Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

You probably were aware ahead of the United Kingdom’s June 23 referendum that the vote would determine whether Britain would remain a member of the European Union (“Bremain”) or leave (“Brexit”).

You probably were aware ahead of the United Kingdom’s June 23 referendum that the vote would determine whether Britain would remain a member of the European Union (“Bremain”) or leave (“Brexit”).

With global markets strong in anticipation of Bremain, you probably didn’t care about the referendum when you went to bed that night. But by the time you woke, you cared that Brexit prevailed—a lot.

On June 24, stocks cratered worldwide. On cue, the talking heads and headlines poured gasoline onto the fire as they blared about “a Lehman Bros.-like contagion worse than 2008,” and other dire warnings of impending apocalypse. Best of all, the various doctors of doom had all weekend to pile on and further heighten investor anxiety.

If we’re going to call this movie the “Brexit Panic,” then it is surely the sequel to the “Oil/Commodity Price Collapse Panic” (earlier 2016), the “China Currency Devaluation Panic ” (2015) and the “Greek Default/‘Grexit’ Panic” (its own series).

(Behaviorgap.com)

(Behaviorgap.com)Panics are scary episodes that evoke your primal “fight or flight” survival instincts. When you’re watching the Dow plunge hundreds of points in a matter of minutes, it’s easy to believe you’re staring into the abyss. We understand because we feel the same visceral fears and emotions.

At the same time, one of our primary roles as professional advisers is to put our emotions on the shelf and help prevent our clients from doing things harmful to their long-term financial future. In other words, we have to trust our experience and process (i.e. finding high-quality companies whose stocks we believe are undervalued), no matter what.

If we correctly assess “high quality,” then the businesses should not be materially hurt by Brexit (or the panic du jour). Brexit will take years to unfold. Whether it ends up being more of a political vs. economic event, it likely will lead to increased volatility.

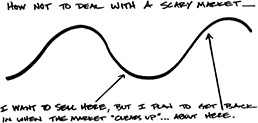

My friend Carl Richards of BehaviorGap.com recently published excellent advice on helping advisers deal with clients in “scary markets.” First, be thankful you’re the one they turn to in times of trouble. Second, empathize with the very real emotions they are feeling. Third, if they say they want to sell everything, ask if this is a permanent exit or, more likely, temporary.

If it’s the latter, if you ask when they intend to get back in, you’ll probably get “when the dust settles.” If it follows prices will be higher when that happens, that sounds a whole lot like selling low and buying high—not a recipe for long-term success.

Remember what Benjamin Graham (Warren Buffett’s professor) said: “In the short run, the market is a voting machine [i.e. prices set by fear/greed], but in the long run, it is a weighing machine [i.e. prices set by company fundamentals].”•

__________

Kim is the chief operating officer and chief compliance officer for Kirr Marbach & Co. LLC. He can be reached at (812) 376-9444 or [email protected].

Please enable JavaScript to view this content.