Subscriber Benefit

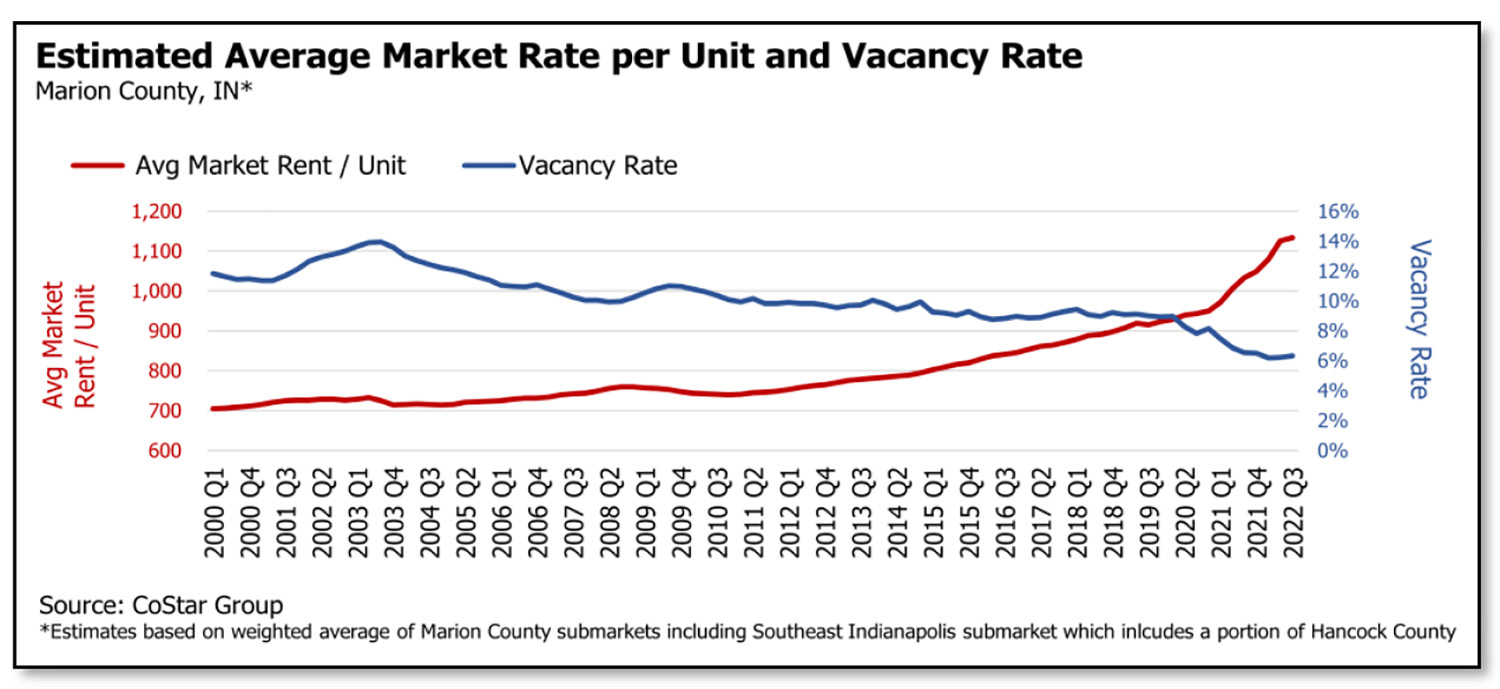

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowRenters in Marion County have seen rent increases, on average, of $200 to $300 per month since the beginning of the pandemic, squeezing tenants while wages have increased at a much slower pace, according to a new study from the Fair Housing Center of Central Indiana.

Meanwhile, landlords have seen a 20-year low in vacancies—just 6%—while struggling tenants face a scarcity of low-cost rental housing.

The report released Monday from FHCCI found a competitive housing market that benefits investors and corporations while causing troubles for lower-income renters, families and renters of color.

“Marion County is in a housing crisis with low vacancy rates driving rents across the county to unaffordable levels for most of our residents,” Amy Nelson, executive director of the FHCCI, said in a media release. “However, that is not the only burden being placed on our renters. Add in the lack of affordable housing options, substandard housing conditions, increasing income-based rent burdens, along with housing discrimination, and the current climate is extremely troubling.”

Most multifamily rental units aren’t affordable to many Marion County renters, the report said. Half of Indianapolis renters make $35,000 or less per year, but only 35% of the county’s rentals are affordable to that group, the study found. This disproportionately affects households of color, the report said, because roughly half of the households below $35,0000 are Black and 13% are Hispanic.

Most multifamily rental units aren’t affordable to many Marion County renters, the report said. Half of Indianapolis renters make $35,000 or less per year, but only 35% of the county’s rentals are affordable to that group, the study found. This disproportionately affects households of color, the report said, because roughly half of the households below $35,0000 are Black and 13% are Hispanic.

Investor and corporate purchasing of single-family homes to convert into rentals is increasing, the report said. This is also affecting Black Indianapolis residents to a higher degree, because these properties are disproportionately located in majority Black neighborhoods like the Far Eastside, Martindale-Brightwood, Meadows and Riverside.

The report also said there isn’t enough affordable housing for families, with just 250 three- and four-bedroom units in Marion County with monthly rents below $875.

Marion County still has the highest concentration of affordable housing in central Indiana. The donut counties see higher rents, with the Hamilton County Carmel-Westfield-Zionsville submarket recently surpassing downtown Indianapolis for the highest market asking rent in the Indy metro area at $1,588 per month. Hancock County has seen a 44% increase in market asking rent since 2019, rising from $811 to $1,171.

The report’s recommendations include asking for several changes to Indiana laws that the FHCCI says favor landlords. It also suggests regulating institutional investors and equity firms that crowd out prospective homeowners, as well as enacting reforms to strengthen tenants’ position in eviction proceedings.

Please enable JavaScript to view this content.

Has anyone bothered to ask why we’re facing such precipitous drops in rental occupancy rates, at a time when, based on the US Census Bureau, birth rates are at an all time low and the 2010 to 2020 increase was the least since 1930-40 (the peak of the Great Depression)? Why would there be such a demand, when people aren’t having kids, aren’t forming new households, and many young adults are continuing to live with mom and dad? Could this surge in occupancy have anything to do with a population surge coming from south of the border?

LOL – this is the the least educated comment I have seen you post in a while…

we have seen a population increase in marion county of legal citizens since 2010…. and total units available outside the mile square has gone down….

but yes – illegal immigrants are the reason I raised rents 20% across the board on all my properties…. sigh

No. The issue is multi-faceted. Zoning that forces low density housing (or, in the majority of cases, single-family houses only), increasing urbanization of the American population (82.66% of Americans live in cities or suburbs and this is projected to increase to 90% by 2050), and agglomeration effects of cities make this an issue. The biggest issues are the supply of apartments, the zoning that makes them so arduous to build, and the NIMBYism that enables such massive constraints (plenty of it based on thinly-veiled “I don’t want ‘those people'” opposition).

Just look at property values in rural communities and you’ll see what’s happening: mass migration from rural areas to more urban areas. The American Dream in small towns is on life support and this is reflected in stagnant/dropping property values in such areas.

Hahahahahahaha

We also have a dump truck load of people moving into the mid west. Climate change, droughts in the south east, and affordability here is much better. Look at Cincinnati… it’s exploded in the last 3 years. Maybe more so than Indianapolis. Until supply catches up with demand nothing is going to change.

south west^*

100% – about 50% of those buying homes in my MKN/BT area are moving here from the coasts or moving back from the coasts…

Most people like the idea of supply and demand to dictate economic conditions. But when fairness is PERCEIVED to not be ideal, then many folks get anxious and look for new solutions. As a veteran of the real estate business I will say that this will all balance out eventually, but just like the auto business now, we have limited supply and strong demand. This is due to a variety of factors that have resulted in a kind of “perfect storm”, the likes of which we have not seen previously. But we better be careful in adopting some of the extreme measures that some states and communities have taken to seemingly make things “more fair” for the masses. Rarely, does government get it right and they often cause more problems than they solve. Can some changes be made? Yes, certainly we can: like institutional investors/equity firms might need some boundaries, and we need to build more affordable housing but I am very familiar with our state laws and I see nothing that “favors landlords” in our statutes. The people spouting this nonsense are exaggerating things and likely have not been involved personally. We need to be aware of tinkering too much with the market or it could create unintended consequences. History does repeat itself – we need to learn from it.

Are you serious? Indiana State Code is FILLED with laws that favor landlords. We have virtually no tenant protections. It’s why Indiana has the second-highest eviction rate in the U.S. and landlords that let their properties rot with no repercussions. Even bare minimum protections that were enacted at the local level received a State response prohibiting them. What a load of crock. The landlords need to be held accountable.