Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe owner of the struggling Lafayette Square Mall on the northwest side of Indianapolis said Wednesday that it expects to spend more than $200 million to redevelop the property, with an initial plan calling for retail, dining, hospitality, education and residential uses, as well as an entertainment and sports district focused on local youth.

The renovated property will be renamed Window to the World and portions of the project could be done within the next year or so.

Sojos Capital LLC, an Indianapolis-based investment firm that owns the mall, said at a news conference it plans to revitalize the 1.2-million-square-foot mall and some adjacent shopping centers and other buildings surrounding the 113-acre site as part of a master-planned effort to boost the International Marketplace district.

Plans for the project call for senior and traditional apartments, a hotel, townhouses, a trail and canal, a 25,000-square-foot international concert center, charter school Monarca Academy, a movie theater, the northwest headquarters station for the Indianapolis Metropolitan Police Department, soccer fields, paddle courts, a sports academy, bike shop, dog park, office space and a dance studio.

Also in the plans is a linear park stretching to Indianapolis Motor Speedway.

“The mall as we know it is no longer viable,” said Fabio de la Cruz, principal of Sojos Capital, who will serve as lead developer on the project. “You have to rethink the concept of a mall. I see this less as a mall than as a neighborhood.”

The $200 million estimate covers the first phase of the project, which includes redevelopment of the mall, 200 apartment units, hotel, the school, movie theater, soccer training facilities.

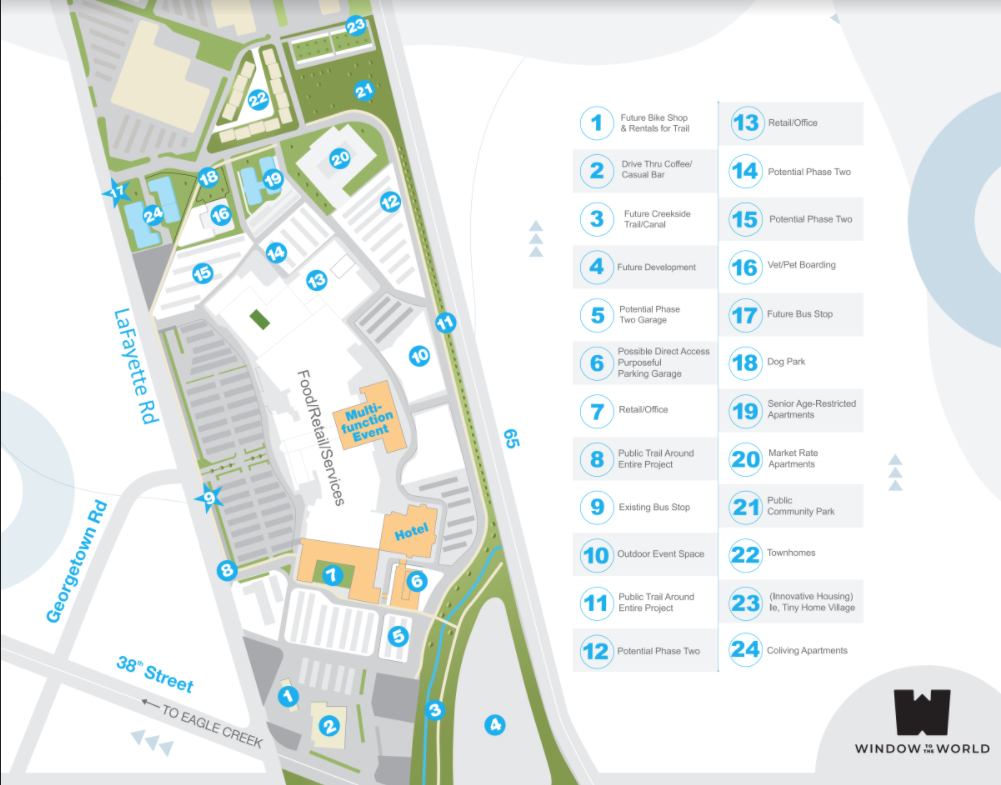

Story continues below graphic

“We’re ready to spend lots of money,” de la Cruz said.

Construction on the movie theater and repairs to the site’s parking lots are already under way. Developers say they plan to transform the mall interior into year-round indoor “streets” that recreate outdoor scenes from around the world.

The project announcement comes just under one year after Sojos Capital affiliate Perez Realty Group acquired the mall from a New York-based firm for about $20 million.

The 1.2-million-square-foot mall on the northeast corner of Lafayette Road and 38th Street is the third-largest shopping center in the Indianapolis area, trailing Castleton Square Mall and Greenwood Park Mall. Built by late developer Edward J. DeBartolo Sr., the mall opened in April 1968 as the first enclosed shopping center in the Indianapolis area.

As of early 2021, the mall was roughly 60% occupied, with about 90 tenants. Three of its four anchor spaces are vacant.

Over the years, there’s been a great deal of speculation that the property could be converted into other uses, in part because of continued challenges for its brick-and-mortar retailers.

Sojos representatives said they plan to capitalize on the mall’s location in an opportunity zone, a federal designation that offers substantial tax breaks to those who invest their capital gains in a real estate development or business in certain areas—oftentimes economically depressed locales. They also hope to involve other investors.

The developer said it was pursuing tax incentives for the project. “We’re working on it,” de la Cruz said.

Story continues below graphic

The renovation includes a full roof replacement for the mall, which will be done in phases with portions of the center closing during construction.

Monarca Academy is authorized by mayor’s charter school program and will begin accepting applications next school year.

Lafayette Square has struggled amid a changing neighborhood and a loss of traditional tenants over the years.

In the 1970s, the mall featured six department stores: Sears, JC Penney, G.C. Murphy, William H. Block, Lazarus and L.S. Ayres. Today, the mall’s only anchor is Shoppers World, after Burlington Coat Factory closed its store there in September 2019.

Smaller spaces are mostly occupied by a mix of local stores and restaurants, with only a handful of national chains in the mix.

Former anchors JC Penney, Sears and Macy’s left in 2005, 2008 and 2009, respectively, leaving gaping holes in the once-bustling property.

A look at the proposed revitalization plan:

Over the next two years, plans call for:

- Ground-up construction of approximately 200 multi-family rental units;

- Renovation of a former anchor store into a boutique hotel;

- Renovation of a former anchor store into innovative office space;

- Renovation of a former anchor store into a multi-functional event space;

- Renovation and leasing of outparcel buildings, such as veterinarian/pet boarding, bicycle sales and rentals, and coffee shop;

- Construction of a new public trail and public park;

- Infrastructure and street improvements

Sojos Capital said it is making exterior improvements to these nearby properties:

- 5046-5210 W. Pike Plaza Road (where Carniceria Guanajuato, Yummy Crab and others are located);

- 4351 Lafayette Road (where AT&T store, Sizzling Wok and others are located);

- 2802 Lafayette Road (Eagledale Plaza Shopping Center);

- 4002 N. High School Road (where JM Dry Cleaners, K-Arise Store and others are located).

Projects involved in the plan:

- Fabio Sports (indoor soccer, paddleball courts, sports academy and dance studio) at 3695 Commercial Drive (expected to be completed by end of 2021);

- International Concert Center at 3733 Commercial Drive (expected to be completed in 2022);

- Trampoline park at 3708 Commercial Drive (to be completed in 2022-2023);

- Ground-up construction of the new IMPD Northwest District Headquarters at 4005 Office Plaza Boulevard (expected to be completed February 2022);

- New soccer fields at 5101-5111 W. 38th St. (expected to be completed in 2022);

- Ground-up construction of soccer facility at 5101-5111 W. 38th St. (completion date to be determined);

- Ground-up construction of Monarca Academy at 5101-5111 W. 38th St. (expected to be completed in 2023);

- Renovation and reopening of movie theater at 3898 Lafayette Road (expected to be completed in 2022).

“The Department of Metropolitan Development is looking forward to collaborating with Sojos Capital and the northwest side community on the revitalization of the Lafayette Square Mall area,” the DMD said in a statement issued Wednesday. “The planned, substantial investments announced today represent an enormous opportunity to accelerate momentum and boost growth in the International Marketplace, a neighborhood vital for the overall equity and prosperity of Indianapolis.”

Please enable JavaScript to view this content.

Well at least the police station is a good idea…

What’s with it and people hating what the market plans on doing unless it fits their narratives? Has the CCP gotten to you people?

“The market plans”??? When they’re using Federal tax subsidy (Opportunity Zone) and asking for local tax dollars? That’s not “private development”. I thought you Real Republicans hated socialism?

My comment was satirical. For some reason, conservatives seem to hate any private development that doesn’t fit with their nonsense narratives. I don’t affiliate with either political party, but I am certainly not a (R).

I do agree that there is a point at which tax breaks for projects become socialism for the rich, but opportunity zone tax breaks do not come close to socialism. This is privately planned, managed, and funded in an area that isn’t providing much tax revenue to the government anyway.

Robert H. – If you ever had a mortgage on your personal home, and if you took the mortgage interest deduction off your federal taxes, and if you deducted your state property taxes from your federal taxes, congratulations! Your were a recipient of “socialism for the rich.”

Robert, OZ tax breaks allow people who make money from gains on real estate investment in OZ to pay NO taxes on those investment gains after 10 years.

If that’s not a handout to the rich, I’m not sure what is. I don’t get that break on money held in my IRA for 10 years.

A different Chris here: While I am all for calling out tax breaks for big corporations and the ultra-wealthy, who should, but don’t, pay their fair share. You seem to misunderstand how a traditional IRA works. Your earnings in your IRA grow tax-free until you begin to take retirement distributions (unless you take an early withdrawal), so yes, you can get a 10 year, or much longer, tax deferral.

That said, I have no problem with certain aspects of socialism. We have never been a purely capitalist nation (nor do I think many people would want to live in a purely capitalist society).

With respect to private developers, I dislike giveaways of public funds when there is not substantial public benefit received, but the Lafayette Square area has been an economically depressed area for decades, and I do not see it improving without some sort of government subsidized redevelopment. I also think this proposed redevelopment seems to be a well though-out comprehensive approach to revitalizing the area that will provide real benefits to the people who live there (I would want to see local hiring goals and wage guarantees as part of any subsidy agreement). Also, the government was, in part, responsible for the area’s decline, both through subsidizing programs that encouraged disinvestment and flight to the suburbs and by failing to adequately fund infrastructure, public safety, and education for the neighborhood. Therefore, the government should be a partner in helping to fix the problems in the area.

I realized I misread Chris B’s comment. Yes, an investor who meets all the requirements and holds an investment for 10 years, can get a tax exclusion on their initial roll-over investment in an Opportunity Zone, though they still pay tax on the subsequent gains on the investment (with some adjustments). In any case, I do not object to subsidies of private developers, so long as the end result is a real benefit to public, including the local residents of the targeted area. Giving a developer a big break on a luxury apartments downtown does not make sense to me since downtown development at this point would generally occur with or without subsidies and downtown is generally not an economically distressed area. But, subsidizing redevelopment of Lafayette Square (with certain commitments by the developer on hiring, wages, reinvestment, etc.) does make sense and is good policy.

Christopher, you haven’t read enough about taxation of gains in OZ investments. If held for 10 years, the holder pays NO tax on the gain, not just none on the original rollover gain but none on the new gains too. It really is a handout to rich investors disguised as progressive public policy.

I’m not against using tax credits to pursue public policy goals, as that’s how our affordable housing industry produces most development. But at the end of the affordability period, development partners do have to pay capital gains tax if they sell, which recaptures part of the income tax credit grant.

Is this a joke?!

I don’t like government social spending, however, if that area of town ever wants to come back, the vacant areas have to have something in them as empty vacant buildings and areas become like a large black hole, like from outer space, that pulls everything in and devours it.

Development tends to produce more development and a lack of it tends to do the reverse. The more private money that can be injected into a project the better. That way they have a stake in its success.

Every time we get exciting, transformative news for our city the sour grapes trolls come out from under their bridge to remind us all that we would be better off if our city was one giant, unproductive parking lot that required none of their hard-earned tax dollars to maintain or grow. Super lame shtick, get some new material folks!

This is a great way to repurpose a failing mall area. I wondered when this kind of repurposing would start happening given the quickly changing retail environment. That area definitely needs some help and putting a police station in as well is a great idea. I know this is not a slam dunk and may or may not work out, but it’s certainly worth the effort with both private and public funds. Best of luck. I hope its a big success.

There’s already a police station there, at 3821 Industrial Drive.

This would be an ideal area for a soccer stadium. Lots of space and an international focus already in place.And good access from interstates, and ,big streets built for high traffic.

I agree, Lynne!

Not for a second rate league team.

Now that’s a good idea!

I am excited for this development in a much needed area!

This is great news. There’s lots of potential in this area between Speedway, Butler Tarkington, and Eagle Creek areas!

And the International Marketplace!

The renderings are really cool and innovative! The plans are outrageous and transformative for the area! The connectivity would be fantastic to other areas like IMS, etc. Unfortunately the canal is nothing more than a money pit, pipe dream fantasy, shown to lure interest, as the cost could not be justified without massive income to support it. Overall, exciting plans for an area that needed such interest and focus. Good luck Sojos you’ll need it!

I can see movies being filmed here!!! Finally!!! A destination worth the visit From out of state!! Enhanced quality of life for sure!!! Add a few 25 floor (plus) towers with beautiful lights for the night!!! Youd attract real clientele!!!!

Thanks for the thorough reporting. This northwest side resident is crossing fingers that this development succeeds. There is benefit to the entire city, too, as everyone traveling from states north or south through our city sees the current blight/remnants of Lafayette Square from I-65… it isn’t a good look for Indy.

I just grabbed dinner at Magoo’s over the weekend. The strip mall that was once nearly empty is now practically full with several new tenants. And the same can be said of most of the strip malls that dot 38th.

Honestly the one thing holding this area down is the mall. And the lack of people. 38th really needs people living on it. This can help establish customer bases for many of the business and workers to work there.

This is a really ambitious plan and I’m hoping for the best.

This is the type of unique development indy needs to showcase itself as a city on the move and its diversity.I have no doubt it would bring people from all over the city and state to experience this unique concept which could be a blueprint of how to save other failing malls across the country.Simon property should pay close attention and even invest in this project on some level.I seen a documentary done in Dallas where the hispanic community there transformed a dead mall into something similar to this project and its a hit for the locals and visitors.If done right, this could be a huge hit for the city and the neighborhood for even more economical growth in the area.

I don’t see all critical cheapasses putting your money at risk

I wish them the best. Senior housing is needed, safe areas to walk, accessible food stores, small houses in the Tiny House are good ideas to create an affordable neighborhood. Maybe a small urban farm space as well.

Keeping my fingers crossed for a successful development.

I seriously don’t understand all these naive comments. I’ve lived here and worked closely in the business community for 30+ years. THIS DEVELOPMENT IS NEVER GOING TO HAPPEN AS PRESENTED. I am completely supportive of developing this area that has so much potential. But this mess has absolutely no cohesion. It’s just a bunch a stuff thrown together. Yes, let’s “spend lots of money.” What a complete joke. And a complete mess. Why not just throw an atomic particle accelerator in there, just to be cool?! Sheesh! This IS a joke.

Yeah, I was gonna say, I hate to be a Debbie Downer, but where are they going to get the funding for all this? It feels like a smaller version of Waterside at the old GM stamping plant all over again.

That was my point. This is total bs.

I don’t see all the armchair developers bashing this while sitting on their arse at the computer doing anything to improve this or any other area of Indianapolis. Put up your own money or shut up.

Looks like a great development just not the right side of town IMO