Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

What do Circle Centre Mall, Old City Hall and a yet-to-be-announced conversion of the former Angi building into apartments all have in common?

None of the projects have so far moved beyond the planning stage, and all three are among the nearly two dozen projects the city is relying on for tax revenue to finance a proposed soccer stadium development on the east side of downtown.

In fact, more than half of the expected developments within the district the city has designated as a professional sports development area, or PSDA, have yet to break ground.

In all, the city is projecting a $3.3 billion development pipeline within the PSDA (out of about $8.5 billion in development projected for all of downtown), although specific plans for some of the projects have not been released publicly and remain largely unknown. That’s much like plans for the stadium itself, which city officials say will be built only if Major League Soccer awards an expansion club to Indianapolis.

“One of the things that we wanted to make sure that we were doing, both for the benefit of the state and the city’s current tax base, is not drawing into [the tax district] properties that are currently producing significant tax revenue,” said Andy Mallon, executive director of the Capital Improvement Board of Marion County, the entity that operates Lucas Oil Stadium and the Indiana Convention Center and would own the proposed soccer stadium.

Instead, the city focused on parcels that offered future development options.

“We wanted to make sure that we have a very reliable case, not the most aggressive or optimal set of assumptions,” Mallon said.

But even before MLS acts—and it has said it could be months or longer before it formally entertains an expansion request—the city is moving to put the stadium funding plan in place. To that end, the City-County Council has approved PSDA boundaries drawn by Mayor Joe Hogsett’s administration and submitted them to the state for approval.

Sports development areas work by redirecting some state and local tax revenue generated by new developments into a fund that can be used to pay off bonds for projects—in this case, the soccer stadium. The PSDA captures only net new revenue, meaning tax revenue that is higher than a base year that is set when the zone is approved.

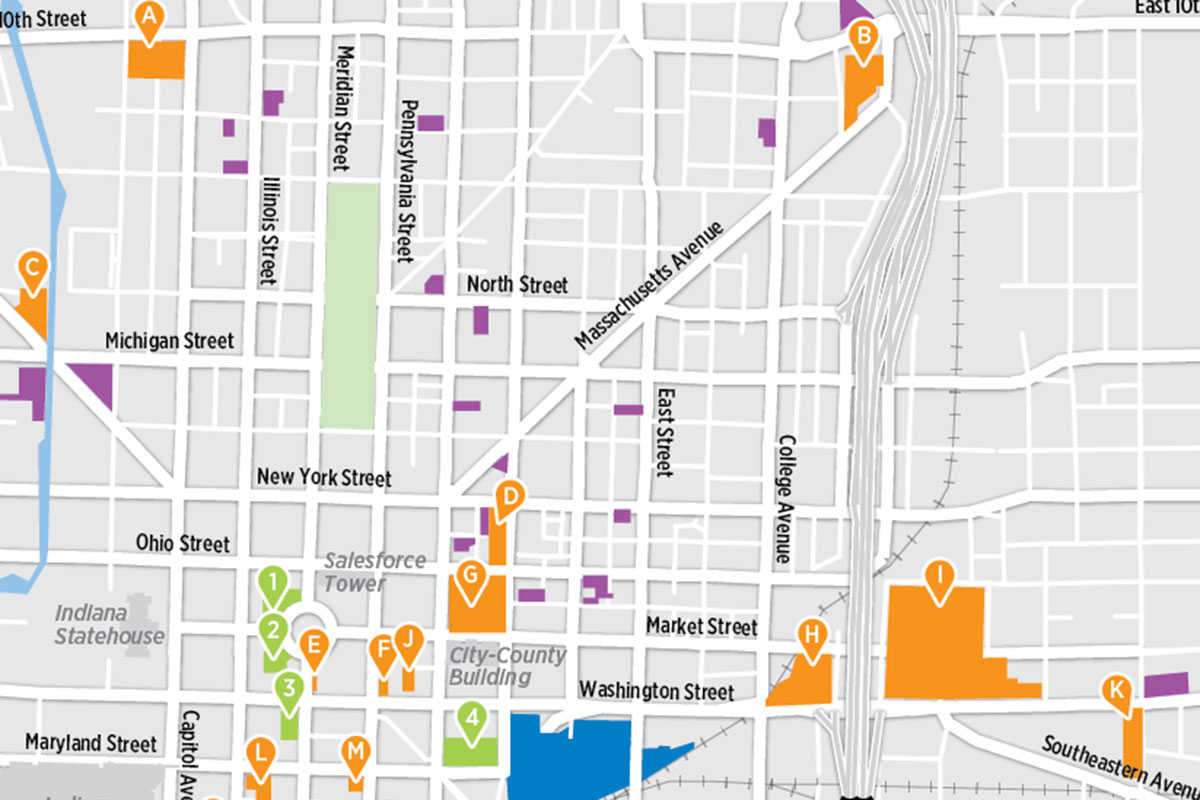

Therefore, the Hogsett administration’s goal was to fill the PSDA with a pipeline of projects with the potential to generate new tax revenue that could be used to build the stadium. That’s why the tax district doesn’t include all properties inside a circle around the stadium site; rather, it comprises a collection of non-contiguous parcels where development is underway or officials anticipate projects to occur.

As part of the approval process, the CIB prepared an initial study detailing how much revenue the PSDA could produce for a stadium project.

The study assumes completion of a number of projects solidly in the pipeline, such as ongoing developments at Bottleworks District in the Mass Ave neighborhood. But it also includes developments that are yet to even be proposed. Among those are potential redevelopments of the former Jail I building and several surface parking lots, including spots along Indiana Avenue and near the City-County Building. It assumes a revamp of Union Station and considers office and retail redevelopment for the former L.S. Ayres building at Washington and Meridian streets and the former Anthem headquarters on Monument Circle.

Crunching the numbers

The report—produced for the CIB by Chicago-based Hunden Partners—finds that, assuming the projects come to fruition, the proposed PSDA could generate at least $2.1 billion in tax revenue over 32 years. But only some of that revenue could be captured for the stadium.

The 2019 state law authorizing the soccer stadium district caps the amount of state tax revenue that can be earmarked for stadium bonds at $9.5 million per year, or a total of $297.9 million, starting in 2025. If there were no cap, the Hunden report says, the PSDA would capture $1.7 billion over the 32-year life of the district.

Local revenue is not capped and could total nearly $522 million over 32 years in baseline market conditions, according to the report.

Under the law, a team’s owners or investors must pay 20% of the cost of the stadium project. The potential investors in a soccer club have not been identified, but Mallon and Faegre Drinker attorney Scott Chinn, who is representing the city on the MLS deal, said Wednesday the administration still expects an investor group to come forward before the state takes up the taxing district publicly.

The CIB on Aug. 2 emailed the study and other documents to the State Budget Agency and the Indiana Finance Authority, which are expected to consider the PSDA later this summer. The State Budget Committee—a five-member, bipartisan group composed of the state budget director and budget leaders in the House and Senate—is charged with the district’s final approval.

The Hunden report projects the PSDA would generate more tax revenue than it needs to fund the stadium—and would exceed the state’s $9.5 million tax cap in every year except the first.

In 2025, the report estimates, the PSDA would generate $3.38 million in state and local taxes; the total climbs to as much as $66.1 million in 2056.

The projections assume a 20,500-seat stadium opening in 2028, although Mallon said because no design work has occurred, city officials don’t know specifics on the size or cost of a stadium. Once the PSDA receives state approval, he said, the CIB will begin design discussions with the investor group, with hopes of incorporating initial plans into an application to join MLS that could be submitted by the end of the year.

“I anticipate that MLS will care what the stadium looks like and where it’s located and [whether] it’s a good stadium,” he said. “So we do need to get our design team rolling. We’re in the midst of that assessment now as we begin these conversations with the Indiana Finance Authority and the state; we’re trying to move on a lot of parallel fronts.”

While the PSDA will be in place for 32 years, Chinn said bonds for a stadium would be financed at 30 years.

Determining the pipeline

Real estate experts said it’s no surprise that Indianapolis plans to rely on a pipeline of proposed and potential projects for stadium funding.

The projects already in process include the Cole Motor campus redevelopment on the near-east side, the CSX building redevelopment across from Gainbridge Fieldhouse, and the Signia hotel and convention center expansion under construction at Pan Am Plaza.

The study projects dozens of existing or potential projects within the PSDA boundaries, ranging from office buildings to hotels to apartment projects. While not all of those are incorporated into the report, Chinn said the PSDA map can be amended to draw those in, although changes would have to be approved by city and state leaders.

Under what are considered base conditions (assuming a 1% inflation rate and stable market conditions), the PSDA is forecast to receive $747.1 million in total tax revenue over the 32-year life of the district from pipeline projects. The study projects that figure could increase to $889 million in what would be considered optimal market conditions (assuming an inflation rate of 2.5%).

Within those totals, the study projects that a stadium complex (the stadium itself plus development directly associated with it) would generate $204.2 million in taxes over 32 years under the base scenario and $264.2 million in an optimal scenario.

Most of the remaining revenue would come from taxes paid at non-stadium sites, including those with projects well underway and others still in the discussion stages.

For example, the Department of Metropolitan Development is in talks with a developer about converting the mostly vacant Angi building at 130 E. Washington St. into a 191-unit apartment building. But Lucas González, a spokesperson for DMD, said the staff is “still in initial conversations, and nothing is official at this time” for the project, which is listed as a $35 million capital investment in the Hunden report.

Likewise, work has stalled on the Motto by Hilton at 1 N. Meridian St., and it’s unclear when or if the project will come back online. After several months of delays, the Kimpton at 1 N. Pennsylvania St. recently began construction, but a timeline for its completion hasn’t been made public. Each of those developments is projected to generate not only sales and income taxes for the PSDA but also innkeepers taxes, which are split by the CIB and the state.

The city also hasn’t finalized an agreement for the redevelopment of Circle Centre Mall, which was announced in December as a $600 million project. Wisconsin-based Hendricks Commercial Properties officials recently told IBJ they expect to complete a deal—including incentives—by the end of this year. Projections put the cost at around $650 million, according to the Hunden report.

The Old City Hall project announced last year could also face additional hurdles on the bond market, as the price for the hotel, housing and museum project has more than doubled since it was announced, to more than $264 million.

Based on assumptions

Andrew Urban, senior vice president of occupier services for the Indianapolis office of Toronto-based commercial brokerage Colliers International, said he’s confident the city has a good gauge on what projects are likely to come to fruition because officials are often in near constant communication with developers.

“Obviously, it’s a forecast, so we can all argue about it,” Urban said. “The math that they did is spot-on correct, but it’s based on these certain assumptions.”

Some pockets of downtown, such as the City Market and Old City Hall areas, are so ripe for development that the city will do whatever it can to help the developer get across the finish line, he said. That’s similar to what’s happened with the Signia project, which was initially being developed by Indianapolis-based Kite Realty Group Trust before the firm withdrew due to financing concerns; the city is now the owner and financier of the project, using bonds that will be repaid through revenue generated by the property.

And because city officials are directly involved in providing data and information for the fiscal analysis, they can play a role in determining the outcome.

“It’s based on the assumptions that the city handed off to the firm to make the analysis … and that’s where you can kind of massage numbers, at the end—say, make it seem rosier at the end of the day,” Urban said. “I’m not saying that’s wrong, as [the projects] could be further along than we know.”

Chris Reckley, director of acquisitions for Michigan-based Dietz Property Group, said he is comfortable with the city’s projections, despite uncertainties about some projects in the pipeline.

“Scrolling through the numbers, at a high level, nothing seemed to be out of order to me. It all seemed doable, especially for a Midwestern-type city,” he said.

Reckley said he had concerns about the previous stadium deal the city had been considering with Indianapolis-based Keystone Group, largely because much of that proposed PSDA was tied to development on the site, including a large concentration of office space, which has struggled mightily since the pandemic.

“It seems like there are reasonable underwritings” for the current plan, Reckley said. “The numbers they’re using to kind of drive the revenue side didn’t seem that outlandish.”

Chinn, the attorney representing the city, said officials are in early conversations with the State Budget Committee about setting a date for a public hearing, but nothing has been finalized. Additionally, the Indiana Finance Authority is examining the Hunden report and other documents associated with the PSDA as it prepares a recommendation for the city’s request.•

Correction: The original version of the story, which was published in the Aug. 16 issue of IBJ, incorrectly stated the status of work on the Kimpton hotel. That project is now under construction. See more corrections here.

Please enable JavaScript to view this content.

The Kimpton Hotel is currently under construction. Hopefully the Motto Hotel will start soon the corner is such an eyesore. Maybe they could turn into apartments.

I agree on the sight being an eyesore. I love the city is showing a desire to develop and there’s momentum. I don’t see why Indy shouldn’t be able to complete most if not all of these projects. Cities like Nashville, Milwaukee, Kansas City and Columbus are all

doing projects of similar size or bigger. So why can’t Indy compete? Im sure the price to do business and interest rates are the same there as here.

Hotel development is tough right now. Relying upon that in the next few years is a risky proposition.

Same for big commercial buildings. Lots of upside down loans floating in the market.

I don’t know what rough is to you but there are 3 20+ story hotels under construction or in design phases right now. Demand is high.

I remain dubious that we can absorb a major league soccer franchise in this market without Simon, or other deep pocket, money backing it.

No other group aside from Simon that could be backing it. Look at the proposed location and who now owns it….

Why is the empty parking lot on Washington Street between Pennsylvania and Meridian Streets not included as one of these mentioned sites. What a waste/void right in the middle of downtown. Can’t the City do something to encourage development of this parcel.