Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe popular economic development tool used by Hoosier cities and counties, known commonly as TIF districts, will face additional scrutiny under a proposal from Rep. Bob Cherry, R-Greenfield.

“We’re trying to have some transparency,” Cherry said during a committee hearing on Monday. “We don’t want to hurt TIF but we want to make sure it’s working.”

While the initial bill ensures a percentage of TIF revenues be dedicated to school corporations, a 12-page committee amendment introduced by Rep. Ed Clere added some accountability.

“The intent is that we have legislative oversight because these redevelopment commissions are, as you know, appointed boards,” said Clere, R-New Albany. “I think many of us would like to see more votes by elected officials on some of these very important matters.”

A brief overview of TIF

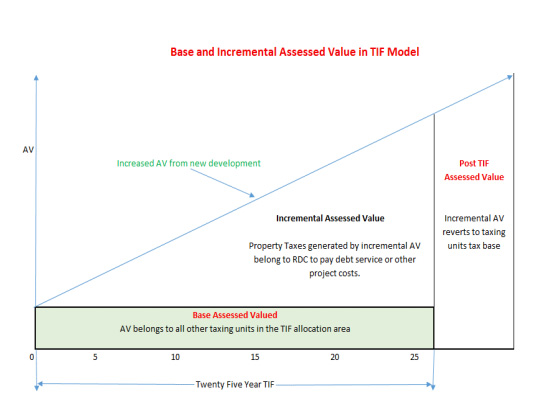

Tax Increment Financing (TIF) is an economic development tool used by governments that “captures” future tax dollar increases generated by a project to pay for related improvements.

Frequently, local governments use TIF to offset costs related to infrastructure surrounding a geographic area, such as the roads and water lines needed to support a new factory or plant expansion.

TIF allows municipalities, through a redevelopment commission, to take on debt that still falls under statutory debt limits while maintaining a “base” of stable funding.

Under Indiana code, the redevelopment commission must conduct a public hearing before establishing a TIF and warn other taxing units, such as school districts, about the hearing.

But even the Indiana Department of Local Government Finance observes several disadvantages for TIF, including that debt under the commission is unlimited and carries a higher risk.

Other entities that would normally benefit from increasing property tax revenue, especially schools, can only receive the same “base” amount – sometimes for up to 25 years. Crucially, TIFs operate under the assumption that values will increase.

According to the Indiana Gateway, the state had 1,148 TIF Districts in 2022 – 884 city-led districts and 264 county-led districts – impacting 173,612 parcels.

According to Cherry, 11% of all the state’s property taxes, over $947 million, were collected from properties inside of TIF districts in the last year.

TIFs’ implementation varies from state to state but some states — including its birth state California — have moved away from TIF. Other states have moved to limit the use of TIF, either by shortening the period of time or creating more explicit goals for the district.

Shortchanging revenues for others

Travis McQueen, the airport manager for the Huntingburg Regional Airport in Dubois County, likened TIF districts to a fishing net that only benefited the entity who cast it. For outside taxing units, such as schools, libraries and airports like his, it means stagnant revenue.

“While it might benefit them, it actually does not help the rest of the entities in that county,” he said.

While property taxes made up a small portion of an airport’s overall budget, McQueen noted that other entities – schools especially – were much more reliant on property taxes.

Dubois County, which includes Huntingburg and county seat Jasper, has roughly 44,000 residents but 10 TIF districts covering 1,162 parcels of land. Increased assessment values for those properties only benefit their area, rather than the county as a whole.

While McQueen and others can testify against a proposed district, they don’t have any say in whether or not the project advances.

“I think that any county that has multiple governments, those governmental units should be at the table when these kinds of decisions are made,” he said.

Monday’s amendment to increase oversight

The amendment introduced by Clere kept the pass-through language from the original bill but reduced the portion from 20% to 10%. That portion could be divided if multiple schools are included in the TIF district. Fire districts also receive an allotment under a formula outlined in the bill.

“(When) you have multiple school districts involved… based on their share of (the TIF district’s assessed value), it would rotate,” Clere said, outlining a requirement for the redevelopment commission to have a representative from school corporations. “The school corporation with the biggest share of (assessed value) would have the first appointment and then once that appointment ends the school corporation with the second-highest (assessed value) would have the second appointment.”

The amendment also includes a spending plan as part of the annual report filed by redevelopment commissioners to the Department of Local Government Finance. The bill encourages entities to use excess revenue to pay down debt associated with the TIF district, rather than using that funding for other projects.

“It introduces a new standard of accountability,” Clere said.

Should a unit decide to use the excess revenue on something outside of the TIF district, that project must satisfy one or two requirements: it must “directly” benefit the area or create/ retain jobs in the private sector.

“Right now what we’re seeing is more TIF revenue is pooled – you have multiple TIF areas in the community and that revenue is pooled and being used without any clear relationship to the area,” Clere said. “They can still use TIF revenue outside of the allocation area but the redevelopment commission would have to adopt a resolution certifying one of two things.”

The committee approved Clere’s amendment and passed the entire bill on a 14-6 vote. The bill heads to the House floor for further consideration.

The Indiana Capital Chronicle is an independent, not-for-profit news organization that covers state government, policy and elections.

Please enable JavaScript to view this content.

As they should.

TIFs should be size and term limited (20 years).