Subscriber Benefit

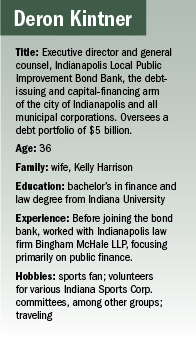

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowFrom his surprisingly small, spare office on the 23rd story of the City-County Building, Deron Kintner, executive director and general counsel of the Indianapolis Local Public Improvement Bond Bank, overlooks the newest additions to his ever-growing to-do list.

Off in the middle distance squat two Massachusetts Avenue white elephants—Indianapolis Fire Department Station No. 7, and the former Coca-Cola bottling plant that’s now part of an 11-acre compound controlled by Indianapolis Public Schools. Both structures are fish out of water in the tony neighborhood, and ripe for redevelopment.

Redevelopment of the former Bush Stadium baseball venue is just one project the bond bank is helping turn into a reality through controversial tax-increment financing districts.(IBJ Photo/ Perry Reichanadter)

Redevelopment of the former Bush Stadium baseball venue is just one project the bond bank is helping turn into a reality through controversial tax-increment financing districts.(IBJ Photo/ Perry Reichanadter)Which is where Kintner comes in. As soon as the city, the structure’s current occupants and potential developers figure out what to do with them, Kintner’s bond bank will help make it happen. Just as his agency has done with far larger downtown projects ranging from Circle Centre mall to the JW Marriott hotel to the new Wishard Hospital and the controversial CityWay development.

And is doing with the Bush Stadium, 16 Tech, and One America and Block 400 redevelopments.

Helping to grease the wheels for big downtown projects is the bond bank’s business, and right now business is good. The Great Recession generated lots of headaches for the agency in general and Kintner (who manages a roughly $5 billion debt portfolio) in particular. But it also created opportunities. Money is cheap and contractors are willing to play ball—music to the ears of someone whose job is to expedite brick-and-mortar projects.

“Interest rates are extremely low,” Kintner said. “Construction costs are low. That’s why with some of these things we have a bit of a sense of urgency in order to capitalize on that.”

It’s quite a job for a 36-year-old attorney who’s working just his second gig out of law school. However, it’s par for the course for the bond bank. Over the last couple of decades, it’s used city coin—most prominently from a gargantuan downtown tax increment financing district—to goose private projects mostly by making publicly funded infrastructure improvements.

“I don’t think it’s a stretch to say that, without the downtown TIF, our downtown wouldn’t be the success story that it is,” Kintner said. “It’s certainly not the only tool and the only reason, but without it and the way city leaders utilized it for the last 25-plus years, we wouldn’t have the city we have today.”

Yet the bond bank’s profile is as low as its goals are lofty. As Kintner is first to admit, few people outside the corridors of power—and a healthy percentage of those inside—seem to understand who he is or what his agency does.

Yet the bond bank’s profile is as low as its goals are lofty. As Kintner is first to admit, few people outside the corridors of power—and a healthy percentage of those inside—seem to understand who he is or what his agency does.

But it’s pretty straightforward. At least in theory.

Powerful tool

The bond bank is a municipal corporation that serves as the debt-issuing arm for the city of Indianapolis and related entities. It gets much of its financial muscle from TIFs, a popular financing instrument used by municipalities across the nation for decades. States and cities use projected tax increases accrued from infrastructure improvements (tax increments) within the boundaries of TIFs to finance current projects—for example, better roads. The programs are traditionally used to encourage development in impoverished or underutilized areas. There are more than a dozen active TIFs in Marion County, including big ones centered around Indianapolis International Airport and 86th Street.

But they’re small potatoes compared with the vast downtown TIF, officially called the Consolidated Redevelopment Allocation Area. It was born during the years-long struggle back in the 1980s to put together the land and infrastructure necessary for a downtown mall. In 1987, several smaller urban TIFs were combined to make the present one, and it was used to help raise $200 million for, among other things, acquiring and demolishing buildings in the notional shopping center’s footprint. One of that plan’s architects, former city controller Fred L. Armstrong, marvels that the TIF is not only still around today, but has grown so much in size and importance.

“I didn’t perceive the TIF or the bond bank doing any managing of property or expanding in the nature that it is today,” Armstrong said. “I felt that the largest project we’d ever be involved in was the mall.”

However, the bond bank proved an important tool for attracting downtown development that might instead have gone to the suburbs, or not happened at all.

“We have to provide an equalizer when companies, developers, capital in general, is looking at either downtown or a very open, less-expensive suburban environment,” Kintner said. “We use the TIF to try and help us level the playing field.”

Firey baptism

Kintner cut his teeth as the bond bank boss by helping put together perhaps the most controversial project his agency has undertaken—the sprawling, $155 million CityWay development. Built on a series of Eli Lilly and Co.-owned parking lots adjacent to the company’s near-south-side corporate campus, it will feature, among a great many other things, a boutique hotel, a YMCA, hundreds of apartments, and some 40,000 feet of retail and office space.

“There were a lot of valuable components to it, with the biggest being that Lilly, the city’s No. 1 employer, said this project was vital to its long-term success,” Kintner said. “They said that if we’re going to attract the type of 21st century employees we want, we need to feel connected to downtown. We need this kind of vibrant development essentially on our front porch.”

Finding the funds in the midst of the Great Recession was tricky. To put it mildly. No wonder Kintner jokes that he got his current job because he “drew the short straw.”

Fortunately, this wasn’t his first bond-related rodeo. Before coming over to the city, Kintner worked as an attorney specializing in public finance for Indianapolis law firm Bingham McHale LLP. He signed on with the bond bank in 2008 as deputy director and general counsel, before moving to the executive directorship two years ago. Among his other accomplishments, he developed and instituted an interest-rate risk-management policy and reduced the city’s variable-debt exposure 90 percent, blunting the recession’s impact on Indy’s books.

By his own estimation, he spent about 10 months working on various aspects of the extremely complex CityWay deal. Prying the necessary cash from lenders required an entirely new approach. Instead of the city’s merely footing the bill for road, sewer and/or water improvements at the site, it became the project’s banker, forking over some $86 million, mostly from the sale of municipal bonds. The loans, guaranteed with money from the downtown TIF, went to CityWay developer Buckingham Cos., which will pay it off with revenue from the project.

Critics immediately cried foul, claiming the plan left taxpayers holding the bag for a private development. Kintner begs to differ. Just look at a map, he says, and you’ll see that CityWay binds the campuses of Lilly, WellPoint, Indiana Farm Bureau and Rolls Royce more strongly to downtown. And the development, if successful, will generate far more tax revenue than the surface parking lots they replace.

“If it wasn’t for the city stepping in and assisting, that project doesn’t occur,” Kintner said. “Everyone that’s seen it and that we’ve talked to has said how much it’s going to do for that area and downtown.”

Having helped link Lilly to the urban core, Kintner is keen on hitching other parts of the city together. For instance, the conceptual Mass Ave redevelopments will unite the street’s north and south ends. Perhaps the neighborhoods surrounding downtown can be similarly linked to downtown.

“There will always be a focus on ensuring downtown’s success, because everyone benefits from that,” Kintner said. “But we really need to start focusing on this ring around downtown, three to five miles out, and try to make sure that the quality of life there is improving or where it should be.”

Some, however, wonder if this smacks of mission creep. Take, for instance, the bond-bank-assisted development called 16 Tech, a reimagining of the stretches of 16th Street and Indiana Avenue near Methodist Hospital as a residential area/biotech industry hotbed. At present, the downtown TIF doesn’t include 16 Tech within its borders. Which isn’t necessarily an issue, because such “outside” projects can still be financed if they directly benefit downtown.

Still, it’s odd that a program originally envisioned to build a mall in the city’s center—and that’s classically been used for things like improving infrastructure in impoverished areas—has come to this. Odd, but not unprecedented.

“What I suspect is happening in Indianapolis is happening throughout the state,” said Bruce Frankel, professor of urban planning at Ball State University. “A good thing becomes abused. I’ve seen that so many times before. Let’s extend it a step further, and by the time you look back, you’re completely outside the realm of what the legislators intended for the TIF, which is revitalization of an area of disinvestment.”

Frankel believes a more traditional use for TIF money was for Fall Creek Place—one of the city’s roughest neighborhoods until a city-led program turned it around. Over time, he believes, such efforts get pushed aside by flashier, higher-profile projects that promise tax revenue for the city, but don’t necessarily address the best, highest calling for a TIF—financing improvements in areas that private equity wouldn’t touch with a 10-foot pole.

But Kintner says that’s not necessarily true. The city is, indeed, working on less publicity-friendly TIF-assisted (non-downtown) projects, such as $11.6 million in infrastructure improvements at the former Fort Benjamin Harrison and $5 million that helped get AIT Laboratories to move its corporate headquarters to an 86th Street location. As for 16 Tech (and, for that matter, Mass Ave), the plan is to absorb both into the downtown TIF, so that whatever the city invests theoretically will be recouped (and then some) via the tax increment.

“We’re working with the City-County Council to discuss the process of expanding the TIF district, getting them comfortable with it so we can move forward with these projects,” Kintner said. “Because all the projects I just mentioned would depend on being within the downtown TIF district.”

New scrutiny

Speaking of the Democrat-controlled City-County Council, at least some of its members would like to have a word with the administration about the bond bank. Or rather, their largely opaque understanding of the deals. District 16 Councilor Brian Mahern co-sponsored a proposal for a study to look into the city’s practices.

“In Indianapolis and across the country, we’ve used these TIFs since the early 1970s,” Mahern said. “They originated as an economic development tool originally targeted at blight. Well it’s transformed now into a general economic tool. The time has come to see how we’re doing and how we should use them going forward.”

For his part, Kintner has no problem with the scrutiny. And he’s bullish about getting more stuff done while the financing and contracting gods keep smiling.

Kintner and his wife, Kelly Harrison, who works in financial planning and analysis for Republic Airways, like to travel—particularly to Costa Rica. But travel may have to wait for a while. Right now, there are deals to make.

“With some of these things, we have a bit of a sense of urgency to capitalize on that,” he said. “The market’s right, both from a marketing and cost standpoint, to move forward on these projects. I don’t know how long it will stay this way.”•

Please enable JavaScript to view this content.