Subscriber Benefit

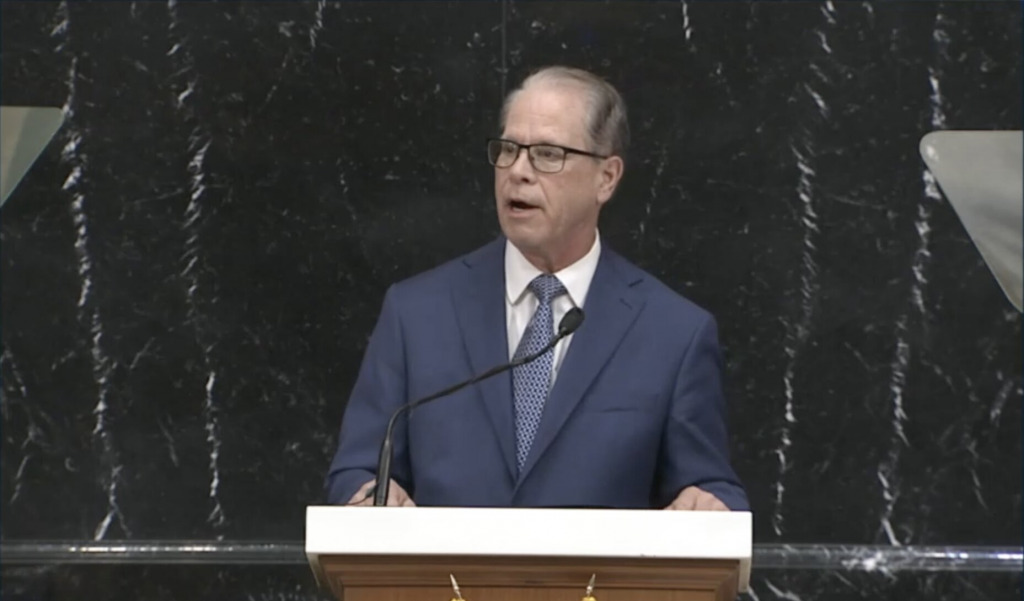

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowCiting the public’s outcry over significant tax bill increases, Indiana Gov. Mike Braun said Tuesday that he will continue to fight for broader property-tax relief after a Senate fiscal committee scaled back his plan for ambitious tax cuts.

Braun said Senate Bill 1—the Senate’s top-priority property-tax relief bill—doesn’t do enough to provide widespread relief now that his proposal has been removed from the legislation.

“I’m going to be out there as an advocate again to get it in that right place,” he said. “So you haven’t seen the end of it.”

While Braun’s plan would have installed tax bill caps and expanded the homestead deduction, the Senate instead passed legislation on Feb. 17 that would slow property-tax growth and target relief to vulnerable demographics.

Those changes led Braun to threaten a veto of the bill—which the Legislature could overrule with a simple majority vote.

On Tuesday, he said he would veto the measure “as a last resort” but doesn’t expect he will need to. His administration is acting collaboratively to find a compromise on the bill, he said, and lawmakers are meeting with him frequently.

Though Braun has been bullish about delivering on his top campaign promise, he told reporters he won’t go overboard and risk damaging much-needed relationships with Legislature leadership.

The primary hurdle for expansive property tax relief is the ability of local governments to cut millions of dollars out of their budgets. Local leaders warned that Braun’s plan would result in significant cuts to critical services. They said the pared-down bill would still mean noticeable rollbacks to services residents expect.

Braun continues to say local bodies can handle the plan but will need to tweak their spending to grow at a pace taxpayers can pay for.

‘If they bought a lot of shiny objects, if they’re sitting on a lot of cash balances, do a little soul searching yourselves,” he said. “We’ll end up in, I think, a place that’s going to be a sweet happy medium.”

Last Thursday, both House Speaker Todd Huston, R-Fishers, and Senate President Pro Tempore Rodric Bray, R-Martinville, told reporters they want to avoid the possibility of a special session to handle the property tax issue.

“We want to get to the right place, and we all want to find property-tax relief for Hoosiers,” Huston said. “And I think we’ll get there.”

Bray said a veto would create challenges.

“We’re going to keep our head down and try to craft a policy that works for the state of Indiana,” he said.

SB 1 is awaiting House introduction and eventual consideration in the chamber’s Ways and Means Committee.

Besides his qualms with the property-tax bill, the governor voiced his support Tuesday for a number of progressing bills, including health care cost transparency, minimum teacher pay raises and additional prosecutor funding support.

Please enable JavaScript to view this content.

SB 1 is a joke. They need to do better.

IN GOP in a nutshell: complain about potholes while reducing the ability of municipalities to fill potholes.

maybe they should spend less on bike lanes that barely get used.

Oh buddy, if you think Indiana municipalities get anywhere near enough money to sustain car infrastructure for longer than its initial shelf life, you have another thing coming.

Low population density. Crazy low property tax rate. Inequitable gas tax redistribution formula and no local gas taxes.

Without fixing these issues, the only real option will be to decrease the amount of right away given to cars. First in Indianapolis, then in the donut counties as their infrastructure ages. The harsh reality of living a car-centric subsidized lifestyle is coming to an Indiana community near you!

What would that fix? It just makes our community less attractive (people love bikes and opportunities to safety conduct outdoor activities) and it wouldn’t fix the problem. Bike lanes are built into street projects that are already ongoing, so removing the bike lane elements wouldn’t actually result in any significant cost reductions. Robert is right, we need to AGGRESSIVELY pursue infill development and increase our population density. Center Township’s infrastructure is designed to handle twice as many people as it does now.

Gov. Braun (and the entire Republican delegation in the Legislature) should read Prof. Hicks’ latest piece in the IndyStar.

LOL. Oh, you were serious.

Hicks is a cartoon and just a reliable Democrat quote for the subject du jour. The only thing more laughable than Hicks is the Gannet organization

The Gov apparently doesnt understand that we are the 9th lowest tax state. There is a tax cap in place at 1% for residential and 2% for commercial. I read where the tax caps could go up to 5 and 7 for residential. Proerty value is going to continue to go up as our housing shortage continues. He apparently has large donors for his campaign that think they pay too much. What is the proposal for commercial buildings? I may agree on some of what he is trying to achieve with schools. Every High School is a small college campus with not so good results. He is going to open up a can of worms and he will not get a 2nd term. That will open the door for some serious chaos.

That tax cap at 1% is a fallacy. Unnecessary school building and Red Line construction “special assessments” make it higher than 1%.

What Chuck said … but interesting that nobody talks about cutting back on expenditures. It is never enough and the masses are getting sick and tired of it.

Indiana has the 4th smallest budget on a per-capita basis among states with a AAA credit rating. There isn’t much to cut. We’re a low-tax, low-service state.

If the State wants to start cutting expenditures, start with extraneous endeavors like LEAP.

Property taxes are already very low while infrastructure and schools continue to fall apart. To further reduce property taxes is to stop making common sense investments that pay off for all Hoosiers. Once a state stops investing in itself, it’s as good as gone.

Cut back? They’re already cutting back on schools and healthcare for people struggling to make ends meet. What more do you want?

We did find the funding for another income tax cut and giving rich people vouchers to private schools. Funny those priorities, isn’t it?