Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowCryptocurrency might not be coming to a bank near you—yet. But bitcoin ATMs are springing up across central Indiana and the nation, and some tech leaders say that, within a decade, cryptocurrency could be more life-altering than the internet.

“Cryptocurrency and blockchain technology—the engine that runs cryptocurrency—is coming so fast and will disrupt so many businesses and industries, a lot of people have no idea,” said Patrick Sells, founder and president of Sells Group, an Indianapolis digital marketing firm that took a hard turn into cryptocurrency last year.

“It’s coming faster than artificial intelligence, virtual reality or autonomous vehicles.”

Julien Nadaud, chief product officer at Carmel-based software company Determine Inc., called cryptocurrency “a revolution.”

Julien Nadaud, chief product officer at Carmel-based software company Determine Inc., called cryptocurrency “a revolution.”

“It’s going to change the way people and businesses interact,” he said.

While bitcoin ATMs—which are essentially exchange stations—are just the tip of the cryptocurrency iceberg, they are a sign of how ubiquitous this emerging technology could become.

Central Indiana has at least three bitcoin ATM operators and about two dozen machines—most popping up in the last two years, in places as conspicuous as the Circle Centre mall food court.

“We started with four [bitcoin ATM] machines in Indianapolis and we’ve quickly grown to 10,” said Michael Dalesandro, founder and CEO of Chicago-based RockItCoin. “We continue to see growing adoption in your market and others.”

So what exactly is cryptocurrency and what is its appeal?

The first question is relatively easy to answer. The latter depends on whom you ask, but its biggest draws are its decentralized, democratic organization, and its antithetical pairing of fully transparent transactions conducted in complete anonymity.

Let’s start with defining cryptocurrency.

It’s a self-regulated, decentralized digital asset designed as a medium for exchanging goods and services. Put another way, cryptocurrencies such as bitcoin are an accounting system.

Bitcoin uses techniques for secure communication called cryptography to record transactions and control the creation of the virtual currency. The photos you see of actual bitcoins are nothing more than a representation. No physical bitcoin or any other cryptocurrency actually exists.

So how is it different from standard currency?

Electronic payment systems have been part of American life since 1871, when Western Union introduced money transfers through the telegraph and in 1914 introduced the first charge card.

Modern-day cryptocurrencies differ from those in one essential way: They don’t represent a claim on value; they are the value.

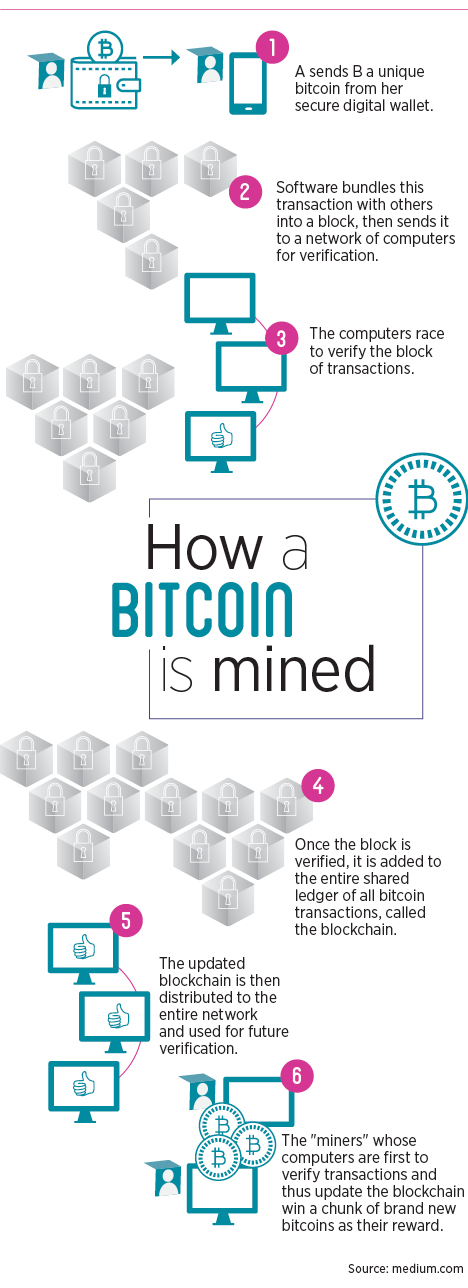

Cryptocurrencies are not controlled by a central authority such as a financial institution or government. Instead, the ledger tracking the cryptocurrency—known as the blockchain—is maintained by myriad computers run by what are known as miners.

The miners, who can be anyone with access to a good computer and the appropriate software, solve math calculations—purposefully complex ones—that are used to record and verify transactions to maintain the blockchain. The miners whose computers first solve the calculations are rewarded with allotments of the cryptocurrency.

In almost every room of Sells Group’s Indianapolis office are computers the company built for the sole purpose of mining cryptocurrencies, such as bitcoin and ethereum. Each rig contains about $7,000 worth of hardware, Sells said.

While cryptocurrency work is still a small part of Sells Group’s business, it’s fast-growing, Sells said. His firm’s “mining rigs” have handled individual calculations in the last year that earned the firm cryptocurrency worth six figures when translated into U.S. dollars, he said, making his company “one of the largest cryptocurrency mining operations in Indiana.”

Anonymity, yet transparency

In traditional payment networks like banks, credit cards, Paypal or Venmo, an account is linked directly to the user’s name and oftentimes a government-issued identification, like a Social Security number. The bitcoin blockchain handles accounts, transactions and privacy much differently.

Anyone can create and store a bitcoin account, called a digital wallet, on a computer or smartphone—without a name, address or email address. It’s nearly impossible to track who owns which account. In fact, some transactions can even be conducted without an internet connection.

But even though the people transacting business are anonymous, the transactions themselves are wide open. Everyone who installs the proper software can see the entire blockchain and can track and verify transactions. Every piece of cryptocurrency is accounted for, making sure no one is giving or getting counterfeit bitcoin. The balances of all accounts are visible on the blockchain—but the owners’ identities are encrypted.

By monitoring and updating the ledger in a collective, consensus-based system, the need for a broker or middleman acting as a repository of information is eliminated. That does away with fees, inefficiencies and the potential for corruption and risk that comes with centralizing information, cryptocurrency advocates say.

“The idea that there’s data somewhere in a network that no one person has authority over, nobody can hack—not even inside jobs—that didn’t exist until bitcoin’s blockchain,” said Erik Townsend, a hedge fund manager who is a noted bitcoin expert and MacroVoices.com podcast host. “I do think this is going to change the world in a big way.”

In the beginning

The genesis of cryptocurrency can be traced to what is called the cyberpunk movement in the 1990s. Cyberpunks were a group born out of a love of the internet, cryptography, the possibility of privacy, and a new way of doing business.

But it took the Great Recession and banking crisis to lay fertile-enough ground for the birth of Bitcoin in 2009. Launched by an anonymous person or group going by the handle Satoshi Nakamoto, bitcoin was the first decentralized cryptocurrency. Since then, more than 1,800 others have been created, but only a handful are commonly used.

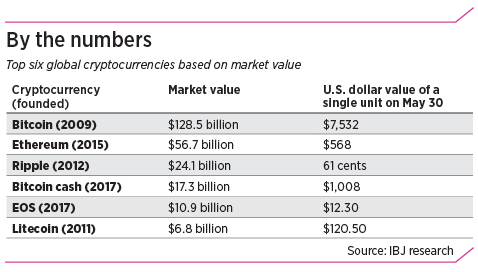

Bitcoin is the largest by market value—the number of “coins” on the market multiplied by their dollar value—at $128.5 billion, as of May 30. The next five are ethereum ($56.7 billion), ripple ($24.1 billion), bitcoin cash ($17.3 billion), EOS ($10.9 billion) and litecoin ($6.8 billion).

Cryptocurrencies come into existence in a process similar to taking a company public. Through an initial coin offering, or ICO, value is established and the foundation stock is issued. There’s one big difference between an IPO and an ICO. An ICO is unregulated because—for now—federal authorities don’t consider most cryptocurrencies securities.

After the initial offerings, cryptocurrencies continue to be issued to the miners maintaining the blockchain until a maximum amount—pre-set by the cryptocurrency’s creator—is reached. In bitcoin’s case, Satoshi Nakamoto set the limit at 21 million pieces to be issued by 2140.

The basic rules of supply and demand set the value of cryptocurrencies. And those values fluctuate wildly.

For instance, a single bitcoin was valued at more than $19,300 in mid-December; by April 1, the value had dropped to less than $7,000. Still, that’s a lot higher than the $1,968 it was trading at a year ago. In 2012, you could snag a bitcoin for less than $100.

Acceptance as currency

While cryptocurrency experts said few Indiana companies deal in or work with cryptocurrencies, a growing number of companies nationwide do accept them.

Overstock.com, Lamborghini, Tesla and even Victoria’s Secret—to some degree—deal in cryptocurrencies.

Sells said his company is developing a business-to-consumer rewards program using cryptocurrency for one of its clients, Indianapolis-based Jordan Standard Distribution, and will announce a similar project for another client this summer.

Many U.S. banks initially dismissed cryptocurrencies, but far fewer today doubt its potential impact.

“I think the concept is valid. We are looking into that space. You have many central banks looking into it,” JPMorgan Co-President Daniel Pinto told CNBC in May. “The tokenization of the economy, for me, is real.”

Some see it as a potential threat to the banking industry.

“Clients may choose to conduct business with other market participants who engage in business or offer products in areas we deem speculative or risky, such as cryptocurrencies,” Bank of America said in a 10-K filing earlier this year. Such increased competition may “negatively affect our earnings” or affect “the willingness of our clients to do business with us.”

Craig Fortner, first vice president of information technology for the Fishers-based First Internet Bank, said First Internet Bank executives “see promise” in the underlying blockchain technology—which can be used in many ways—but remain “neutral” on cryptocurrency.

First Internet Bank is “unlikely to dive in” to cryptocurrencies because they are not regulated, Fortner added.

Regarding bitcoin, “you cannot have something where the business proposition is to be anonymous and to be the currency for unknown activities,” Pinto said. “That will have a very short life, because people will stop believing in it, or the regulators will kill it. Cryptocurrencies are real but not in the current form.”

Still, he added: “I have no doubt that in one way or another, the technology will play a role.”

Undeniable upside

Proponents say the upside of cryptocurrency and blockchain technology is overwhelming.

Fortner said cryptocurrency could offer a uniform way to transfer a currency globally in real time—something that is currently impossible.

The decentralized, distributed ledger behind cryptocurrencies makes it nearly impossible to hack—at least with today’s technology. Not even an administrator could defraud the blockchain, as could—and does—happen with a centralized system.

And since the blockchain is housed on multiple computers, it can’t simply crash or be taken down.

Cryptocurrency proponents love that it removes a middleman, and the accompanying fees.

“Before, if you wanted to send something of value across the internet, you had to get someone else involved. You had to have a credit card company or Paypal or maybe a bank involved in the transaction,” said Gavin Andersen, founder of Washington D.C.-based Bitcoin Foundation and a forefather of the cryptocurrency movement.

“The promise of bitcoin is that you’re directly sending this currency to another person and then the bitcoin network performs the function that normally Paypal, a bank or a credit card company would perform,” Andersen said.

But because maintaining bitcoin’s blockchain is lucrative, some early adopters predict banks and governments will eventually try to take over.

Global IT firm Infosys, which last year opened a hub in Indianapolis and plans to expand here, recently announced it is setting up a blockchain for seven banks in its home nation of India. Some say that’s a foreshadowing of the banking industry’s trying to muscle in and take over the citizen-run cryptocurrency systems.

Investment or currency?

Because of their relatively high value and volatility, cryptocurrencies like bitcoin are “more like a bar of gold than a dollar bill,” Fortner said.

Nakamoto clearly designed bitcoin as a means to trade goods and services, not merely for investment purposes. Most cryptocurrencies, including bitcoin, are completely transferable and every piece of bitcoin can be broken down into 100 million pieces, so there’s room for it to expand to small-value transactions.

While few U.S. citizens find immediate need for cryptocurrencies, a global cryptocurrency has real allure for people and businesses in parts of Asia, Africa and Central and South America where access to banking is limited and the government-issued currency is unstable.

About 2.5 billion adults worldwide don’t have bank accounts, and cryptocurrency advocates say the new technology gives people opportunities to have a bank within their cell phone.

As more parts of the world adopt cryptocurrencies, global companies in the United States will have to consider using them, said John Sarson, principal with Blockchain Momentum LP, an Indianapolis-based hedge fund that invests in blockchain technologies and cryptocurrencies.

“Places like Miami and Los Angeles are already cryptocurrency hotbeds,” Sarson said. “In Miami’s case, it’s because Latin America has picked up on it due to the instability of its currency.

“Right now, Indiana is standing flat-footed when it comes to cryptocurrencies,” he said. “There is no understanding of the impact this is going to have by business executives here.”

Sarson said if Indianapolis is going to continue to build its reputation as a tech hub, it “needs to get on board.”

But before bitcoin and other cryptocurrencies explode globally, one major limitation in the technology needs to be conquered.

“Scalability is an issue,” said Karthik Kannan, management professor at Purdue University’s Krannert School of Business. “Because of the complexity of the math required to maintain the blockchain, you can only do so many transactions, and that is a limiting factor to this technology.”

The bitcoin blockchain can handle about seven transactions per second. That pales in comparison to the 750 wire transactions per second Western Union can spit out using traditional currencies or the 25,000-plus transactions per second Visa can handle.

“Almost any consumer knows the frustration of waiting even 10 to 15 seconds for their Visa transaction to go through,” Kannan said. “If bitcoin or any other cryptocurrency were ever used by the masses, it would be many, many times worse.”

In May 2017, as activity on the bitcoin blockchain heated up, it took up to four days to complete a transaction.

Security worries

Speed isn’t the only concern. Some might see banks, credit card companies and payment systems as unneeded middlemen, but they offer an undeniable layer of security not present in unregulated cryptocurrency.

While the underlying blockchain itself is secure, the digital wallets that store currency can be compromised. If a laptop or cell phone housing a digital wallet is ruined or stolen, the bitcoin is gone. And tech experts say never keep a fully stocked digital wallet on hardware that is connected to the internet. That can too easily be hacked and your cyber loot heisted.

While the underlying blockchain itself is secure, the digital wallets that store currency can be compromised. If a laptop or cell phone housing a digital wallet is ruined or stolen, the bitcoin is gone. And tech experts say never keep a fully stocked digital wallet on hardware that is connected to the internet. That can too easily be hacked and your cyber loot heisted.

Keeping it on a thumb drive or a hard drive not connected to the internet—and in a fire-proof safety deposit box or safe is best—then download only the amount of cryptocurrency you need immediately to a wallet connected to the internet, security experts said. When a person loses track of his or her digital wallet, there’s no way—because there’s no central monitor—to claw the cybercash back.

James Howells of Great Britain says he lost 7,500 bitcoins when he accidently discarded his computer hard drive in 2017. As the value of those bitcoins grew to $75 million, he petitioned government officials in his hometown of Newport, South Wales, to let him dig up—at his own expense—his neighborhood landfill. That request was denied. Even by today’s standards, Howells’ lost bitcoin is valued at $60 million.

Transactions with the ATMs that are sprouting up must also be treated with care. Cryptocurrency that is transferred into a digital wallet via the ATMs should be quickly moved into a more secure off-line digital wallet. Some users even opt to carry paper with QR codes affiliated with their bitcoin information—preferring not to scan a QR code from their digital wallet at the ATM or fearful of having a large amount of cryptocurrency on their cell phone.

Users can then scan the QR code on paper to transfer that loot to an off-line storage device.

But that can be dangerous. RockItCoin’s website warns: “Be careful with the paper wallet since it holds all the funds sent to that … address. Transactions are irreversible so if a paper wallet is lost, damaged or destroyed the funds are LOST FOREVER!!!”

Tales from the dark side are not limited to individual users.

In 2014, a well-known Tokyo-based bitcoin exchange and depository, Mt. Gox, suffered an irreversible collapse.

Mt. Gox announced that approximately 850,000 bitcoins belonging to customers and the company were missing and likely stolen, an amount valued at nearly $500 million at the time.

“The lesson of Mt. Gox is, you don’t leave your bitcoin with an untrustworthy third party,” Kannan said.

Regulation gyration

Government officials at every level are struggling with how to regulate cryptocurrencies. New York and several other states require a license to deal in cryptocurrencies. But that has chased away a number of tech companies, a scenario many regions would like to avoid.

There’s also been a crackdown on initial coin offerings when the Securities and Exchange Commission deems the organizers are packaging cryptocurrencies as securities or making promises to potential investors or users they can’t keep.

Indiana Secretary of State Connie Lawson in May announced that her office has taken an enforcement action as part of an international crackdown on fraudulent ICOs and cryptocurrency-related investment products. The action, called Operation Cryptosweep, is being coordinated by the North American Securities Administrators Association.

The creators of bitcoin and other cryptocurrencies are worried government officials will eventually outlaw non-regulated cryptocurrencies and come up with a government-issued option.

The privacy and anonymity afforded by cryptocurrencies is a magnet for unsavory people and businesses like drug buyers and sellers and unlicensed and unauthorized arms dealers. The anonymity factors also mean cryptocurrencies can be a means of trying to avoid paying taxes. That has raised the antennas of government and law enforcement officials.

Many cryptocurrency advocates say U.S. and other government officials will use the threat of terrorists using cryptocurrencies as a reason to shut them down. But those same advocates say the governments have other reasons to want control.

“There’s so much government can do with digital currency that they can’t do with traditional currency,” said Townsend, the MacroVoices.com podcast host. “With government-issued digital currency, every single transaction is traceable and controllable by the government.

“Every single payment has to have the tax ID of the payor and the payee,” he said. “Every single transaction can be voided or clawed back by the government. It’s the opposite of bitcoin. I’m predicting a Libertarian holocaust. It’s a horrible thing, and I hope I’m wrong.”•

Please enable JavaScript to view this content.