Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now Facebook is one of the five “FAANG” stocks (along with Apple, Amazon, Netflix and Google’s parent company, Alphabet) whose market values (number of shares outstanding multiplied by stock price) soared to stratospheric levels on the promise of certain growth, regardless of the state of the economy, interest rates, tariffs or other factors affecting “mere mortals” of corporate America.

Facebook is one of the five “FAANG” stocks (along with Apple, Amazon, Netflix and Google’s parent company, Alphabet) whose market values (number of shares outstanding multiplied by stock price) soared to stratospheric levels on the promise of certain growth, regardless of the state of the economy, interest rates, tariffs or other factors affecting “mere mortals” of corporate America.

On July 25, Facebook shares (NYSE-FB) touched a record high of $218.62, as investors eagerly anticipated yet another stellar earnings announcement from the company after the market close. But owners were blindsided and “unfriended” the stock in droves after Facebook posted disappointing results for second-quarter revenue, growth in “daily active users” and profits.

Additionally, management reduced expectations for near-term revenue growth (i.e. slowing growth in users and users less willing to share personal information, which hurts FB’s ability to sell targeted ads) and warned that a surge in spending for beefed-up security (Russian election interference), privacy protection (Cambridge Analytica personal data scandal) and new product launches would hurt profitability for several years.

The reaction was swift and severe. Facebook dropped 19 percent the following day, erasing $119 billion of market value, the biggest-ever one-day drop for a U.S. public company. To put this loss in perspective, $119 billion is:

◗ Larger than the market value of 457 of the stocks that make up the S&P 500.

◗ Just under the combined market value of the entire U.S. commercial airline industry: Delta, $37B; Southwest, $34B; United Continental, $22B; American, $18B; Alaska, $7B; and JetBlue, $5B.

◗ About 60 percent of the amount of inflation-adjusted market value lost by the entire U.S. stock market on “Black Tuesday” (Oct. 29, 1929—$200B).

The reason this is important is the FAANGs have become “one-decision stocks”—stocks you should buy, no matter how expensive, and hold forever. Indeed, according to Bespoke Investment Group, the FAANGs in 2017 all soared 30 percent or more and added $851 billion in market value. This stellar performance continued in the first half of 2018, as the five FAANGs boosted their market value by $523 billion, while the other 995 stocks in the Russell 1000 large-cap index added just $183 billion.

According to Goldman Sachs, the five FAANGs contributed 81 percent of the S&P 500’s 3 percent return for the first half of 2018. Amazon rose 45 percent and alone accounted for 36 percent of the S&P 500’s return. Apple gained 10 percent and contributed 15 percent, Netflix jumped 106 percent and contributed 15 percent, Facebook rose 11 percent and contributed 8 percent, and Alphabet increased 7 percent and contributed 7 percent.

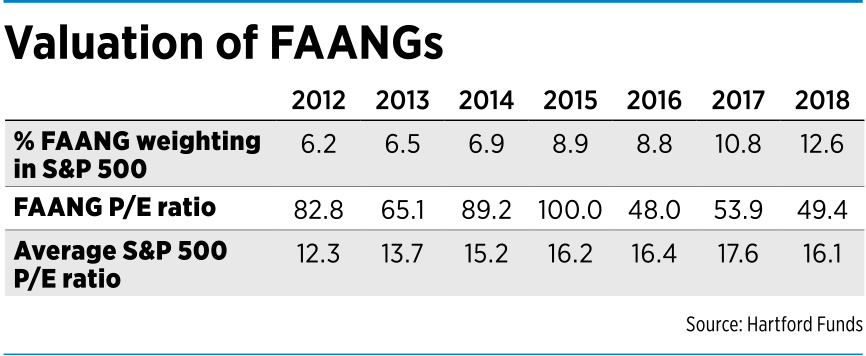

As shown in the table below from Hartford Funds, as a result of their jumbo-size performance, the valuation of the FAANGs (as measured by their price/earnings ratios) is also much richer than the S&P 500’s.

The FAANGs have been priced for perfection, as if their business models and execution will be infallible. Just like during the technology bubble of the late 1990s, the valuation of the FAANGs don’t make sense to us. Also like then, I can attest that not owning them has made for a long, lonely walk through the performance desert.

The FAANGs have been priced for perfection, as if their business models and execution will be infallible. Just like during the technology bubble of the late 1990s, the valuation of the FAANGs don’t make sense to us. Also like then, I can attest that not owning them has made for a long, lonely walk through the performance desert.

The “Nifty-Fifty” large-cap growth stocks were also “one-decision” market darlings in the late 1960s and early 1970s, but eventually crashed. The second, third and fourth largest one-day drops were Intel ($90.7B) and Microsoft ($80.0B and $64.1B), all coincidentally during the bursting of the technology bubble in 2000.

Nobody can say if Facebook’s stumble will prove to be a temporary blip or the proverbial “canary in the coal mine” for the FAANGs. Price and valuation always matter—eventually. As Mark Twain said, “History doesn’t repeat itself, but it does rhyme.”•

__________

Kim is the chief operating officer and chief compliance officer for Kirr Marbach & Co. LLC. He can be reached at (812) 376-9444 or [email protected].

Please enable JavaScript to view this content.