Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

The CEO of Phoenix-based Alpine 4 Holdings Inc., whose subsidiaries include Indianapolis-based RCA Commercial Electronics, delivered a stark yet hopeful message to investors late last month.

“This year has posed formidable challenges. Our performance has fallen well short of expectations for corporate, our subsidiaries, and for our shareholders,” Alpine 4 CEO Kent Wilson wrote in a Dec. 29 letter. “To be candid, the company grapples with unparalleled challenges, and it is imperative to acknowledge the intricate and obstacle-laden path ahead.”

Wilson’s letter blamed both internal factors, including delays in filing financial reports with the U.S. Securities and Exchange Commission, and a host of external factors, like rising interest rates and tightening banking conditions.

In that letter, and in a subsequent interview with IBJ, Wilson said Alpine 4 is taking steps to right the ship. It is putting more focus on its best-performing subsidiaries—including a licensee of RCA, a storied brand long associated with Indianapolis—while jettisoning the weaker ones.

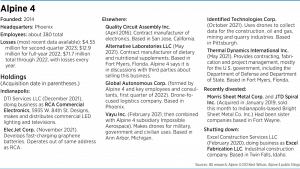

Alpine 4 is small for a publicly traded company, with only about 380 employees, including its corporate staff and all its subsidiaries. It is a holding company with a handful of operating companies in different industries around the country.

Alpine 4 acquired DTI Services LLC, which does business as RCA Commercial Electronics, in December 2021 for $14 million.

Alpine’s other Indianapolis-based subsidiary is ElecJet Corp., which has a handful of employees and is developing fast-charging graphene batteries. The company, which Alpine 4 acquired in November 2021, was formerly based in Texas but now shares office space with RCA at 5935 W. 84th St.

The company’s other holdings include a California-based contract electronics manufacturer, drone-related companies in Phoenix, Michigan and Pennsylvania; a supplements maker in Florida; and others.

Through the end of 2022—the most recent full-year data available—Alpine 4 has lost a total of $71.7 million.

But Wilson told IBJ Alpine 4 is cutting costs and taking other steps to improve its financial situation. “By the end of 2024, we’ll be in a lot better shape to be able to generate money—to generate profit.”

Cost-cutting measures

A big part of that cost-cutting involves closing or divesting some subsidiaries.

This month, Alpine 4 sold Fort Wayne-based Morris Sheet Metal Corp. and its sister company, JTD Spiral Inc., to Indianapolis-based Bright Sheet Metal Co. Inc. for $1.58 million plus the assumption of certain liabilities, including unfunded pension liabilities.

Morris Sheet Metal was a profitable company when Alpine 4 acquired it in January 2019, Wilson said, but the pandemic changed that. A large customer imposed COVID-19 visitor restrictions that prohibited Morris from being able to do work at that site, Wilson said, and pandemic-related supply chain problems increased both shipping and steel prices dramatically.

Another underperformer, Wilson said, has been Alternative Laboratories LLC, a Fort Myers, Florida-based maker of dietary and nutritional supplements that Alpine 4 acquired in May 2021. Wilson said Alpine 4 wants to sell that subsidiary and is in talks with third parties about a possible divestiture.

Within months of Alpine 4’s acquisition of Alternative Laboratories, Wilson said, one of its largest customers filed for bankruptcy, reducing Alternative Laboratories’ revenue by about half.

Wilson said last week that Alpine 4 is also in the process of winding down operations at Idaho-based Excel Fabrication LLC, an industrial construction company Alpine 4 acquired in February 2020.

Aside from some of these subsidiary-specific challenges, Wilson said, rising interest rates, tightening banking conditions and turnover with Alpine 4’s outside auditor have also posed challenges.

On Jan. 11, Alpine 4 disclosed to the SEC that its board had voted to terminate its outside auditor, Phoenix-based RSM US LLP, which had served in that role since September 2022. As of early this week, Alpine 4 had not announced who its new auditing firm would be.

A ‘crown jewel’

Amid the turmoil, Wilson said, Alpine 4 is keeping a firm hold on RCA Commercial Electronics, which has about 50 employees and makes commercial lighting, televisions and video monitors.

“RCA is one of our crown-jewel companies. We’re not open to selling that,” he said.

RCA Commercial Electronics, founded in 2009, sells commercial televisions for the hospitality and health care markets, as well as gaming monitors. The company also sells commercial LED lighting and in 2019 acquired the lighting and lighting controls business of LG Electronics USA.

For the first half of 2023, the most recent figures available, RCA posted profit of $1.26 million, one of only three Alpine 4 subsidiaries to do so. The others were Florida-based defense contractor Thermal Dynamics International Inc. and California-based electronics manufacturer Quality Circuit Assembly Inc. Alpine 4 as a whole posted a $10.3 million loss.

Alpine 4 uses the RCA name under a licensing agreement with Technicolor, the French company formerly known as Thomson Consumer Electronics, which owns the brand.

The RCA name has a long history, and at one time the company employed thousands of Hoosiers at facilities in Indianapolis, Bloomington and Marion.

RCA Corp., originally known as the Radio Corporation of America, was founded in 1919 and based in New York City. General Electric purchased RCA in 1986, and the company then known as Thomson acquired RCA’s consumer electronics division in 1987.

Thomson had its Americas headquarters in Indianapolis before moving to Carmel. The Carmel site closed in 2017, and all of RCA’s Indiana factories are also closed.

Wilson said Alpine 4’s cost-cutting measures, plus some recently secured financing, give him hope that better days are ahead.

“I’m very optimistic about where we’re going in the future,” he said.

Alpine 4 has not filed a quarterly financial report since August, making it difficult to get a full picture of the company’s current financial situation.

In that Aug. 11 second-quarter report, Alpine 4 reported its involvement in several legal proceedings, including a settlement in which Alpine 4 agreed to pay $3.9 million plus 250,000 shares of stock to the person who had sold Alpine 4 a company called Horizon Well Testing LLC.

Alpine 4 no longer owns Horizon, the SEC document says, but it will be making settlement payments in installments through Dec. 1 of this year.

In mid-November, the company notified the SEC that it would not be able to file its third-quarter report on time because its corporate controller and several of its subsidiaries’ controllers had left, and because the company was trying to raise additional capital. That financial report had not been filed as of earlier this week.

On Dec. 27, the Nasdaq Stock Market LLC notified Alpine 4 that the company’s stock was in danger of being delisted because its share price had closed below $1 for the previous 30 days. The company has until June 24 to bring its stock price up to the required $1 per share.

Shares of Alpine 4 closed Tuesday at 57 cents.•

Please enable JavaScript to view this content.

Sounds like another house of cards where the only ones benefiting are the owners and their large salaries at the expense of the investor’s. That’s too many unrelated business to expect anyone to manage well.