Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowIndianapolis developers receiving tax abatements have committed to providing nearly $5 million to help struggling middle- and low-income families gain access to economic opportunities and become more upwardly mobile.

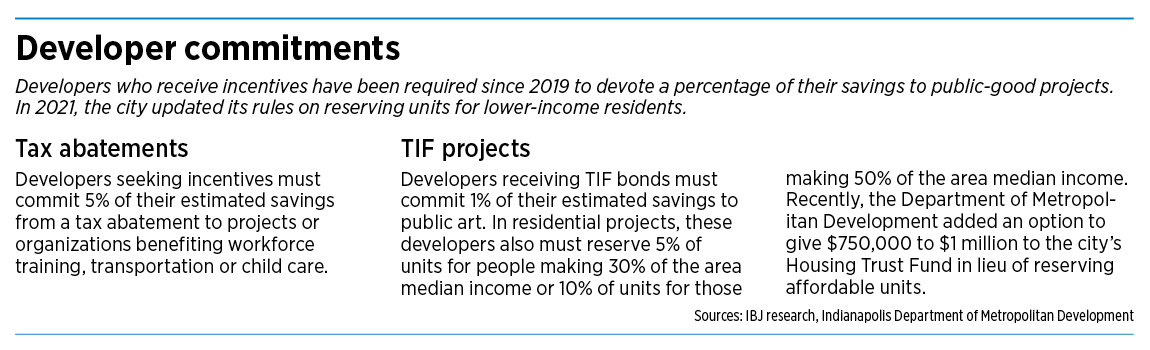

The commitments have come over the past four years as the city has required developers to put 5% of their estimated tax savings into workforce training, transportation improvements or child care.

The Metropolitan Development Commission has approved “inclusion” plans for 41 businesses that have requested abatements. Businesses often choose multiple methods to fulfill the requirement, but most have invested in infrastructure improvements aimed at improving safety for pedestrians or cyclists.

Twenty-one of the inclusivity plans include on-site or nearby sidewalk, trail and pedestrian-focused improvements and account for $2.3 million of the $4.8 million in commitments.

Some of those plans include donations to IndyGo or to community organizations and unincorporated towns, including $96,834 to IndyGo’s charitable foundation.

As part of the $180 million Market East redevelopment—which includes City Market and the Gold Building—locally based co-developers Citimark and Gershman Partners have committed to spending $500,000 on improvements to Wabash Street.

Emily Scott, administrator of community and economic development for the Department of Metropolitan Development, said these infrastructure investments increase sidewalk connectivity and rehab roads and trails that might not have seen improvements for years.

“I think in particular, that has been a positive and very outwardly tangible impact of some of these projects,” Scott told IBJ.

These commitments are more visible than donations to workforce training programs such as Indy Achieves. Indy Achieves exists within the city’s Employ Indy program and doles out “completion grants” to help Marion County residents who have some college credits but need financial assistance to complete their degrees.

Just over $2 million has been committed through the abatement program to workforce training plans, with $167,000 going to Indy Achieves.

Chelsea Meldrum, the organization’s chief development and external affairs officer, said some of these donations aren’t due until the end of 2027. But the money could fund 125 additional completion grants, which usually amount to about $1,325 each.

Many developers have instead opted for their own workforce training programs. Such internal programs account for another $500,000 in abatement-related commitments.

For an abatement that will finance a new testing facility on the Tibbs Avenue campus, Rolls-Royce has committed to a $1 million training program in partnership with the United Auto Workers union and the U.S. Department of Labor.

Meat-alternative manufacturer Greenleaf Foods’ commitments are also unique. To finance a move to its North Post Road facility, Greenleaf requested a tax abatement and committed to providing an employer child care reimbursement program through Early Learning Indiana, English-language and high school equivalency classes through Warren Township Adult Education, and annual in-kind donations of food to local charities.

Most developers have not chosen child care as the main piece of their 5% inclusivity requirement. Just four plans include child care, with $18,000 in total investment.

Indy’s incentive program was born in part through the Inclusive Economic Indicators Lab offered by the Washington, D.C.-based Brookings Institution in 2017. It worked with the Indy Chamber and economic development organizations from two other cities to help find ways to fill gaps in the city’s workforce and improve upward mobility.

In the years following, the Indiana University Public Policy Institute convened a citywide “inclusive growth working group,” which included representation from the Mayor’s Office, the Indy Chamber, the Central Indiana Community Foundation and other local stakeholders. In 2019, the new requirements for tax abatements were adopted.

City documents call the shift a “road map for economic development that seeks to address systemic challenges and set our city on a path toward inclusive growth for all Indianapolis residents.”

The program is still relatively new, Scott said. Many companies may not have yet been required to fulfill their commitments.

“If they have a five-year tax abatement, all of that investment may not happen at year one. It’s oftentimes kind of deployed across the life of the incentive. … I think 2022 was probably the first year that we had more projects that were actually starting to have to provide their compliance,” Scott told IBJ.

Companies approved for a tax abatement are required to submit annual progress reports to the Department of Metropolitan Development in order to receive their tax breaks.

If companies are not in compliance, department staff may recommend that the Metropolitan Development Commission shorten an abatement period, reduce an abatement, or, in the worst cases, “clawback” taxes the company owes to the city.

“Luckily so far, I don’t think we’ve run into any that have not done their investment in the transit, training or child care pieces,” Scott said.

Meanwhile, the city has bolstered other programs with similar goals of offering tax incentives with community-improvement strings attached.

For projects receiving tax-increment financing, developers are required to put 1% of the projected savings toward public art. An ordinance creating the requirement passed in 2016 after at least two failed attempts at creating a public art program in the city.

For residential projects, developers are required to set aside units for lower-income residents and families. These units provide rents lower than market rate.

One option is to make 5% of units affordable to families at 30% of the area’s median annual income. According to the U.S. Department of Housing and Urban Development, this metric for Indy is at $19,200 for an individual and $24,700 for a family of three.

The second option is to have 10% of the project’s units affordable to individuals and families at 50% of the median salary, which is $32,000 for an individual and $41,100 for a family of three.•

Editor’s note: IBJ has updated this story to remove an incorrect headshot of Emily Scott.

Please enable JavaScript to view this content.