Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe software as a service—or SaaS—market is going gangbusters.

That’s great news for SaaS companies, and in many cases for customers, who prefer to essentially rent their software and receive automatic updates rather than buy it outright and be responsible for its upkeep.

Subscription software usually requires less hardware and personnel to run. It’s updated and improved frequently—which means it often offers more features and functionality than software out of a box. And SaaS companies are known to be responsive with customer service.

Wheeler

WheelerPlus, the initial cost—with SaaS companies offering myriad payment options and introductory offers—is often lower than buying and maintaining software.

But over time, costs add up. In fact, the expense of software subscriptions—on a per-employee basis—is now rivaling the sky-high costs of providing employees and their families with health insurance. As a result, the proliferation of SaaS has become a big problem for the companies that use it and a giant headache for many information technology administrators.

“In some ways, this is like a runaway train,” said Brad Wheeler, vice president for information technology at Indiana University. Every chief information officer “has his hair on end about this. And we still don’t know where this is going.”

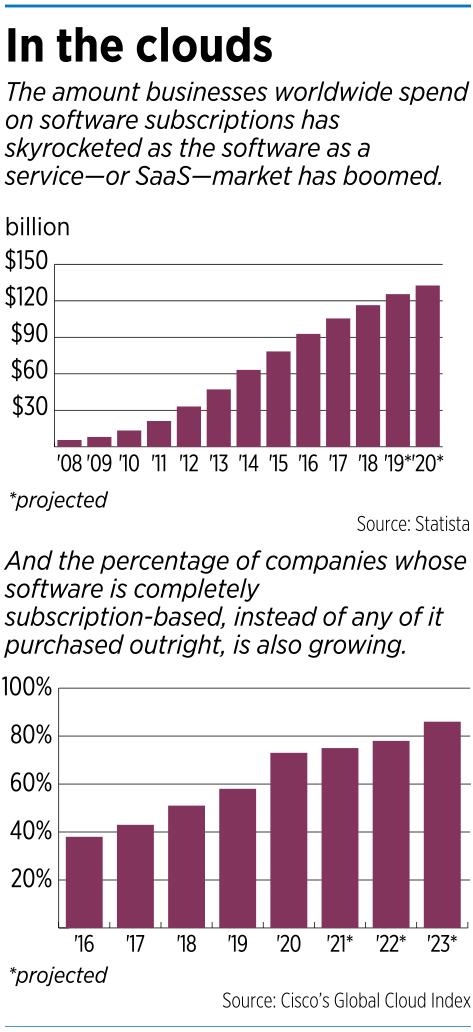

The worldwide SaaS market is on a trajectory that would make any Wall Street analyst salivate. It has grown from $5.6 billion in 2008 to a whopping $116.4 billion in 2018, according to research firm Statista.

Numbers from another leading research firm, Gartner, are slightly lower but show the same dramatic growth curve. Both research firms project the SaaS market will continue to climb at an annual rate of 17% to 23% over the next five years.

Numbers from another leading research firm, Gartner, are slightly lower but show the same dramatic growth curve. Both research firms project the SaaS market will continue to climb at an annual rate of 17% to 23% over the next five years.

The percentage of companies that rely solely on subscription-based software is also rapidly rising. In 2016, that number was just 38%, according to Statista. This year, it is 58%, and Statista projects it will be 73% next year—and could reach 86% by 2023.

Companies like Oracle—which in 2016 announced that all of its software would soon be moved to the cloud and sold on a subscription basis—are pushing the trend.

While software subscriptions have been around for decades, the SaaS explosion was triggered by several factors from 2012 to 2014, tech experts said.

“It came during a time when a lot of corporate computer technology got old and was being changed,” Wheeler said. “At the same time, cloud companies matured and there arose this fear that technology was changing so fast that companies’ software and hardware would quickly become outdated.”

Adding to that, tech experts said, the ease of access to cloud technology made it relatively simple for an entrepreneur with a bit of technological savvy and vision to launch a SaaS company.

As a result, many niche SaaS products were born to solve specific problems. All those new software options turned corporate heads and other employees into kids in a proverbial candy store.

The business model is genius for SaaS companies. Subscriptions give them what tech investors covet most: annual recurring revenue.

“It’s a big deal to get that total contract on the books and have a guaranteed source of income for a set number of years,” Wheeler said.

Technology business experts told IBJ that SaaS companies often run gross margins as high as 80%.

“It’s definitely a high-margin business across the board,” an IT administrator told IBJ. “You’re essentially running one machine, but selling it to a lot of customers.”

Creeping costs

To no surprise, annual software subscription costs have also gone up—way up.

According to a recent analysis of more than 30 million transactions, Zylo—a local firm that helps its customers track and manage software subscriptions—found enterprise companies are spending an average of more than $10,000 per employee per year on software. So, for every 100 employees, companies are spending $1 million on software subscriptions.

Christopher

ChristopherIn comparison, the average cost for a company to provide health care to an employee and his or her dependents is about $14,000 per year, according to the National Business Group on Health.

“Companies are spending tens of millions, if not hundreds of millions, of dollars a year on software” subscriptions, said Zylo CEO Eric Christopher.

According to Zylo data, companies with 1,000 employees have an average of 500 subscriptions. That can include basics like the Microsoft Office suite or specialty software like ADP’s payroll services.

Some companies have more subscriptions than they do employees, Christopher said, and the phenomenon is not limited to big companies. Zylo, for instance, has 60 employees and nearly 80 software subscriptions, he said. He admits to having 12 subscriptions himself.

SaaS companies make it easy to get started and often entice potential customers with introductory offers or payment options that make the programs look like a bargain compared with buying software.

“There’s this thought that you can subscribe to something for one year and see how it goes,” Christopher said. “In reality, though, subscriptions get locked in.”

That can cause SaaS expenses to creep up almost unnoticed.

Konow

Konow“Little by little, each [subscription] decision seems like a modest step,” said IU’s Wheeler. “But at some point, it becomes real money—real big money. If you’re not careful, you find yourself renting it for $1,000 a month when you could buy it for $300 a month.”

The problem isn’t necessarily the number of software subscriptions a company has or their cost, said Chris Konow, vice president of CleanSlate Technology Group, a Carmel consultancy with a practice devoted to software spend management.

The biggest concern is making sure a company is getting an appropriate return for the subscriptions and eliminating waste and duplication.

“We preach that you need to put people in place that have an ownership of this issue, and you need a formal road map or process in place to track these expenses,” Konow said.

Without that, he said, a number of problems arise, not the least of which is that no one knows how much money is going out the door to pay for all the subscription software.

IT chiefs losing control

One of the biggest concerns for corporate IT administrators is software subscriptions acquired without the knowledge or control of the IT department

That, administrators said, leads companies to pay for duplicative services and sign deals that don’t leverage the buying power of the entire organization—not to mention the security concerns that come with tying various software services into a company’s central system.

According to research firm IDC, 60% of U.S. technology spending occurs outside companies’ IT department.

Fleming

Fleming“This can be a serious issue for the IT department. There’s a real sense of losing control over this,” said Robin Fleming, former chief technology officer for Angie’s List who is now CEO and co-founder of Anvl, a local cloud-based software firm that markets business-safety applications to reduce and prevent injuries for maintenance workers.

“There has to be a balance between letting team members innovate and determine what they need and being so locked down that it stifles the company,” Fleming added.

“But you do have to have a method to monitor the spend. Having policies in place, doing formal audits and having someone or a firm dedicated to tracking the SaaS spend is really critical now.”

Fleming said managing SaaS spending is one of the top two concerns—along with cybersecurity—of any IT department.

“That’s how big of a deal this is,” she emphasized.

A company can get subscription software for just about anything these days. There’s Microsoft Office 365 for backbone office needs; Workday for human resources and financial management; and collaboration software like Dropbox, WebEx, GoToMeeting and Slack.

There are loads of marketing software packages, including Salesforce’s extensive suite. There are subscriptions for financial functions such as Financial Force, QuickBooks and Expensify. There are also subscriptions for services like Google Ads and LinkedIn.

Annual subscription costs, tech experts said, run from about $100 to millions of dollars.

Many subscriptions, Christopher said, cost $8,000 or so a month—or about $100,000 a year. And it’s not uncommon, he added, for subscriptions costing $10,000 to $50,000 annually “to never be seen by the IT department.”

This seismic shift in the way companies are handling computing needs is causing some to change their internal structures.

Entering 2017, only 30% of chief information officers had a cloud computing/SaaS strategy, according to Gartner. Just two years later, that number is 80%.

Strategy alone isn’t enough. IT administrators told IBJ that implementing a serious software subscriptions management plan can save a company as much as 30% on its SaaS bill. For a 200-employee company, that could be an annual savings of $600,000.

Zylo’s Christopher isn’t convinced companies have a handle on SaaS spending.

“They think they do, but they don’t,” he said. “Most companies don’t have anyone monitoring which subscriptions are being ordered and if they’re being used and what they’re being used for.

“We’ve seen companies buy the same subscription over and over again—even within the same department,” he added.

“Companies have human resources managers looking over employee issues, health care professionals managing the insurance and benefits programs, but no dedicated software manager. It’s too big an expense to let go unchecked and not coordinated. And the problem is only getting bigger.”•

Please enable JavaScript to view this content.

Suddenly, having that IT staff on payroll to run the on-prem version vs the SaaS based offering starts to make a lot more sense as startups scale into mid-size companies.

It’s funny how the only hierarchy mentioned in the article is under the CIO. Someone had to pay for these licenses — and someone had to approve those expenditures…why no inquiry to the financial branch(es) as to their take for how & why they’re approving the financial outlay?

.

As much as people hate the IS branch for spying upon them by doing this, it might be time to analyze the logs to determine who is connecting where, and compare that with the people who have been dually approved by the financial and technical folks to have those connections.