Subscriber Benefit

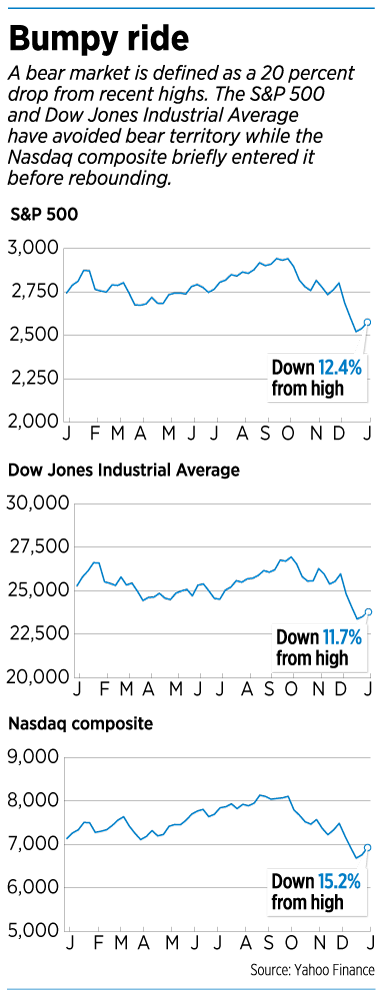

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe stock market took investors on a wild ride in 2018, reaching record highs in the late summer and early fall but ending the year with a loss.

The Standard & Poor’s 500 index, a major benchmark, peaked on Sept. 20, when it closed at an all-time high of 2,930.75. But it dropped sharply during the fourth quarter, closing as low as 2,351.10 on Dec. 24.

For the year as a whole, the S&P 500 lost 6.2 percent—the first annual loss since 2008.

What’s an investor to do during these turbulent times? We asked local financial professionals for their best advice on weathering the storm and finding opportunity.

Look forward, not backward

Susan Elser, financial planner and president of Elser Financial Planning Inc.

Elser

ElserDuring one of the longest bull markets in decades, investors might have been comfortable with the stock market. But following a volatile 2018, many year-end statements will show a loss for the first time in a long time.

Price/earnings ratios have declined quite a bit, indicating more value in stocks.

While we find it fruitless to predict the market, it can be fruitful to take advantage of lower stock prices.

Try to take an opportunistic approach to market dips, and avoid letting the noise of daily headlines and market swings cause a panic. Rather than “buy and hold,” use disciplined rebalancing to maintain your target stock/bond allocation.

Taking a little profit out of stocks when prices rise and moving a little money into stocks when prices decline might improve your return.

It is also important to not look backward at investment returns.

Had you based 2018 investment decisions on 2017 performance and increased your emerging-market stocks, you would have seen them go from being the best performer in 2017 to the worst in 2018. Diversification is your friend, as all asset classes take turns outperforming one another.

Remember, too, that picking individual stocks is closer to gambling than investing. Popular tech stocks such as Facebook, and a few “widows and orphans” stocks such as GE, declined more than the broader market in 2018. Low-cost, broadly diversified mutual funds can be more advantageous, although less exciting.

Consider that, with rising interest rates, short-term bonds have been steadier than long-term bonds. Maintain enough in short-term, investment-grade bond funds to be comfortable during a declining stock market and use these funds to avoid selling stocks when prices are down.

Last, consider tax planning given current low income-tax rates.

Younger people should consider funding a Roth IRA or Roth 401(k) for decades of tax-free growth, rather than taking an immediate tax deduction with a traditional 401(k) or IRA. This also hedges against the risk of higher tax rates in the future, a possibility given the large federal debt.

There is no adjusted gross income limit to contribute to a Roth 401(k), and those with adjusted gross incomes below $193,000 (if married filing jointly) or $122,000 (if single) can fully fund a Roth IRA.

Have a plan, and don’t panic

Erin Shaw, Indianapolis market team lead for J.P. Morgan Private Bank

Shaw

ShawVolatility in the markets is normal; markets go up and down all the time in the short term—but don’t let that derail your plans.

In fact, the market has suffered pullbacks of 10 percent or more in 21 of the last 38 years, yet the full-year market return was positive 29 of the 38 years.

However, we acknowledge volatility can make investors uneasy, ushering in feelings of fear. Reacting to market movements might sometimes seem like the right thing to do for the short term—but research suggests this approach actually diminishes returns.

When markets are doing well, we can become euphoric and might buy at all-time highs to make more money. And when markets are going down, we might become despondent and sell at all-time lows to avoid further losses. Overreaction can cause investors to fall into a losing strategy—buying high and selling low.

The time horizon for your money is important, and volatility may matter in some cases more than others. Before making any decisions regarding your portfolio, ensure you have a goals-based plan based on your short- and long-term objectives.

Questions to discuss with your adviser:

◗ Has the primary intent for your wealth changed in the past year?

◗ What goals are most relevant to your intent this year?

◗ Are your resources positioned in the best way possible?

◗ Given your resources, are your goals still feasible?

At the end of the day, given the changes in the market, can you achieve the goals that are most important to you and your family?

We believe we’re late in the cycle—but not at its end. Moving toward the later part of the economic cycle, we must recognize the challenges and volatility that a maturing cycle brings.

As we approach a drawdown, consider some changes that could help reduce your portfolio’s future volatility and increase returns, like defensive portfolio positioning, risk assessments and proper diversification.

Volatility can offer opportunities

Matthew Sanchez, senior investment adviser, Biechele Royce Advisors

Sanchez

Sanchez In 2019, one of the best ways to protect yourself from uncertainty while being ready for opportunities is to have a plan and a dynamic strategy. Every business has a plan, and your finances should, too.

In 2019, one of the best ways to protect yourself from uncertainty while being ready for opportunities is to have a plan and a dynamic strategy. Every business has a plan, and your finances should, too.

A financial plan, which includes an emergency fund, outlines your goals and gives you a baseline for what actions should or should not take place in your investing.

A strategy outlines how to accomplish those goals.

Short-term stock market turbulence, or volatility, is the driving force behind investors taking actions against their best interest—buying high and selling low, instead of the other way around.

By assembling a strategy during calm conditions, investors can make better decisions than when trying to create a plan in the heat of the moment.

While many investors don’t like volatility, skilled investors see it as an opportunity.

The fundamentals of a company do not change as quickly as its market price. Value investing, as popularized by Benjamin Graham and his highly regarded successor, Warren Buffett, allows the investor to buy companies that are fundamentally high-quality when they’re trading at discounts to their intrinsic value.

While many focus on the cyclical nature of the economy and performance of indexes such as the S&P 500, they often fail to recognize the opportunities at the individual company level.

There are always opportunities, as each stock has its own bull and bear market. The key is to be patient and ready to act when prices are attractive.

Investors who want returns independent of the stock market should consider alternative investments.

Alternatives have several uses: They can increase diversification, dampen volatility and enhance returns.

The common misconception of alternatives is that they must be correlated with either real estate or commodities, but that’s simply not true. Strategically, they can act like dry powder while waiting for prices to fall or they can be used to replace stocks or bonds by targeting either yield or growth.

These investments might not be suitable for everyone, so it’s best to work with a professional with experience in this area before making an investment decision.

Stay balanced and diversified

Jonathan Koop, portfolio manager, Bedel Financial Consulting Inc.

Koop

KoopThere is no doubt 2018 was a difficult year for investors.

From trade wars and rising interest rates to political turmoil and increasing fiscal deficits, there were many culprits on which to lay blame for 2018’s roller-coaster ride. Looking forward, many of these issues will persist into 2019. This suggests investors should prepare for an environment with greater volatility and possibly lower returns than they had been accustomed to during the last decade.

Much like last year, the actions of the Federal Reserve will be important to watch as it attempts to normalize from the unprecedented quantitative easing program that held interest rates near zero for a record length of time.

As rates rise and the monetary stimulus that helped support the market since the financial crisis in 2008 is removed, decreased liquidity and improving risk-free alternatives could put downward pressure on stocks.

Within the equity markets, balance and diversification remain key.

Because of relative underperformance in some assets, your portfolio might no longer have the appropriate exposures and thus need rebalancing.

Specifically, focus on value stocks, which potentially could provide some relative protection in a market downturn due to their defensiveness and historically low valuations.

Similarly, international and emerging-market economies, which have substantially underperformed the U.S. market in recent years, offer attractive valuations.

Despite all the uncertainty, most economic indicators are not signaling that the economy is headed for an imminent recession.

Unemployment and inflation remain low, corporate earnings are still well above historic norms, and consumer spending this holiday season rose to a six-year high. Recent trends in the stock market have been negative, but the same sentiment is not reflected in the underlying economic data.

Amid the longest bull market in U.S. history, it was easy to forget that volatility and bear markets are normal parts of the investment process.

History has shown that periods following large downturns are often opportunities to achieve meaningful returns in the following years. As 2019 begins, investors should meet with their adviser to ensure their investment plan is consistent with their long-term financial goals—and stick to that strategy.

Don’t hold too much cash

Helen Goldstein, president of Goldstein Group Financial Advisors LLC

Goldstein

GoldsteinWe expect the market volatility that we experienced in 2018 to continue. Three major headwinds for the market are: 1) Geopolitical risk: progress of the trade negotiations with China and the future of Brexit; 2) Interest-rate risk: uncertainty of the effect of the Federal Reserve’s interest-rate policies on economic growth; 3) U.S. fiscal policy risk: uncertainty of U.S. fiscal policy in a divided Congress.

However, financial markets do not define the economy. Despite the last few months of market volatility, the U.S. economy remains solid. Looking at U.S. economic fundamentals, there is still reason for guarded optimism in 2019. Although the economy is slowing, economic data is not currently pointing to a recession. The technical indicator of a recession is two consecutive quarters of negative GDP growth. The latest data released from the U.S. Bureau of Economic Analysis for third-quarter GDP was positive 3.4 percent.

If you are in retirement or need your money in the short term, it is important to keep a year’s worth of your expenses in a cash reserve. Regardless of market conditions, knowing your fixed, variable and one-time expenses is critical in determining the amount of this cash reserve. This allows you to continue meeting your expenses without having to sell during a down market.

A large cash position may make you feel better but can hurt your portfolio’s growth potential. Remember, if you are close to retirement, you do not use all of your money the day you retire. The average person spends close to 20 years in retirement, which is a long-term time horizon for investing.

It is impossible to time when to add money to the market. If you are currently investing the same amount monthly regardless of share price (i.e. in a retirement plan), you are dollar cost averaging. In a declining market, each month you are buying more shares at a lower price. This removes emotion from your investment decisions.

During volatile market times, it is important to remember that a well-diversified portfolio of quality investments, matched to your time horizon, is the best path to meet your financial goals.•

Please enable JavaScript to view this content.