Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowIndiana’s newest public company is an operation in a hurry.

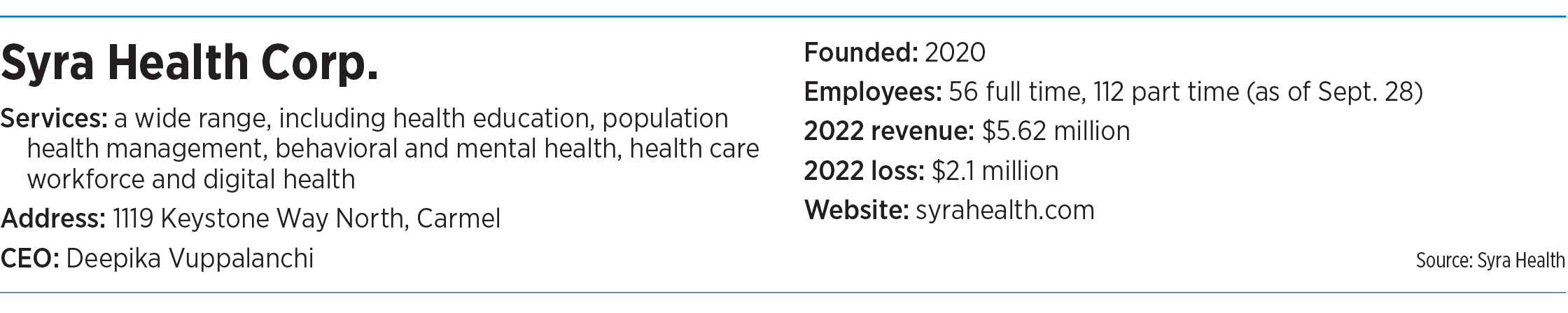

Syra Health Corp., a health care services company based in Carmel, has yet to mark its third birthday. But already it has 56 full-time employees, annual revenue of $5.6 million and a host of contracts it has won from Indiana to Washington, D.C.

And two weeks ago, it began trading its shares on the Nasdaq Capital Market, raising $5.3 million after expenses in its initial public offering.

But Syra faces a slew of challenges, from winning new customers to launching products and services quickly to stem its growing losses. It is burning through millions of dollars a year in payroll, research and overhead, and it posted an annual loss last year of $2.1 million. In December, the company’s independent accountant expressed “substantial doubt” in Syra’s ability to continue as a going concern without obtaining additional capital.

On top of that, Syra relies on a single client, the Indiana Family & Social Services Administration, for more than 95% of its revenue. Through the FSSA, the company provides services primarily to the NeuroDiagnostic Institute (the state’s newest psychiatric hospital, on the campus of Community Hospital East) and the Division of Mental Health and Addiction.

But if top officials are ruffled by the challenge, they don’t show it. Instead, they talk about developing products and services, such as a phone app designed to help people with anxiety or depression assess and monitor their mental health.

The company’s mission is to improve health care by providing services and technology for a variety of needs, from nursing staffing to public-health training.

CEO Deepika Vuppalanchi, who holds a doctorate in molecular biology and genetics, uses the language of her trade in describing the company’s portfolio.

“We provide evidence-based, data-driven solutions and services,” she said.

Syra offers health services in five broad areas: behavioral and mental health, health education, population health, digital health, and health care workforce.

That might sound like a sprawling group of businesses to put under one company. But Syra officials, in their recent prospectus, say the service lines are related through “promoting preventative health, holistic wellness, health education and equitable health care.”

Syra (the name means “perfection” in Sanskrit, an ancient language of India) started up in November 2020, at the height of the pandemic, and turned to the public markets fairly early to raise money and get its message out.

“We want to get on a bigger platform, bigger exposure, which also means access to capital,” said Sandeep Allam, who holds the twin roles of president and executive chairman.

Going public

The company, however, has experienced a few fits and starts in launching its IPO. In May, when it filed its registration documents, the company estimated that it would raise up to $8 million. Then in early September, Syra cut that estimate by about one-third, to $5.4 million, with a company official saying the move was due to a decision to limit the number of shares available to complete the IPO quickly.

Three weeks later, Syra revised its estimate again, saying it expected to raise $6.7 million—higher than the previous estimate, but lower than the original.

The company went public on Sept. 29, but after expenses, it was able to keep only $5.3 million of the $6.7 million, a fairly modest sum by traditional IPO standards. The median deal size for IPOs over a five-year period ending in 2021 was $218 million, according to research firm Dealogic.

Syra said it revised estimates several times because the markets have been “fluid” lately. “As a result, the size and amount of the offering naturally fluctuates with market conditions,” a company spokeswoman said.

Syra intends to use proceeds from the offering for marketing and sales, application development, research and development, and working capital and other general corporate purposes. The lead underwriter was Kingswood Capital Partners LLC.

It’s too soon to say whether investors are buying Syra’s growth story. In the first few days, the stock’s performance has been less than robust. Since going public at $4.125 a share, the stock has dropped to the mid-$2 range, closing at $2.37 on Oct. 10. That’s down 42% in just seven trading days, even as the Standard & Poor’s 500 index edged up about 1% in the same period.

Some financial advisers, however, say Syra is working in a hot sector and could well tap into that excitement.

“They are focused on a lot of really strong areas, including behavioral health, which is a very strong area of health care right now,” said Jonathan Sadock, managing partner and CEO of Paragon Ventures, a mergers and acquisition advisory firm based in Newtown, Pennsylvania. “And when you couple behavioral health with digital health, which is also something that is grossly needed, you can understand their excitement.”

But others say Syra likely had few choices but to turn to the public market, as many private investors are giving a cold shoulder to early-stage companies, which are still proving themselves and often racking up big losses.

“There is probably more public-market interest than private-market in this instance,” said Roger Lee, a senior research analyst at Columbus-based Kirr Marbach & Co. LLC. “Private-market valuations for cash-burning companies are horrific.”

A ‘nano-cap’

There’s little doubt that Syra is tiny by Wall Street standards. It rang up revenue of $5.62 million last year. Its market value, calculated by the stock price multiplied by number of shares outstanding—is about $12 million. That classifies it as a “nano-cap,” or the smallest category of public companies.

Those small companies often have to work extra hard to get attention from potential investors.

Syra officials recently hit the road for investor conferences in Las Vegas and other cities to sell their story. The company calls itself an “emerging growth story” in its registration filings.

“We hope to become a leader in clinical health care solutions by providing customized and comprehensive end-to-end solutions for our customers in the public and private health care sectors and expand our operations to other metropolitan areas,” the company said in its prospectus.

Even as it sells off part of its equity into the IPO, management is holding tightly to voting control. Under a dual-stock-owner plan, shares of Class A common stock get one vote per share, but each share of Class B common stock gets 16.5 votes. As of Sept. 28, Class B shares represented 79.6% of the total voting securities outstanding.

The class B shares are largely held by company management.

Multiple service lines

Some of Syra’s offerings have been picked up fairly quickly. One of its earliest projects came in 2021, when it won a bid to help FSSA understand mental health trends in the state.

“So, we just started the company, and we were like, ‘This is a space that we can totally deliver,’” Vuppalanchi said. “We have the talent pool. So, we bid.”

Syra won a two-year, $610,000 contract to bring 16 agencies from the state into one committee, share data, prioritize strategies and write reports using its own staff of experts, including data scientists and public health analysts.

FSSA has posted Syra’s numerous reports, fact sheets and research briefs on its website. Perhaps the most comprehensive is a 164-page report on the “prevalence, consumption and consequences” of alcohol, tobacco, marijuana, opioids, stimulants, mental health, problem gambling and viral hepatitis/HIV/AIDS.

An FSSA spokesman said the agency uses the annual epidemiological reports from Syra to inform decisions, partnerships and strategic initiatives.

“Syra satisfied its contract requirements,” he told IBJ. FSSA recently expanded the contract for an additional two years, through 2025, for $636,000.

The company has since picked up other contracts with FSSA, including a $14.6 million, four-year contract to help staff and schedule nurses and other workers at the NeuroDiagnostic Institute.

Syra has also won a series of contracts worth millions of dollars from government agencies in Kansas, Ohio, Indiana and other states. Its latest win, announced this month, was a five-year, $4.75 million contract with the District of Columbia’s Department of Behavioral Health, to help provide a comprehensive psychiatric emergency program and its employment program.

Syra said that, in many of its dealings, it partners with outside providers, including psychiatrists, therapists and other experts.

Short track record

But some of its services are still awaiting customers—or are still on the drawing board. As one example, Syra has developed a telehealth platform for mental health services that it said provides an interactive patient experience.

The platform, called Syrenity, is designed to offer 24/7 access to counseling and care coordination with a variety of medical health professionals such as psychiatrists, therapists, nurse practitioners and peer coaches.

“Currently, we offer telehealth and prevention program services; however, to date, we have not generated any revenue from such services,” the company’s government filing said.

Syra also has developed other digital and cloud-based platforms that include health apps, artificial intelligence and patient engagement.

“Our Soulcial app, which we intend to launch in the second half of 2023, is intended to connect the mind, body and soul elements and provides a way to connect to caregivers and peers, thus alleviating social isolation,” the company’s filing said.

The company recently launched CarePlus, a “user-friendly” electronic medical records system designed for small to midsize health care organizations that can’t afford the expensive systems now on the market.

“Furthermore, we intend to offer an artificial intelligence chatbot trained to have human-like conversations using a process known as natural language processing to facilitate and provide end-to-end query resolution for the patients,” the company’s filing said. But a few sentences later: “To date, we have not generated any revenue from any of the foregoing offerings.”

Many of the company’s big plans might come to fruition, but Syra’s track record seems too short to draw any conclusions. As of now, Syra seems to be a company of dozens of projects, many still in very early stages.

When asked if the company was still in a startup phase, Allam said he never wants to lose the “startup mentality.”

“Because constant innovation, constant build is going to keep on happening with this company,” he said.

Vuppalanchi, the scientist-turned-CEO, readily admits she has never run a public company.

But she pointed to other managerial stints she had at private companies, including senior medical director of Precision For Value, a Carmel company assisting pharmaceutical and life sciences clients; medical director of Symbiotix, a Kentucky-based scientific medical communications firm; and medical director of DWA Healthcare Communications, a Carmel medical education strategies company.

“I have a great team, great leadership and amazing people I’m surrounded by,” she said. “So I think it’s just going to be a fruitful experience.”•

Please enable JavaScript to view this content.