Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowJust seven years ago, it was hailed by both companies as a blockbuster deal that would pay off for years.

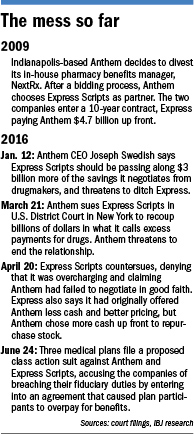

But today, the agreement by Indianapolis-based Anthem Inc. to sell its pharmacy-benefits arm to St. Louis-based Express Scripts for $4.7 billion has turned the companies at each other’s throats, culminating in a multibillion-dollar legal battle that began early this year.

Under the deal, Express Scripts agreed to contract for and sell prescription drugs to Anthem and its members. Anthem said it was entitled to periodic reviews of how much it pays for drugs, a process the companies last went through in 2012, resulting in revised prices.

The next time wasn’t so smooth. The two sides revisited prices again last year, but have yet to reach an agreement. Anthem claimed it was entitled to lower prices and sued Express for $15 billion. Express Scripts denied it was violating the contract, and countersued a month later.

The next time wasn’t so smooth. The two sides revisited prices again last year, but have yet to reach an agreement. Anthem claimed it was entitled to lower prices and sued Express for $15 billion. Express Scripts denied it was violating the contract, and countersued a month later.

How the deal soured illustrates the growing tension between health insurers and their partners, with insurance companies pushing back to make sure services are being provided at a fair price.

It is also drawing additional attention to the issue at the center of the dispute—high drug prices—which has become a lightning rod in the health care world. Pharmacy benefits managers, such as Express Scripts, contract for and sell prescription drugs to end users—in this case, Anthem and its members.

The legal dispute is still winding its way through U.S. District Court in New York, and it’s too soon to say which side has the upper hand.

But the two companies have decidedly different takes on what went wrong, and are outlining their arguments in voluminous court filings.

Soured relationship

In the beginning, back in 2009, it seemed simple.

For Anthem Inc. (then known as WellPoint Inc.), selling its pharmacy-benefits-management division, called NextRx, for a whopping $4.7 billion to Express Scripts would provide much-needed cash to buy back stock, pay taxes, pay down debt and have enough left over for future acquisitions.

For Express Scripts, the deal would instantly make it the second-largest pharmacy-benefits manager in the United States, based on prescriptions filled, and position it to become the industry’s largest player a few years later.

The centerpiece of the deal was a 10-year commitment to work together. Express Scripts would become the exclusive provider of pharmacy-benefits services to WellPoint, including network management, claims processing and specialty-pharmaceuticals management.

WellPoint retained control of medical policy, formulary and integrated disease management aspects of its pharmacy benefits.

Executives on both sides praised the deal as they rolled it out. The move, they said, would allow employers to have their medical and drug costs managed in an integrated fashion.

“Importantly, through this strategic alliance with Express Scripts, we will enhance the health care value we bring to our members,” Angela Braly, then CEO of WellPoint, said. “This alliance will create an organization with greater resources and capabilities, which will provide members with more cost-effective solutions as well as access to state-of-the-art [pharmacy management] services.”

George Paz, then CEO of Express Scripts, said the deal would allow both companies to blossom. In an interview with the New York Times, he called WellPoint “a fast-growing, acquisitive company.”

“We see their growth as part of our growth,” he said.

Turn of events

Swedish

SwedishBut Braly resigned under pressure from shareholders in 2012. Her successor, Joseph Swedish, had different thoughts about how the deal was playing out.

This January, he said Express Scripts should be passing along billions of dollars in savings it negotiated from drugmakers. He threatened to ditch Express Scripts as a partner, even though the alliance runs through 2019.

“We are entitled to improved pharmaceutical pricing that equates to an annual value capture of more than $3 billion,” Swedish said at a health care conference. “To be clear, this is the amount by which we would be overpaying for pharmaceuticals on an annual basis.”

Much of those savings would be passed on to clients, he said.

Two months later, unable to reach an agreement, Anthem sued Scripts for $15 billion, alleging the company violated its contract through excessive charges. Express Scripts turned the tables a month later, filing a countersuit and denying Anthem’s charges.

As part of its defense, Express Scripts said it originally offered Anthem two options while negotiating to buy NextRx.

The first was to offer a smaller upfront payment, which would be made up with lower drug prices over the 10 years. The other was for a higher upfront payment, which would include higher drug prices.

“And Anthem chose, in essence, Door Number Two,” Michael Carlinsky, attorney for Express Scripts, told a New York federal judge last month, according to a newly filed court transcript. “It took the deal to accept up-front $4.675 billion as opposed to, I think, Door Number One was roughly $500 million, just so the court can appreciate the difference.”

According to court filings, the two sides had signed an agreement that Anthem or a consultant would conduct a market analysis every three years to ensure that it was receiving competitive drug prices.

“In the event Anthem determines that such pricing terms are not competitive, Anthem shall have the ability to propose renegotiated pricing terms to Express Scripts,” the agreement said.

In return, Express Scripts—which has two central Indiana fulfillment centers with a total of 1,300 employees—agreed to “negotiate in good faith over the proposed new pricing terms.”

It’s unclear how often the two sides would renegotiate prices. Those details were redacted in court filings.

But the dispute now focuses on whether Express Scripts is charging Anthem higher than the market prices for drugs, and if so, what Express Scripts is obligated to do in return.

Breaking point

Anthem attorney Glenn Kurtz told the judge that drug prices “have changed pretty substantially” in recent years, and at this point, Express Scripts is overcharging the insurer and its members more than $14 billion through the remaining life of the agreement.

Several analysts say they believe Anthem is being overcharged. Lance Wilkes, senior health care analyst with Sanford C. Bernstein & Co., estimates Anthem is paying more than $1 billion a year above market rates.

Even so, he doubts that Anthem will be able to get out of its contract before 2019 or even be “granted rate relief,” he wrote in a research note.

Silver

SilverHarry Silver, a health care attorney at the Potomac Law Group in Washington, said Anthem has the better argument.

“Taking the allegations as true, that the price was to be renegotiated in 2015 based upon what a third party decided, it sounds as if Express Scripts is not living up to its end of the bargain,” he said.

Either way, the relationship between the two companies seems to be reaching a breaking point, said Ana Gupta, an analyst at Leerink Partners.

“The latest news has taken a very unhealthy turn and we see it unlikely that Anthem renews its contract with Express Scripts past 2019, and is likely to leave sooner to the extent it can manage the transition for consumers smoothly,” she wrote in a research note.

The standoff underscores that insurers are not timid about making sure they are getting a fair price for the services they buy for their members.

Luria

Luria“There’s huge dollars involved in these kind of disputes,” said Neil Luria, a health care attorney with SOLIC Capital Advisors, a restructuring and investment banking firm in Evanston, Illinois. “In most cases, it involves an ongoing business relationship. You’re fighting for money, but at the same time, you continue to work with each other. It’s a delicate relationship.”

The dispute is occurring as drugmakers, hospitals, insurance companies and public officials increasingly talk about the price of prescription drugs.

Prescription drug spending last year in the United States was estimated at $457 billion, or about 16.7 percent of overall personal health care services, according to a recent report from the U.S. Department of Health and Human Services. That’s up from $377 billion, or 15.3 percent of all personal health care services, in 2013.

That reality could give Anthem leverage, at least in the court of public opinion, if it can prove Express Scripts is artificially inflating drug prices, said Les Funtleyder, a health analyst at E Squared, a New York hedge fund.

“Whether they win in a court of law is a different story.”•

Please enable JavaScript to view this content.