Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowAn activist investor group that has pressed Genesco Inc. to sell off some of its holdings says it’s not pleased that the retail conglomerate is targeting troubled Zionsville-based Lids Sports Group for divestiture.

Nashville, Tennessee-based Genesco announced Tuesday that it was “initiating a formal process to explore” the sale of Lids. Genesco has owned Lids since 2004, when the hat and team sports apparel retailer was known as Hat World.

Lids has struggled financially in recent years, and it is currently by far the weakest performer in Genesco’s portfolio.

“We believe Lids Sports Group is undervalued as part of Genesco and that its sale would generate capital that the company can deploy productively to further enhance shareholder value,” said a written statement from James Bradford, Genesco's lead independent director and chairman of a special committee formed to explore the Lids sale.

That language echoes a filing made Jan. 16 by an activist investors group led by California-based Legion Partners Asset Management LLC and Connecticut-based 4010 Capital LLC, which between them own more than a million shares of Genesco, or just over 5 percent of the company’s total shares. Most of those shares are held by Legion Partners.

That language echoes a filing made Jan. 16 by an activist investors group led by California-based Legion Partners Asset Management LLC and Connecticut-based 4010 Capital LLC, which between them own more than a million shares of Genesco, or just over 5 percent of the company’s total shares. Most of those shares are held by Legion Partners.

In that filing, the investors said they believed Genesco’s shares were undervalued, and they urged the company “to monetize certain segments of its business and return a significant amount of capital to shareholders.”

Until Tuesday’s announcement, neither Genesco nor the activist group had weighed in on which parts of the company might be considered for a sale.

After Genesco made its announcement, Legion Partners told IBJ it was not happy about the decision.

“We are disappointed that the board did not initiate a more thorough comprehensive review of all strategic alternatives. A sale of Lids, in our view, does not go far enough in resolving the significant underperformance issues at the company,” Legion Partners Managing Director Chris Kiper said via email.

Kiper declined to comment further about what his group might do next.

Legion Partners has a history of investing in companies, then pressuring them to make changes.

In January, Connecticut-based food distributor Chefs’ Warehouse Inc. announced it had agreed to appoint two new independent directors to its board, as part of an agreement with a shareholders group led by Legion Partners. Legion owns about 6 percent of Chefs’ Warehouse’s outstanding shares.

In contrast to Legion Partners' opinion, financial analysts said they see the Lids development as a positive.

“We would view a sale of Lids favorably given its drag on overall profitability and given it would provide more time for (Genesco) to focus on its core footwear brands,” wrote Erinn Murphy, a senior research analyst at Piper Jaffray & Co.

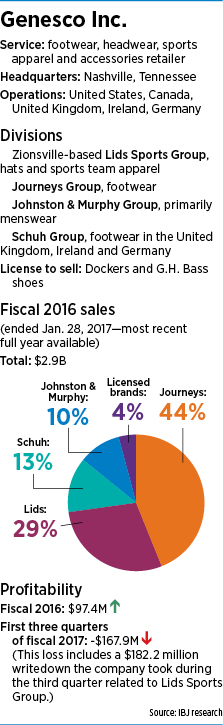

Lids and youth-oriented footwear retailer Journeys Group are the two largest parts of Genesco’s business. On numerous occasions, Genesco CEO Robert Dennis has described their performances as “a tale of two businesses” because of the sharp contrast between them.

Genesco’s other divisions include Europe-based footwear retailer Schuh Group; Johnston & Murphy Group, which primarily sells men’s footwear and apparel; and a licensing division that sells Dockers and G.H. Bass footwear.

In its report, Jefferies Group LLC said selling Lids “would be a significant long-term positive” for Genesco, especially since Lids faces “some structural challenges that are unlikely to go away completely,” namely online competition.

Lids could fetch around $60 million, or $3 per share, if it were to be sold, the Jefferies analysts estimated.

But the Jefferies analysts also said they were “somewhat surprised” that Lids was the division Genesco is looking to sell.

“While Lids has been struggling … we would have thought management would look to first divest either Schuh or J&M, which are smaller, more profitable, and, in our view, have a larger universe of potential buyers,” the Feb. 14 Jefferies report says.

In his report, C.L. King & Associates analyst Steven Marotta also said a Lids sale would be a positive, though he also noted the overall uncertainty surrounding the matter.

“Ultimately, a successful sale of the Lids Sports Group to the primary competitor would make both operations more profitable,” Marotta wrote. “Given the limited pool of buyers, handicapping the likelihood of a successful divestiture is difficult, to say the least.”

Genesco’s board has established a committee of four independent directors to oversee the sale process and has retained the firm P.J. Solomon as an adviser in the matter.

Genesco’s board has established a committee of four independent directors to oversee the sale process and has retained the firm P.J. Solomon as an adviser in the matter.

"The Lids Sports Group has been an important part of Genesco, and we still see significant potential for the business," Bradford said. "We believe, however, that it is in the best long-term interests of the company and its shareholders to focus on building upon our core footwear platform, in which the businesses share common strategic characteristics and where we believe we can generate greater operating efficiencies and synergies."

Genesco also acknowledged that a sale is not a certainty.

“There is no assurance that the process to explore the sale of the Lids Sports Group business will result in any transaction or the adoption of any other strategic alternative,” Genesco said in Tuesday’s statement.

The company also said that it “does not intend to make any further disclosure concerning these matters unless or until a definitive transaction agreement is reached or until the board determines to conclude the process.”

In its most recent full quarter, ended Oct. 28, Lids reported a 9.5 percent drop in sales, to $181.3 million. Earnings tumbled 76 percent, to $2 million. Lids had 1,177 stores at the end of the quarter, down from 1,240 at the beginning of the year.

In a mid-fourth-quarter financial update last month covering the important holiday season, Genesco said comparable sales for Lids had declined 14 percent for the quarter-to-date period ending Jan. 4, compared with the same period a year earlier.

In comparison, Journeys posted a 10 percent comparable sales increase.

Comparable sales include both same-store sales and online sales. For Genesco as a whole, comparable sales increased 1 percent for the quarter-to-date period.

Genesco plans to release its fourth-quarter and full-year results March 15.

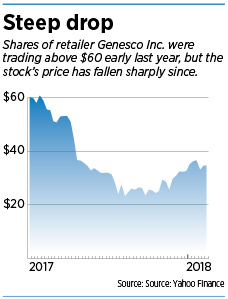

Shares of the company have languished in recent months, but the Lids announcement gave a boost to the stock’s price.

Shares were trading around $38 late Wednesday morning, up about 10 percent from Tuesday’s closing price of $34.40. The stock has traded from $20.90 to $60 per share over the past year.

Lids, which got its start as Hat World in 1995, had been Genesco’s most successful subsidiary for years after it was acquired in 2004. But it has struggled in recent years after stumbling in a bid to diversify into apparel and equipment for youth and school sports teams.

Lids announced in 2014 that it would move its headquarters from Indianapolis to Zionsville as part of a $22 million expansion that would create 758 jobs by 2025. It opened the 150,000-square-foot office at Creekside Corporate Park in late 2016.

As of June 2017, Lids had more than 9,000 employees, including 471 at its Zionsville headquarters.

Please enable JavaScript to view this content.