Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowWes Montgomery Park, named after the Indianapolis-born jazz guitarist, will soon be home to the reverberating rhythms of pounding basketballs in a covered shelter.

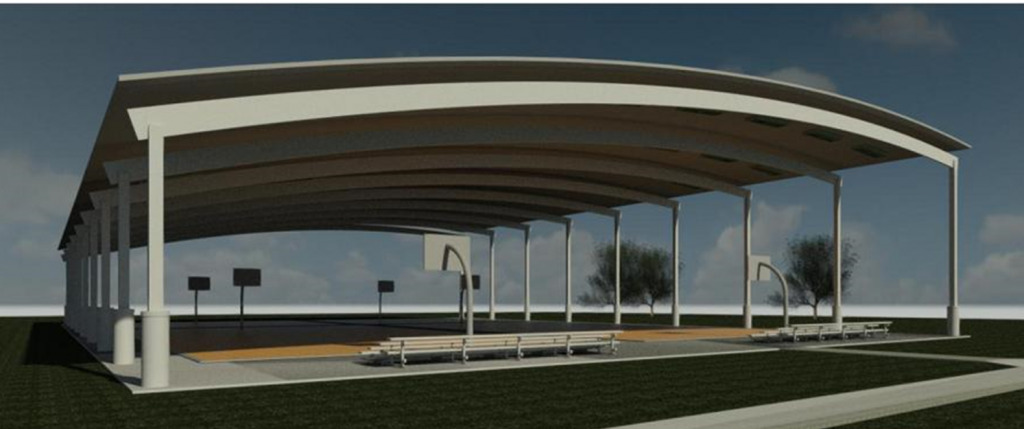

City crews broke ground on the $2.6 million project on Wednesday. The covered but open-air basketball courts will be the first in the Indy Parks system. Two full-sized and two half-sized basketball courts will be sheltered by a pavilion.

The project is expected to be complete by the end of the year.

Wes Montgomery Park at 3400 N. Hawthorne Lane was named after the musician in 1970, two years after his fatal heart attack at just 45 years old. He was the most influential and revered artist who emerged from the Indiana Avenue club scene after World War II.

“We are proud to break ground this community-focused structure, the first of its kind in the Indy Parks system,” Mayor Joe Hogsett said in a media release. “And with a roof overhead, the courts will be open no matter if the weather calls for Montgomery’s cover of ‘Sunny’ or his version of ‘Here’s that Rainy Day.’”

This year marked the centennial of Montgomery’s birth, spurring documentaries and performances honoring the storied musician.

The project is receiving American Rescue Plan funding, of which $16.7 million is going to 26 parks. For the pavilion, $1.3 million of funding will come from ARPA and an additional $1.3 million will come from Indy Parks’ capital budget.

Indy Parks also recently received an $80 million grant from Lilly Endowment, although it isn’t a funding source for this project.

The park currently has a splash pad, open green space, and uncovered basketball courts. It’s also slated to get an open-air roller rink, which is currently in the design phase.

Please enable JavaScript to view this content.

That’s a cool feature. However, you would think the park would have some sort of space devoted to live music. I don’t know, maybe a small stage or mini amphitheater? If it doesn’t, I feel like it’s a pretty major fail…

A nice feature for our city park. I look forward to hooping there.