Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now Simon Property Group CEO David Simon takes pride in his company’s rich dividend and the fact that it’s increased every year since the financial crisis 11 years ago.

Simon Property Group CEO David Simon takes pride in his company’s rich dividend and the fact that it’s increased every year since the financial crisis 11 years ago.

But some analysts think that streak might be coming to an end, now that the COVID-19 crisis has put the company under extraordinary pressure and prompted the temporary closure of its 200 U.S. shopping centers.

Analysts say firms across the country from a broad range of industries will be taking a hard look at their dividends in the coming weeks, as the pandemic forces businesses to focus on conserving cash to face the uncertain weeks and months ahead.

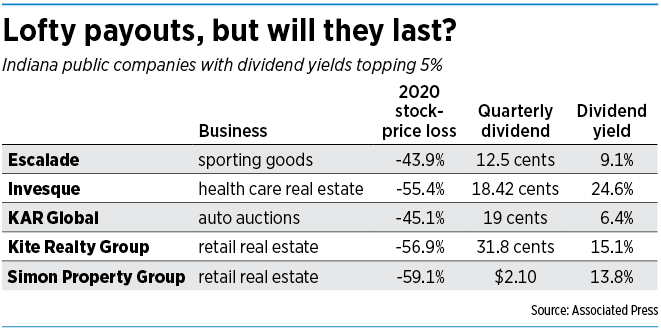

In central Indiana, analysts are especially locked on Simon and fellow shopping center owner Kite Realty Group Trust. Investors have thrashed both stocks this year—Simon is down 59% and Kite 57%—which has pushed their annual dividend yields to eye-popping levels.

Simon’s yield (calculated by dividing the annual cash dividend by its stock price) is 13.8%, while Kite’s is 15.1%. Those alluring numbers create a compelling investment opportunity—if the firms can maintain their dividends. But if they can’t, investors will have fallen into a costly trap.

Alexander Goldfarb, managing director at Piper Sandler & Co. in New York, is forecasting dividend cuts at several big retail real estate firms, but not Simon and Kite.

He acknowledges, though, that it’s far from clear what will happen. “We are going with the information we have,” Goldfarb said. “No one has ever modeled this,” he said of the national lockdown caused by the COVID-19 pandemic.

Goldfarb added: “Obviously, in this environment, you cannot rule anything out. As you know, Simon prides itself on balance sheet strength, but they are also fiscally prudent. They will take appropriate steps to make sure the company is well-positioned coming out of this.”

At an investment conference on March 2, before the severity of the COVID-19 crisis had become clear, Simon Chief Financial Officer Brian McDade noted that the company had paid out more than $32 billion in dividends since its 1993 initial public offering.

Simon and Kite representatives did not respond to requests for comment.

Simon’s quarterly dividend is $2.10 per share, which gobbles up about $644 million in cash every three months. Kite’s dividend is 32 cents per share, which consumes $27 million every quarter.

Simon is among 21 companies in the S&P 500 that Bloomberg specialists forecast will trim their payouts in the second quarter. Others include Starbucks Corp. and Royal Caribbean Cruises Ltd.

Analysts say how retail landlords like Simon and Kite fare will depend partly on the outcome of the inevitable negotiations they will have with their battered tenants over rent deferrals and rent reductions. At the same time, the landlords likely will seek breaks of their own on mortgage and property tax payments.

Mitch Kummetz, an analyst with Pivotal Research Group, tried to gain insight into that give and take during Shoe Carnival Inc.’s quarterly conference call on March 25 but got nowhere.

“I know April rent is due soon. Are you guys going to pay rent? How are you thinking about leases, and is this going to end up in the hands of the lawyers … so that you get some rent relief?”

“I know April rent is due soon. Are you guys going to pay rent? How are you thinking about leases, and is this going to end up in the hands of the lawyers … so that you get some rent relief?”

Shoe Carnival CEO Clifton Sifford wouldn’t provide any guidance on the call about such matters or his company’s overall 2020 financial performance. “It is just not foreseeable right now,” he said.

Shoe Carnival did stand behind its 8.5-cents-per-share quarterly dividend, with Sifford stating: “At this time, we do not anticipate any changes to our quarterly cash dividend policy.”

Whether Shoe Carnival and other firms pull back in future quarters likely will hinge on the depth of the recession the country will face in the months after the pandemic abates.

In his annual letter to shareholders on April 6, JPMorgan Chase & Co. CEO Jamie Dimon said he expects “a bad recession … combined with some kind of financial stress similar to the global financial crisis of 2008.” He added that JPMorgan’s “huge and powerful earnings stream” gives it the financial muscle to absorb losses.

The financial crisis of 2008 proved brutal for banks nationwide, and in Indiana three institutions failed—Irwin Union Bank & Trust Co. in Columbus, Integra Bank in Evansville and SCB Bank in Shelbyville.

More than a half dozen Indiana banks cut their dividends to a penny a share during that slump, including Muncie-based First Merchants Corp., which had racked up 22 years of annual dividend increases.

Mike Renninger, an investment banker specializing in financial institutions at Renninger & Associates, said he’s hearing no chatter in the industry to indicate Indiana banks are planning dividend cuts.

“Most of them are in a very good position from a capital perspective,” he said. “While it is too early to tell what kind of losses they will incur, they are certainly in a position to incur some losses and still pay dividends, as long as it is not a systemic and long-term situation.”

He said the government’s rapid rollout of aggressive stimulus programs should allow many bank customers that otherwise would have failed to stay afloat.

“It is my hope that the economy recovers fast enough so that banks don’t suffer outlandish losses,” he said.

Renninger added: “Banks oftentimes pay between 2% and 3%, and I believe there are many bank investors who see it as a very safe and reliable income stream. Banks would think long and hard before they would break that string of reliable dividends.”•

Please enable JavaScript to view this content.

I realize this story is about dividends, but one potential silver lining of this pandemic, is the final demise of Sears. Eddie Lampert has been able to hold on to valuable real estate at hundreds of properties that should have been re-developed long ago. I look forward to the fire or bankruptcy sale of all the remaining properties. The new vibrancy created by the demolition and rebuilding will have a strong positive effect on the bottom line of mall owners.