Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe pain just keeps getting worse for Auer Growth Fund.

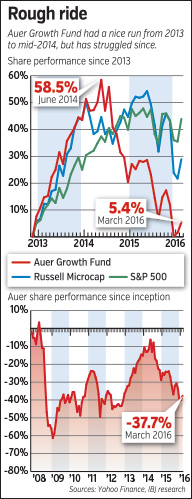

Investors in the Indianapolis-based mutual fund have lost about 5.7 percent so far this year, adding to the woes of double-digit percentage losses in 2014 and 2015. From its debut in late 2007 through the end of 2015, its average annualized return was negative 5 percent, while the overall market, as measured by the S&P 500, rose an average of 6.3 percent annually.

The investment losses combined with customers who’ve opted to cash out have sent the fund’s assets careening to $25 million, down from more than $200 million several years ago.

The mutual fund’s founder, Bob Auer, said he’s disappointed with the results but will stick to his guns. Auer said the only thing that could prompt the fund to shut its doors is another massive economic downturn, if that.

“[Assets] would have to go below $10 million and stay there for probably two years,” Auer said in a phone interview, speaking about a scenario likely to happen only with a deep recession.

“If that would happen … it’s more likely that you lose your job before we close this fund.”

Auer Growth Fund is a high-risk play, with relatively high fees but the potential for high reward. Its investment philosophy is fairly simple: It buys stock in companies that see quarterly earnings jump 25 percent from the previous year, see quarterly revenue leap 20 percent, and boast price-to-earnings ratios below 12.

Auer sells those stocks when the price doubles or when that performance stops.

Auer

AuerThe firm had a respectable 2009, returning 36.5 percent to investors, including dividends, while the S&P 500 returned 26.5 percent that year. It returned a remarkable 44.5 percent to investors in 2013, versus 32.3 percent for the S&P 500.

But as major stock market indexes notched seven straight years of gains since 2009, Auer Growth Fund hasn’t kept up, posting three years of declines and one year of relatively flat performance.

Mutual fund tracker Morningstar doesn’t cover Auer Growth Fund, but senior analyst Laura Lallos described the fund as a laggard among its peers.

“Just looking at its star rating and its returns and risk so far, this fund has been very risky with very minimal payoff, overall, since inception,” she said.

“It earned one star, which is a reflection of its risk-adjusted performance, and it also has very high fees.”

According to Morningstar data, Auer Growth Fund has a 1.98 percent expense ratio, while the average for the 261 funds in its small-blend category was 1.24 percent.

Auer, the 54-year-old fund manager, has said the fees reflect the extra work of having micro-cap stocks represent a large portion of the portfolio, about 80 percent lately. Micro-caps are less liquid and can be more expensive and time-consuming to trade.

Klimek

KlimekHe also said the upside his fund offers is potentially greater than that of low-cost funds—pointing out that his investment strategy helped turn $100,000 into more than $30 million from 1987 to 2007.

“We think the small-cap [sector] is where the money is going to be made, not in the large caps,” Auer said.

“Some of these large caps, we don’t see how they’re going to go up a lot more. The value is really in the small caps, but the managers really haven’t started digging down to those. But when it does start—as we’ve seen in the past 30 years—it can be very powerful. Just when is it going to start?”

Auer, a former Morgan Stanley broker, said the $100,000 he started with came from his father, who’d run a small chemical firm. They put the money in a retirement account, conceived their investment strategy and didn’t add money for two decades. When the figure reached $32 million in 2007, they opened the fund to outsiders.

But the timing proved unfortunate. The fund debuted publicly near the start of a steep bear market marked by the Great Recession, falling about 60 percent in 2008 and never fully recovering.

After the fund’s 44-percent return in 2013, it seemed poised for a solid 2014. But the tide quickly turned as the prices of many of its portfolio holdings sunk after oil prices and commodities declined.

In addition to lagging broad indexes such as the S&P 500 most years, it has also trailed exchange-traded funds sharing the Auer Growth Fund’s micro-cap focus. For example, the iShares Micro-cap ETF and Wilshire Micro-cap ETF each posted returns around 20 percent in 2012, while Auer Growth Fund returned 2 percent, including dividends.

It underperformed those two indexes by at least 8 percentage points in five of the past eight years, according to Morningstar data. A hypothetical $10,000 investment in those two indexes at the end of 2007 would be worth at least $12,000 today, while the same investment in Auer Growth Fund would be worth $6,305.

Jim Klimek, a local securities attorney, said the past several years’ investment landscape has probably weighed on the fund.

“When you see the Dow Jones going up month after month, you might decide it’s not necessary to take that extra risk on these very-small-cap funds to get a pretty good return,” he said.

Auer Growth Fund had$66 million under management at the end of 2014. But the following year, a single institution Auer declined to identify gradually pulled out, withdrawing about $25 million in the process.

Today, the fund has a few hundred investors, Auer said, and the Auer family represents about half of the roughly $25 million under management. He said the decline in assets has shrunk the five-person operation’s income, but it hasn’t induced layoffs.

He believes brighter days are ahead, and that money will pour in once performance picks up.

“When it has a good year, it’d be a lot nicer story,” he said. “But we’re not going to hide from anything. It is what it is and we’re actually proud of the strategy and how good it has done, but unfortunately it’s struggled here lately. But we don’t think that’s going to stay the case.”•

Please enable JavaScript to view this content.