Subscriber Benefit

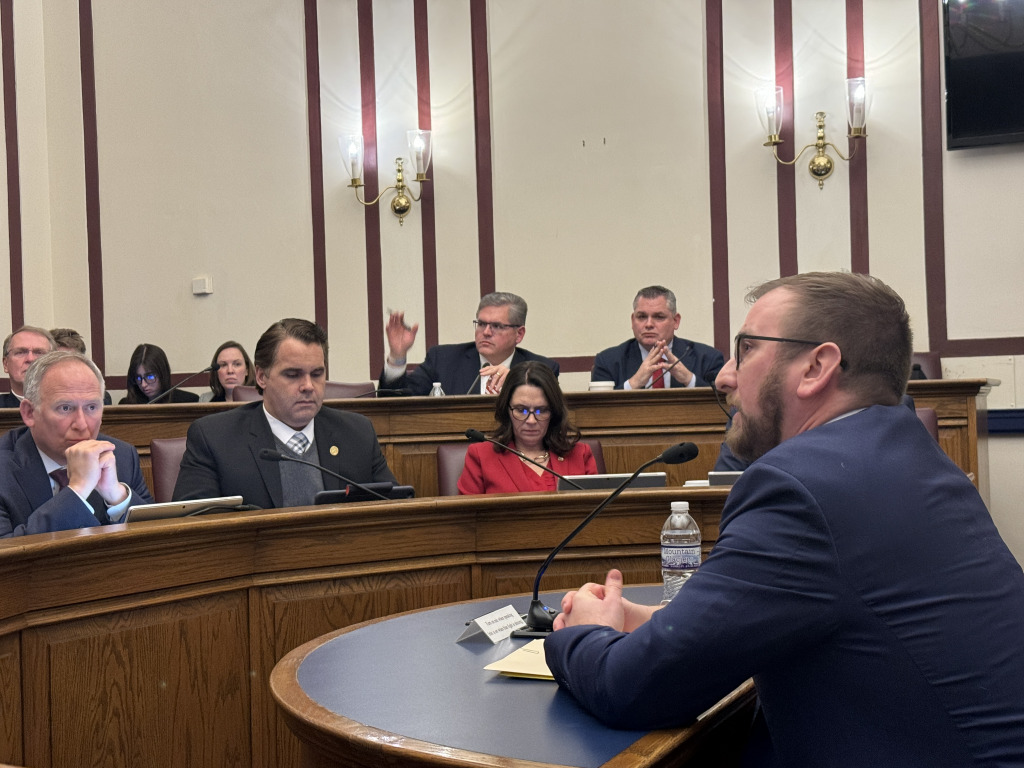

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowA committee of state lawmakers heard nearly four hours of testimony Wednesday on legislation that would undo a taxing district that Indianapolis government approved last month to impose a fee on downtown property owners in the Mile Square.

House Bill 1199, authored by Rep. Julie McGuire, a Republican from southern Indianapolis, would repeal a provision the Legislature approved last year to allow the Indianapolis City-County Council to create the taxing district. The revenue is intended to help pay for a low-barrier homeless shelter, homeless outreach, downtown cleanliness initiatives and safety ambassadors.

Proponents of the legislation, which include some downtown property owners, the Indiana Apartment Association and the Indiana chapter of Americans for Prosperity, a conservative think tank, argued that the provision approved last year was done without transparency and should have been properly vetted in a public forum.

The authorizing language was slipped into last year’s state budget bill in the waning hours of the legislative session and never went through the typical committee hearing process.

“Supporters of the tax want you to believe there’s overwhelming support,” said Brian Spaulding, vice president of government affairs for the Indiana Apartment Association, in testimony to the House Ways and Means Committee. “If that’s the case, why is there no transparency?”

Supporters of the repeal also argued that the city could have established an economic enhancement district, or EED, under a previously existing law that requires a certain number of signatures from property owners who support the taxing district.

Under that law, a 2018 effort by Downtown Indy Inc. to establish an economic improvement district failed in the face of heavy opposition from the Indiana Apartment Association and a dispute over whether the not-for-profit had collected the required signatures from more than 50 percent of property owners.

Dave Flaherty, CEO of Indianapolis-based Flaherty & Collins Properties, which owns 846 apartments in the Mile Square, said Wednesday that the tax will scare away development.

“This makes it super hard to develop,” he told the committee. “This kind of action … is not a good look for the city in my opinion.”

The majority of people who testified were against the bill and support the taxing district.

They included several downtown residents, who argued the legislation would undo the work of corporate and civic leaders to boost perceptions of downtown in the aftermath of the pandemic and the 2020 protests for racial justice.

Groups including the Indiana Sports Corp., the Indy Chamber and Visit Indy also voiced support for the taxing district. A letter of support for the district signed by representatives from the Central Indiana Corporate Partnership, Elanco Animal Health Inc. and Salesforce also was submitted to the committee for consideration.

City officials also appeared at the Statehouse to show their support for the district, including Chris Bailey, interim chief of the Indianapolis Metropolitan Police Department, and Dan Parker, chief of staff to Mayor Joe Hogsett.

Some supporters noted that the Mile Square taxing district did receive a public hearing when the City-County Council voted in December to approve it.

Wednesday’s Statehouse hearing was for testimony only. Committee chair Jeff Thompson, R-Lizton, said after the meeting that members of his caucus are still discussing whether to hold a vote on the measure. Thompson is listed as a co-author on the bill along with Rep. Mike Speedy, a Republican from Indianapolis.

House Speaker Todd Huston told IBJ he supports more public debate on the issue but stopped short of endorsing a full repeal.

Under the taxing district ordinance approved by the City-County Council, single-family homeowners would pay an annual $250 flat fee starting in 2025. Owners of commercial properties would pay nearly 0.17% of their properties’ gross assessed value, or about $1,681 per $1 million in gross assessed value.

Apartment owners as a group would be hardest hit by the new tax, contributing an estimated $1.87 million of the $5.5 million expected to be generated annually. The association represents 280,000 rental units throughout the state, including 5,000 in the Mile Square, according to spokesman Charlie Tinkle.

Please enable JavaScript to view this content.

Reminder that this tax was driven in part by Eric Holcomb … If you truly want to see where Marion County residents stand, let them impose their own tax rates instead of only being allowed what the state of Indiana allows.

I’d love to see what alternative tax that the apartment association wants to see. That’s right, they want a free ride.

Over 30 representatives of business, owners of apartments, residents (of single family, condo, and apartments), and civic institutions came to testify in opposition to HB1199 and in support of the Mile Square EED as a mechanism to invest in public safety, homelessness response, and cleanliness. Only five came to support the repeal — two of which are funded by out of state groups and none of which opposed it at the City Council. The support is overwhelming and it is clear. Downtown needs solutions and the vast majority of downtown property owners are ready to move forward.

Don’t forget the bill is introduced by someone who does not represent the downtown area, either.

Julie McGuire, yet another Marion County Republican with nothing but no’s.

I have attended both the City-County Council hearing and the Ways & Means hearing yesterday.

One thing is very clear; opposition to the EED is being driven by interests outside of the Mile Square while the EED has strong support within it.

The mayor, law enforcement, businesses, and civic organizations all believe that the EED is crucial to a safer, cleaner, more welcoming and prosperous downtown. Every elected legislator on the state and local level that represents the Mile Square supports the EED.

It’s really simple, do the voices of downtown Indy matter or will outside interests be allowed to prevent us from coming together to enact solutions to better our community?

So now, we can’t help the homeless without having more public hearings? That makes no sense…

Disgusting rhetoric all around.

Giving junkies free needles isn’t helping them, Charles. And yes, I just conflated homelessness to junkie. For the ones this low-barrier shelter will be “helping”, it’s a pretty fair overlap.

But it puts them “out of sight, out of mind” for the downtown NIMBYs…or at least that’s the intent. Since there will probably be many, many more homeless coming to Indy for three-hots-and-a-cot without any expectation of getting sober, the new place will fill up instantly. And the junkies rejected from Wheeler and Salvation Army will still lurk around nearby, so it probably won’t move the marker one bit.

And pity to the businesses/homeowners in the Shelby/Southeastern area (what’s it called–Irish Hill)? With a massive assembly of zombies congregating in the area, their property will be worth nothing.

“Supporters of the tax want you to believe there’s overwhelming support,” said Brian Spaulding, vice president of government affairs for the Indiana Apartment Association, in testimony to the House Ways and Means Committee. “If that’s the case, why is there no transparency?”

There is plenty of transparency. The tax had to go through the city-county council, and now it’s being retroactively being heard in the statehouse.

Lobbyists and special interests own our statehouse. It’s sad.

And it’s going to require a Board that is comprised 50% appointees from the City and 50% from the State…kinda sounds like there’s going to be a mechanism for transparency to me.

I don’t support the state overriding local tax decisions, but this is a really bad idea. If the city wants these things then pay for them out of general revenue, don’t make the CBD a more expensive place to live, work, or visit through targeted taxes when it’s increasingly a place people don’t be in the first place.

Why should people outside of the CBD pay for extra services for the CBD that they themselves wouldn’t get?

The Mile Square is the fastest growing neighborhood in the city.

Jeffrey–

I don’t remember where I learned this (does the Census have 2023 estimates), but Indy has been losing population since 2020. Most of the apartment buildings going up right now–and there really aren’t that many–were conceived and financed before COVID and the summer of riots. How many new buildings are being planned right as we speak, when the market is starting to soften? I’ll admit I don’t know the answer, but I bet you don’t either. Compared to 2019, does downtown look like a place where lots of people are going to want to live?

Testimony in the committee hearing indicated that there is over $9 Billion of additional private investment projected to come to downtown Indy in the next several years, including a major redevelopment of the Old City Hall site (which will include housing). I purchased my home in January 2022 and it has appreciated slightly over 10%. Given the headwinds of the major change of greater remote work, it’s hard to make the case that downtown is not an attractive place to live. It’s not for everyone, but most of my neighbors wouldn’t want to live anywhere else. We would just like to have our votes and elected representatives respected by the State Legislature.

And I thought our lawmakers were too busy messing up other issues to hear this!

Meh!

I agree with 21 R.

The city has a habit of acting without transparency.

RDOOR did the same thing by buying the homeless shelter land without transparency to the residence. The homeless shelter is not going to work under present operating theories. At yesterday’s zoning hearing they said they have the money. Ŵhy tax the mile square.

If you really want it to work , you have to be leaders. Take away the right to camp and loiter on public land. Then the homeless won’t have a choice. Then put professional behaviorist in the shelters to help them see another way of life. Your all politically .motivated. we all have to be lead by rules. Except of course for the homeless.

Until the crime in the area is eliminated all the tax boondoggle in the world won’t help. Just had another homicide at the Transporation center last week. Hopefully the mayor will sober up to the situation.

The Mile Square has been negligible in the murder stats the last couple, years, which i demonstrated to your detriment the last time this came up.

Claiming that the downtown murder rate is negligible, as Joe predictably does, fails to consider that downtown has indeed had a few murders each year, and those numbers did rise along with the rest of the city in 2020–2023. I’ll confess that getting violent crime to zero is pure unicornia. But dismissing homicides downtown isn’t going to help the remaining bars and restaurants who depend on an image of safety for patrons–or for attracting organizations to hold their conventions nearby.

Sure, the per capita crime rate may be worse in a random square mile in Brightwood or Haughville, but are those areas getting targeted for yuppie growth? In due time, the businesses won’t be able to sustain themselves with a streetscape where 1 out of 4 people are pushing a trash-filled shopping cart. And once enough trendy businesses leave, the Millennials and Gen Z-ers will have no reason to prolong the dorm/frat culture in a cheap 5-story apartment building.

Does anybody see the irony that the state and state lawmakers, that have no skin in this game because all of the state property in the mile square is exempt, is trying to kill this.

I was never in favor of calling this a tax. The state can’t tax the state or federal government. I think it should have been something like a curb fee, where every property is required to pay a $1 per foot of curb. I still don’t know if this would get the state to pay their share, but it would collect from all of the not-for-profits (like churches and Wheeler mission).

Why on earth would you want to tax and penalize Wheeler Mission? Making them pay for service they would never dream of providing (overnight shelter for actively-using junkies) is putting financial and ideological pressure on an organization that has been instrumental in keeping downtown Indy’s positive image. That the image is largely eroded has more to do with city-level policies than incentivize homelessness. Wheeler Mission can’t keep up with an opioid epidemic, and they shouldn’t be expected to put their workers in harm’s way to accommodate the folks jabbing needles into their arms each day.

Homicides aren’t helping either. Indy also used to have one of the best detective forces in the country. It had one of the highest rates of solved homicides, to the point that it was featured in true-crime reality TV series. I’ll confess I’m too lazy to research right now; can anyone tell me if those numbers are still so good, since Hogsett took office and went through a slew of police chiefs?

The image of downtown is still hugely deteriorated. Junkies permanently build camps on Monument Circle and pass out in neglected doorways like they think this is San Francisco Tenderloin. (That seems to be what the Hogsett admin wants us to become.) And then these bums walk into places like Potbelly or Rocket Fizz to take a dump and do god-knows-what else. How long before Potbelly says “Enough!” and goes the way of Starbucks?

And on top of this, we’re expecting to tax the people more heavily who live there. Apartments will pass these costs on to the tenants. Oh well–if the Democrat supermajority wants this, I guess that’s what they should get. I mean, back in the 1960s, the Dems already ushered in the previous urban collapse back in the 1960s and 70s. At least then, the GOP was partially to blame for white flight from urban problems. Now that cities are back from a 20-year rebound and are more Dem-centered than ever, who will the Dems presiding over the collapse blame this time around?

Wow, Lauren’s on a roll today. Lots of hate and fear-spreading rants. Even more than usual.