those things compete in the marketplace.

So certainly what Terry’s talked about at the beginning is critical. Having some market certainty is what’s going

to drive the end result. It’s not policy that’s going to develop the solutions to our carbon challenge. It’s

industry and technological innovation that’s going to develop the solutions, and some of those solutions are going to

be in coal and some of them are going to be in nuclear and a lot of them are going to be in new resources of renewable energy.

Research credibility

IBJ: Might the issue of whether the science of climate change has lost some credibility in turn diminish

business opportunities in sustainable matters? Most everyone has heard about the self-incriminating e-mails among scientists

of the East Anglia Climate Research Unit in the U.K., which keeps one of the biggest data sets on the climate. There was been

some hand-wringing among the unit’s scientists that the earth is not warming to the extent predicted.

Pippen: Understand in the energy world that the investments, at least in (electricity) base load, tend to

be 30- and 50-year term investments. So the decisions that are being made have to have kind of that outlook. I don’t

think anybody up here will say that sustainability is a bad thing, that lower emissions are a bad thing, that cleaner air

and land and water are bad things. We don’t manufacture the way we used to. We found efficiencies because there’s

a business reason, there’s an environmental reason, there is health and welfare reasons to do it. So I don’t see

sustainability or lower emission technologies going away.

Hamilton: I’d like to tag on to David’s comments but first say that from a public education

perspective, we are going to continue to talk about the carbon footprint reduction benefits of recycling because there are

a lot of folks out there that are compelled by that message. From an economic perspective, the energy savings of recycling,

the energy conservation of recycling, is a win-win for our economy, especially in a manufacturing state.

For example, we have several thousand Hoosiers employed in the aluminum industry. It takes 95 percent less energy to make

aluminum out of an aluminum can than out of raw materials. Recycling aluminum cans makes sense for that whole industry. Glass—huge

energy savings when you make glass out of recycled cullet than sand. Fifteen years ago we had zero glass processors in Indiana,

now we have five across the state. As for steel, it’s 74-percent less energy (intensive) to make steel out of recycled

steel. Obviously, we have thousands of Hoosiers employed in the steel industry. We have a growing electronics industry, thanks

in part to our new electronics recycling industry. Recently we received a letter from Electronics Recycling International

about possibly placing a processing facility in Indiana to thoroughly recycle electronics down to the basic elements, employing

200 people.

They’re looking to Indiana for incentives to come here instead of elsewhere in the Midwest. Shingles, construction

demolition waste—we have research going on at Purdue working with INDOT and others in the industry to take shingles

off roofs and put them into road pavement. We have a growing bio-based plastics industry in Jackson County. There’s

Saraplast that has their operational headquarters to make plates and spoons out of corn instead of petroleum. We have the

largest green refinery in the United States, for sure, maybe in the world, in Whiting. We have the largest plastic bag recycling

facility in the country in Jackson County, and there’s significant growth and innovation in all areas of the recycling

industry primarily because of the energy savings benefits of recycling.

Hsu: As a scientist I believe there are enough scientific studies that point to man-made climate change.

But that debate is going to continue regardless of the direction of the debate and the result of the debate. I think technologies—renewable

energy—is always going to be important from a two-point view. One is technology development. We know we need a variety

of technologies in order to fulfill future energy needs, and the development of new technologies take time. If you just consider

how long it took us to develop this oil-based and gas/coal-based technology, then you can imagine how long it’s going

to take for us to develop other types of technologies to take their place.

And the second angle is that there’s limited resources regardless of how long you think your coal is going to last

or your oil is going to last. Nobody believes that we have unlimited resources. And, again, think about how long it takes

to develop those new technologies. If we don’t start working on those issues now, when you wait ‘til you know

that you have a peak oil situation or your coal is beginning to run low, then it will be too late.

————————————–

Charging for waste

IBJ: Some questions from the audience. Carey, would not changing from charging for recycling to charging

for waste provide more incentive to recycle?

Hamilton: Certainly there are lots of ways to improve curbside recycling programs, incentive-based programs, fee-based, where

in “pay as you throw” you pay for the amount of trash that you make and your recycling is free. There are other

ways to do it, so we’ve got to figure out what makes sense for Indianapolis and move forward.

Nuclear power

IBJ: Recently the Obama administration announced new funding for nuclear power generation. Does anyone

think Indiana’s ready to emphasize nuclear power again and perhaps start Marble Hill back up again?

Hsu: Well, again from a technology (perspective), nuclear is going to be important. There is no silver bullet

to solving our energy problems, so we need all the solutions, and the solutions need to include nuclear, and I think it would

make sense for Indiana to get into that race.

Pippen: Let’s understand, we are participating in nuclear energy. The Cook Nuclear Plant, 60 percent

of its energy comes across the Michigan border and powers South Bend and Fort Wayne. We also have Babcock & Wilcox down

in Mount Vernon, which is the only nuclear manufacturing facility left in the U.S. because of the issues with the Marble Hill,

the 1970s issues. The Governor has said if somebody brings a good proposal to us we will sit and talk and see where we go.

It has to fit within the mix. It has to fit within the paradigm of keeping energy costs low and reliable for Hoosiers, so

it’s not a blank check.

Personally, I’m very interested in the development that Babcock & Wilcox is doing on modular nuclear technology.

Rather than doing the 1,000-megawatt plants, they’re doing scalable 10- to 125-megawatt modules. So it’s a lower

upfront investment and allows for better distribution around the state. If it fits into the utilities’ portfolios, we’d

be happy to talk to them and see how that develops. It’s basically the technology that’s running aircraft carriers

and submarines being transferred into a commercial use for the state.•

Please enable JavaScript to view this content.