Trump extends China tariff deadline, cites progress in talks

U.S. and Chinese negotiators met through the weekend as they seek to resolve a trade war that's rattled financial markets.

U.S. and Chinese negotiators met through the weekend as they seek to resolve a trade war that's rattled financial markets.

IBJ’s Lindsey Erdody, The Journal Gazette’s Niki Kelly and TheStatehouseFile.com columnist Mary Beth Schneider talk about which issues are moving forward and which ones are fading away.

The measure comes after revelations that a state agency awarded some grants for struggling veterans to its own employees.

Critics of the latest version of the bill have charged that it would be ineffective without listing the personal characteristics—such as race, religion and gender identity—that it covers.

Spectacle Entertainment—a company founded by some of the same investors that operated Centaur before it was purchased by Caesars Entertainment—is in the process of buying Gary-based Majestic Star Casino I and Majestic Star Casino. It has said it wants to move one of the casinos to the Interstate 80/94 corridor and the other to Terre Haute.

A change made to legislation designed to boost funding for the Capital Improvement Board means the quasi-governmental agency could see an additional $15 million in tax funds annually—nearly double what was initially proposed.

Raju Chinthala had never heard of Indiana before he came to the United States from India in 1994. In the 25 years since, he has become one of the state’s greatest champions.

Even though some districts are projected to lose students, they would still get more state money because of changes to Indiana’s funding formula that add funds for vulnerable students and because lawmakers put more money in the budget overall.

Gov. Eric Holcomb’s office announced this week that 10 substance abuse coalitions each will receive a $75,000 grant to develop, improve and enhance treatment and recovery initiatives.

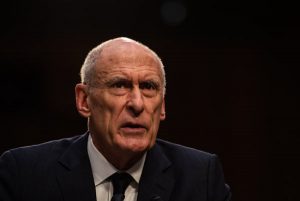

Indiana’s Rep. Susan Brooks said it would be “worrisome” if Trump were to remove Coats as director of national intelligence. And Sen. Mike Braun of Indiana said he seems no indication a change is coming.

The Senate amended Senate Bill 12 so it no longer specifies that crimes motivated by bias based on race, religion, sexual orientation, gender identity and other categories are eligible for stronger penalties.

Two residents with a home on Lake Michigan contended lakefront landowners should have the right to limit who uses the beaches abutting their properties.

The president has never seen Coats—the nation’s top intelligence official and a former senator from Indiana—as a close or trusted adviser, sources told The Washington Post. But Trump has become more frustrated with him in recent weeks over public statements that Trump sees as undercutting his policy goals.

The first tax filing season under the new federal tax law is proving to be surprising, confusing—and occasionally frightening—for some Americans, especially those accustomed to getting money back from the government.

The Indiana House Ways and Means Committee fended off amendments and objections from Democrats on Tuesday and ushered the bill to the full House for consideration.

The more generous scale has boosted IPS’ performance as it launches a new strategy of partnering with charter operators, by allowing some innovation network schools to earn high marks despite overall low test scores.

Fishers intends to start construction on the first section of the trail, from 106th Street to 126th Street, later this year.

The spending plan includes the additional $286 million per year requested by the Indiana Department of Child Services, covers increases in Medicaid costs, and hikes K-12 spending by 2.1 percent in 2020 and 2.2 percent in 2021, which is slightly higher than the 2 percent annual increase suggested by Holcomb.

After more than three hours of testimony and discussion on Monday morning, the Senate Public Policy Committee voted to send the bill to the full Senate for consideration.

The Dunes were initially recommended to become a national park in 1916, because of their biological diversity and geological features.