Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

A House lawmaker is reviving an effort to make changes to the business personal property tax that would offer a bit of a windfall to small-business owners while reducing local government revenue.

Rep. Peggy Mayfield, R-Martinsville, is filing legislation that would raise the exemption that determines which companies must pay the business personal property tax. Her bill would exempt all companies that own machinery, equipment and other tangible goods that cost them, in total, less than $250,000. The current threshold is $80,000.

The proposed change could essentially eliminate as many as 48,000 tax returns, according to past legislative estimates.

Mayfield’s bill is the latest in a series of efforts over decades to reduce the personal property tax on businesses and simplify its administrative accounting headaches. The concept has the support of House Speaker Todd Huston. But its chances of passage are less clear in the Senate, where leading Republicans are pushing for other ways to lower the tax burden on small business.

Mayfield’s particular approach revives a failed effort in last year’s legislative session to eliminate the minimum tax businesses pay for new equipment, also known as the 30% depreciation floor. Businesses pay at least a 30% tax of the purchase price on machinery and equipment, even if it is several years old.

Last year’s tax-cut package included a measure to phase down the individual income tax rate from 3.23% to 2.9% over seven years, but lawmakers failed to come to agreement on changes to the business personal property tax despite strong support from Gov. Eric Holcomb, the Indiana Chamber of Commerce and the Indiana chapter of the National Federation of Independent Businesses.

Local government leaders harshly opposed the proposed cut that would have slashed local revenues by $100 million statewide by the year 2037, according to a fiscal impact study by the Legislative Services Agency. A study by Indianapolis-based economic research firm Policy Analytics also found that eliminating the depreciation floor would have resulted in residential homeowners paying a larger share of the overall tax burden.

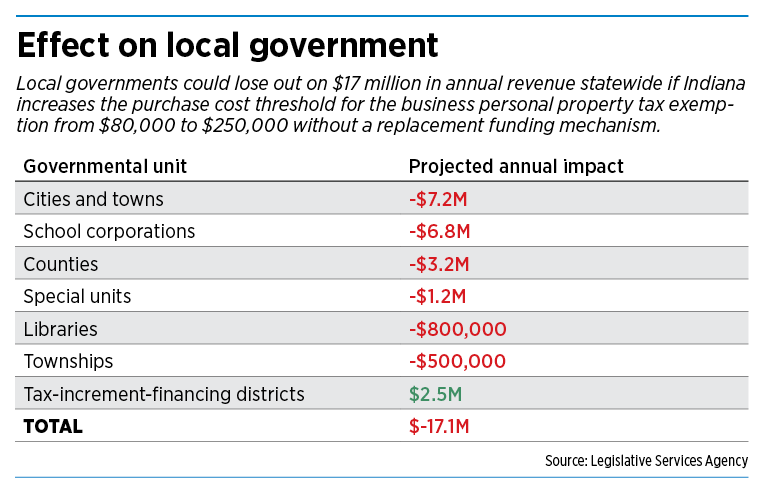

But experts in Indiana tax policy say Mayfield’s proposal is an easier pill to swallow. According to a fiscal impact study conducted last year on a similar bill authored by Sen. Aaron Freeman, R-Indianapolis, increasing the threshold to $250,000 would decrease annual local revenues by $17 million statewide—a considerably smaller margin.

“The depreciation floor affects the big businesses, whereas this threshold proposal only affects small and medium-sized businesses—which make up a much smaller fraction of personal property,” said Larry DeBoer, a retired professor of agricultural economics at Purdue University who co-wrote the Policy Analytics study. “This would also save money for local governments because there would be less forms to process.”

DeBoer said that while the change would still shift costs onto residential homeowners, it might go unnoticed given that homeowners are already expecting higher property tax bills as home values have risen dramatically in the past several years.

Making the case

With a background in local government and small business, Mayfield would appear to be the ideal candidate to appease both sides of the debate.

Now in her sixth term, Mayfield won her election bid in 2012 after serving as the Morgan County clerk for six years. She and her husband, Dean, have owned an insurance company for three decades.

Raising the threshold to $250,000 would exempt about 80% of small businesses from paying the tax, she said.

“It would be one less thing that a small businessman has to worry about,” Mayfield said. “They’re having to go through the exercise to pay an accountant to find out they don’t owe any money.”

The change would keep Indiana competitive with other Midwestern states that have either cut or outright eliminated taxes on personal property, supporters said.

“There aren’t that many states that do this, and it punishes businesses for investing in property and machinery,” said Indiana Chamber of Commerce CEO Kevin Brinegar. “There are tens of thousands of small businesses that have very little machinery and equipment and still have to pay a CPA and a really small amount of property tax.”

Natalie Robinson, director for the Indiana chapter of the NFIB, said the change would benefit small businesses that are already disproportionately burdened by tax laws. “In a lot of cases,” Robinson said, “it costs them more time and effort to determine the tax that is owed than filing the return.”

Illinois stopped collecting the tax in 1979 and replaced the funding by imposing a 2.5% surcharge on income for corporations; a 1.5% surcharge on incomes for partnerships, trusts and S corporations; and a 0.8% tax on invested capital of a public utility.

The state of Michigan picked up the tab for local governments after it eliminated the tax on industrial personal property in 2014. Local units of government receive a portion of the state’s use tax to make up for the loss. Non-industrial personal property initially valued at less than $80,000 is exempted, as it is in Indiana.

Ohio began phasing out its personal property tax in 2006, and until 2011, revenues were fully replaced by the state. Additional taxes on commercial businesses, electric utilities and natural gas companies were used to backfill future losses, but the state continues to make payments to local governments based on their loss.

The 2022 proposal to get rid of the minimum depreciation floor would have had Indiana replenish the losses in local revenue for the first several years, but after that, local entities would have to deal with the reduced revenue, a provision that didn’t sit well with some municipalities.

Mayfield’s bill currently does not have a replenishment mechanism but could be amended to include one if a majority of her caucus agreed on increasing the exemption threshold, she said.

Local government advocates say they oppose any changes to the tax that do not offer a funding replacement.

“Further reductions, freezes or state-mandated cuts just means it’s going to be that much more difficult for locals to keep up with the cost of inflation and services,” said David Bottorff, executive director of the Association of Indiana Counties. He noted state law will keep total property tax collections from increasing more than 5% in 2023, which is less than the current 7% inflation rate.

Matt Greller, CEO of Accelerate Indiana Municipalities, said cutting or eliminating the tax wouldn’t do much to bolster Indiana’s business climate, which is already among the best in the nation.

“I think that has to be taken into the equation,” Greller said.

An uncertain path

It’s unclear whether Mayfield’s initiative will become part of the GOP’s overall agenda.

After calling for a reduction in the tax last year, Holcomb has since shifted his focus to increased funding for public health, investments in K-12 programs and stronger economic development incentives, including $500 million for a second round of funding for the READI program.

“It’s not on my agenda right now, but I’d entertain it if it got any steam,” Holcomb said.

Sen. Travis Holdman, a Republican from northeastern Indiana who chairs the Senate Tax & Fiscal Policy Committee, has authored legislation to create a commission to study the feasibility of phasing out the state’s personal income tax and reforming property tax. He declined to say whether he would support Mayfield’s bill or if the commission would look into adjusting the tax.

Sen. Ryan Mishler, chair of the Senate Appropriations Committee, said he would be open to changes if there were greater demand from the business community. “As we talked to some of the companies, at least the ones I’ve spoken with, that wasn’t one of their priorities,” said Mishler, R-Mishawaka. “Workforce, child care, housing—those are their priorities.”

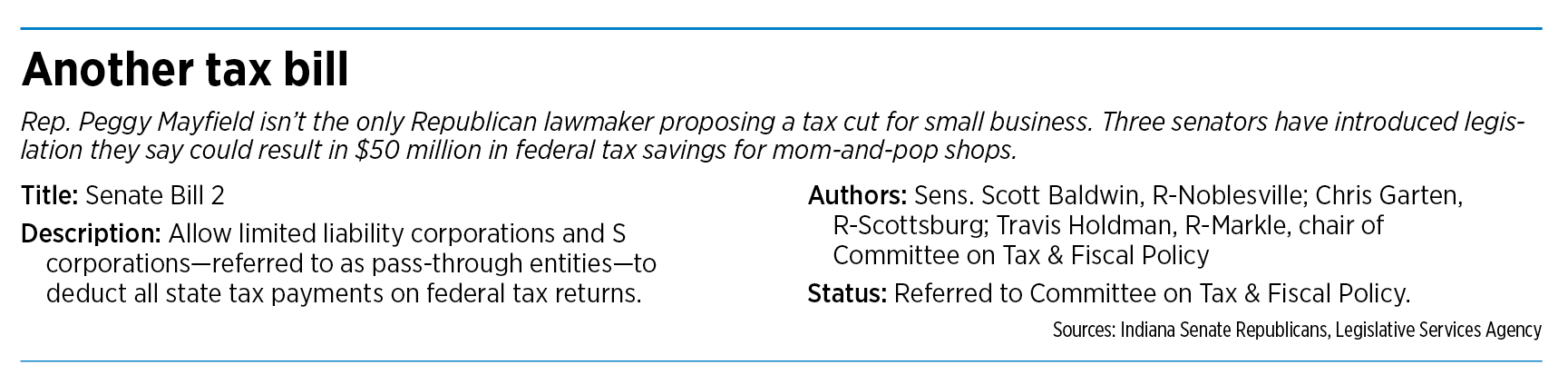

Among the Senate Republicans’ priorities is a measure that would change state tax law so limited liability corporations and S corporations can deduct all state tax payments on federal tax returns.

Regarding changes to the business personal property tax, House Speaker Huston said he has always supported reducing the tax and was pleased to hear Mayfield was taking up the issue.

Rep. Jeff Thompson, who chairs the House Ways and Means Committee, said he wants more time to analyze the state’s financial outlook before taking a position. Mayfield’s bill is expected to be assigned to the Ways and Means Committee.•

Please enable JavaScript to view this content.

Just another bill that will be studied to death by our legislators before being shuffled to the side. But let’s make sure the state sandwich bill gets a hearing!

Let’s take care of the homeowners with homestead credits first. The property tax rate is causing people to lose their homes and choose between food, medicine and utilities. Stop finding more ways to spend and go back to some of the bills with frivolous spending and cut those programs. You are taxing the responsible working people to death to take care of the lazy ones.

Completely inaccurate depreciation of the depreciation floor by this author. As properly explained by Katz, “The application of the of the 30% depreciation floor has been the subject of much scrutiny and publicity in recent years. Current tax law states that a company or business cannot be assessed less than 30% of their original taxable cost on their taxable business personal property assets. This requirement applies to commercial property no matter what the depreciable life of the asset is. This increases the tax burden on thousands of Indiana businesses. Thus, businesses have pushed for Indiana to either reduce the 30% floor or eliminate it completely.” It’s not 30% of the purchase price, but 30% of the original taxable cost. More quality journalism from the IBJ…