Subscriber Benefit

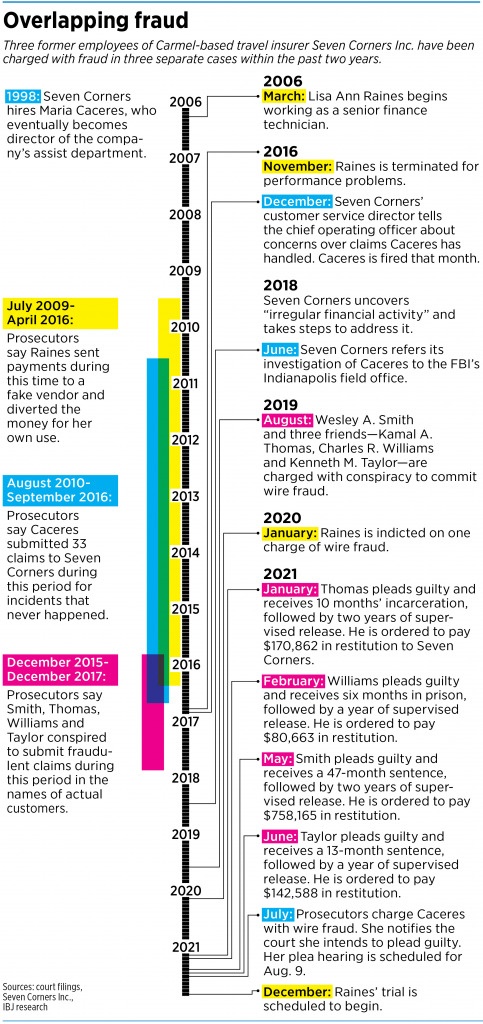

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowMaria Caceres, a former employee of Carmel-based Seven Corners Inc., stands accused of defrauding the company by submitting false claims—the third employee to face such charges within two years in separate criminal cases that allege more than $3.5 million in fraud against the travel insurance company.

One of the three former employees, Wesley A. Smith, has pleaded guilty and been sentenced to prison. A case against Lisa Ann Raines is pending.

Though attorneys for the three either declined to comment or did not respond to an IBJ query, court filings would suggest the cases are unconnected—none of the three former employees is named in allegations against the other two.

Unrelated fraud cases at the same company are quite unusual, said a fraud investigator who is not involved with the Seven Corners cases.

“It’s very uncommon for multiple defendants to be indicted for similar crimes at the same company if it wasn’t part of the same overall fraud,” said Doug Kouns, a retired FBI agent and the owner and CEO of Carmel-based investigations firm Veracity IIR.

Seven Corners discovered the alleged fraud incidents in the years after a company overhaul.

Established in 1993 by Jim Krampen and Justin Tysdal, Seven Corners offers trip insurance for both U.S. and international travel, as well as medical insurance for those traveling outside their home country. The company has 140 employees.

Krampen and Tysdal ran the company as unofficial co-CEOs for years. Then, in 2014, suffering from stagnant revenue, customer-service problems and its founders’ fatigue, Seven Corners hired a consultant to help revamp its structure and leadership.

In 2016 and 2017, the company hired three new executives and eight directors. It retained some existing employees and hired a large number of new ones after others left the company. Seven Corners also created structures that emphasized corporate culture and employee training.

Jeremy Murchland joined the company in 2018 as vice president of sales and was named president in 2020. He told IBJ the company “uncovered irregular financial activity” in 2018, describing the fraudulent activities as “an isolated event with indictments rolling out over the past few years.”

He declined to say whether additional charges could be forthcoming. “This investigation remains an active investigation and, as such, we are unable to provide any additional details on the matter as we continue to work with Federal investigators,” Murchland told IBJ via email.

False claims

In a case filed this April and previously unreported, former longtime employee Caceres is accused of submitting 30 fraudulent claims totaling $615,154 from August 2010 to September 2016. Three other submitted claims were denied for suspicion of fraud.

According to the criminal complaint, Caceres joined Seven Corners in 1998. She later became director of the company’s assist department, which processes insurance claims and helps customers who need emergency health care while traveling internationally. Court papers do not identify Caceres’ city of residence.

The complaint accuses Caceres of conspiring with associates outside the company to create fictitious customers, purchase travel insurance policies in their names, and create and submit false claims. Caceres is also accused of doing online searches for news stories, medical reports and other information she could use to create the false claims.

Of the 30 fraudulent claims, the complaint says, 29 were paid to accounts owned by a person identified only as R.C., “an individual with whom Caceres is known to have a personal relationship.”

As part of the scheme, the complaint says, R.C. also posed as the representative for a hospital in Venezuela seeking reimbursement for services rendered. In reality, the complaint says, R.C. never worked at that hospital.

In December 2016, Seven Corners’ customer service director raised concerns with the company’s chief operating officer about Caceres’ claims activity. The company terminated Caceres that month.

Court documents indicate that Caceres intends to plead guilty to one charge of wire fraud. Her plea hearing is scheduled for Monday.

Caceres’ attorney, Julie Treida of the Indianapolis firm Treida Law PC, declined to comment.

The other pending case involves Raines, who lives in Anderson. According to court documents, Raines was a senior finance technician at the company from 2006 until November 2016, when she was terminated for performance problems.

Raines is accused of opening a bank account in the name of L&B Tape Co. in 2006. Then, from 2009 to 2016, Raines is accused of making 65 payments totaling $2.1 million from Seven Corners to L&B Tape.

According to court documents, Seven Corners uncovered the fraud after her departure, when the company’s controller, who had joined the company in 2017, discovered numerous payments made by Raines to L&B Tape, an entity the controller did not recognize.

Court documents do not specify when Seven Corners learned of the fraud, but federal investigators interviewed Seven Corners employees in 2018, and interviewed Raines in October 2019. Raines was indicted on one charge of wire fraud in January 2020.

Raines’ case is set to go to trial in December. Her attorney, federal public defender Bill Dazey, told IBJ via email in January 2020 that “this case presents a complex set of circumstances, best commented upon when it has run its course.”

Dazey declined to comment when contacted by IBJ last week.

The third case involves McCordsville resident Smith and three of his friends, all four of whom pleaded guilty earlier this year to one charge of conspiracy to commit wire fraud.

According to court filings, Smith and his friends conspired to file $499,000 in fraudulent claims on behalf of actual Seven Corners customers from December 2015 to December 2017. Court records do not indicate when Smith worked at Seven Corners.

Prosecutors say Smith also used a company credit card to make 235 fraudulent transactions to purchase more than $221,000 in airline tickets and hotel stays for himself, family and friends and diverted six medical-service overpayments worth more than $37,000 into his personal bank account.

In May, Smith was sentenced to 47 months in prison and ordered to pay $758,165 in restitution to his former employer. The other three defendants—Kamal A. Thomas, Charles R. Williams and Kenneth M. Taylor—received lesser sentences that also included imprisonment and orders of restitution.

Smith’s attorney, Joshua Moudy of the Indianapolis firm Kammen and Moudy LLC, did not return a phone message left with the firm’s receptionist.

The U.S. Attorney’s Office, the prosecutor in all three cases, also declined to comment.

Not always reported

Experts say it’s difficult to know how prevalent employee fraud really is, and not all cases end up in the legal system.

According to a 2020 report by the Association of Certified Fraud Examiners, only 59% of workplace fraud cases are reported to law enforcement. Another 28% result in civil litigation.

The report is based on 2,504 responses from certified fraud examiners submitted to a 2019 online survey.

Among employers that did not report their cases to law enforcement, the report said, the most common reasons included the belief that internal discipline had been sufficient (46%), fear of bad publicity (32%) and the use of a private settlement to resolve the issue (27%).

But though the exact prevalence is hard to know, experts say certain factors make companies more vulnerable to fraud—and companies can take steps to reduce their risks.

Kouns, the Veracity IIR CEO, said major vulnerabilities include a lack of controls or auditing; lack of access to information; and an atmosphere of ignorance, apathy and incapacity.

Although Seven Corners has taken steps to revamp its culture and operations in recent years, it’s not clear from the outside what the company has done specifically in response to the ongoing fraud investigation.

In his email to IBJ, Murchland declined to give details: “To assist in preventing this from happening again, internal procedures and controls have been and are in place to detect and immediately report any irregularities with our financial activities.”

Murchland said the hiring of the consultant and the cultural revamp were not related to the financial irregularities the company later discovered.

Kathleen Hart, an attorney at Indianapolis law firm Riley Bennett Egloff LLP, said she advises her clients to adopt protocols that create checks and balances for financial transactions. Checks above a certain amount might require multiple signers, for instance, or unknown payees might require verification by someone other than the person authorizing the payment.

“That would have put a stop to many of these fictitious payees,” Hart said of the Seven Corners incidents.

Kouns said security cameras in the workplace can help deter crime, as can company meetings to discuss fraud prevention. “It just sends the message to employees that you’re on top of this.”

Hart, who specializes in business litigation and serves as outside general counsel for clients, said it’s also important to foster a culture in which employees feel they can raise concerns about things that seem “off,” even if they aren’t sure why. “They all need to know they’re part of a team, and the team’s success is the success of everyone.”

Hart cited the case of a nutritional-products company whose receptionist noticed there was less merchandise in stock than the inventory system said there should be. The receptionist reported her observation, and the company learned an employee had been embezzling by taking products, selling them off the books and pocketing the cash.

Creating a “see something, say something” culture can go a long way toward identifying and preventing fraud, Hart said. “It all goes down to what you teach your employees is important.”•

Please enable JavaScript to view this content.