Gov. Mike Braun signs executive order creating fraud prevention council

The new Indiana Council on Fraud Detection and Prevention is expected to focus on federally funded programs administered by state agencies like Medicaid, SNAP and WIC.

The new Indiana Council on Fraud Detection and Prevention is expected to focus on federally funded programs administered by state agencies like Medicaid, SNAP and WIC.

Drive Planning operated an office in Fishers that was overseen by former managing partner Gerardo Linarducci, who is facing civil fraud charges from the U.S. Securities and Exchange Commission and multiple lawsuits from investors.

Gerry Linarducci, former managing director of Drive Planning LLC, faces charges related to an alleged scheme to defraud real estate investors in Indiana and nationwide.

Authorities said the woman diverted company funds to pay personal expenses, such as credit card bills, golf equipment, wine and luxury travel, including an 11-day stay at the Four Seasons in Hawaii.

Jordan Chirico is facing both criminal charges and civil litigation over his alleged connections to what authorities describe as a $200-million-plus Ponzi scheme.

Two owners of a gas station and convenience store in downtown Indianapolis have filed a lawsuit against another partner.

Kevin Calvert, 57, was charged with 43 counts of Medicaid fraud and an additional count of theft following an investigation by the attorney general’s Medicaid Fraud Control Unit.

The former Indiana University guard was arrested this week by the Carmel Police Department on one count each of theft and fraud of amounts between $750 and $50,000.

The former manager of a credit union branch in Indianapolis has been charged after investigators say she stole more than $350,000 from customer accounts.

Jason L. Crace entered a guilty plea for assisting in the preparation of false tax returns on behalf of clients who participated in an illegal tax shelter.

The lawsuit claims the crypto venture company lied about how much money it had raised in order to persuade the fund to also invest.

Federal officials said Rodney Grubbs had solicited millions of dollars in investments from pickleball players and enthusiasts across the country, offering promissory notes with “guaranteed” interest rates of 10% or higher.

The operator of AurumXchange, a virtual currency exchange, had been charged with five counts of money laundering and two counts of willfully failing to file a tax return.

The lawsuit alleges Cindy Mowery, the board president, used Marion County Fair Board money to pay painters for work done at her home.

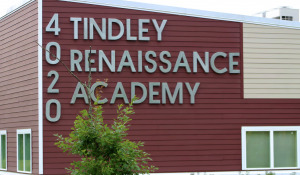

Brian Metcalf, who led the charter network from July 2019 through December 2022, pleaded guilty to two of the nine counts of wire fraud outlined in an indictment filed in 2023.

Leaders of the Indiana Virtual School and Indiana Virtual Pathways Academy face both federal and state cases in which they’re accused of defrauding the state of millions of dollars.

James Henley, 35, pleaded guilty to multiple charges in the schemes, including money laundering, aggravated identity theft and wire fraud.

A former employee of a Greenfield-based contracting business has been sentenced to 30 months in prison on charges that she defrauded her former employer out of more than $1 million.

A federal investigation into Juan Santiago’s activities revealed an alleged “recurring pattern of fraudulent tax preparation practices.”

The pair stole at least five inmates’ personally identifiable information, including names, dates of birth, and social security numbers, authorities said. They were accused of using the stolen identities to open at least nine accounts at various Indiana banks using fraudulent passports.