Bills on underused school buildings, cursive writing advance

Meanwhile, Hoosiers have their first new law for the year—and it’s a retroactive business tax deduction in time for tax season.

Meanwhile, Hoosiers have their first new law for the year—and it’s a retroactive business tax deduction in time for tax season.

Although the proposal advanced 8-0, lawmakers cautioned that the bill still needs more work. More amendments are expected in the full chamber.

House Bill 1143, which sought to establish “The Hoosier State” as Indiana’s official nickname, died in a House government committee Tuesday after historians raised questions about the “Hoosier” origin story outlined within the proposal.

The latest draft of the proposal also targets transgender students by prohibiting school employees from using a name or pronoun that is inconsistent with a student’s sex without a parent’s written consent.

The Catholic Diocese of Fort Wayne-South Bend is defending a private high school in northern Indiana after a top Republican lawmaker admonished the school for “disgusting” behavior.

The spending plan also falls short of Gov. Eric Holcomb’s recommendations for public health funding,

Indiana House Republicans will seek to expand the state’s “school choice” program despite a top GOP senator’s call for more voucher school reforms.

A bill that would raise the speed limit for trucks on certain Indiana roadways advanced to the full Senate on Tuesday despite opposition from the state’s largest truck drivers group.

The proposal seeks to advance the construction of carbon capture and sequestration projects, while also giving special privileges to a company preparing to undertake the nation’s largest carbon dioxide storage project.

A top Republican lawmaker threatened to hold up new state spending for Indiana’s voucher school program after he claimed to have witnessed “disgusting” behavior at a private Catholic school in Indiana.

The proceedings stem from an ongoing legal saga between Rokita and Dr. Caitlin Bernard, an Indianapolis OBGYN.

The measure would provide multiple remedies to temporarily drop tax bills, including through a short-term property tax cap and an increase in state income tax deductions. It would also curb how much local units can raise their tax levies.

Indiana House lawmakers advanced a bill Monday that could encourage more natural gas in the state and allow utilities to charge ratepayers for a plant before it ever goes online.

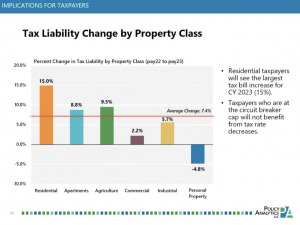

Taxable residential assessed values shot up 15% in Indiana from 2021 to 2022—even after tax abatements, deductions and credits—according to data from the Association of Indiana Counties.

State lawmakers in House and Senate education committees collectively took up more than a dozen bills on Wednesday. Most of those measures advanced or are scheduled for committee votes next week.

State lawmakers are prioritizing multiple bills in the current legislative session that seek to increase data privacy, but it doesn’t appear that lawmakers have an appetite to regulate common surveillance technology such as license plate readers used by law enforcement.

Last year, a similar bill got a hearing in a House committee but never received a vote. Nearly two dozen education advocates testified against the previous bill and no one spoke in favor.

A new study projects homeowners’ bills payable this year could increase as much as 15%. That’s more than double what previous reports estimated for the upcoming bills.

Dozens of bills are already advancing through committees and legislative chambers halfway through the third week of Indiana’s 2023 session.

A national pet brand chain is a driving force behind two Indiana bills that would block local communities from enforcing outright bans on the retail sale of pets. Such ordinances already exist in cities like Bloomington and Carmel