Simon hiring from within to replace departing CFO

Brian McDade has been with the retail real estate giant for 14 years, serving in various senior finance and accounting roles.

Brian McDade has been with the retail real estate giant for 14 years, serving in various senior finance and accounting roles.

Only about $3 billion of retail real estate changed hands in April, a 27 percent drop from a year earlier and the lowest monthly tally since February 2013.

The two-story location is one of 63 Sears that parent Sears Holdings announced Thursday were “non-profitable” and would be closing.

Kite Realty Group Trust now sports a whopping 8.5 percent annual dividend yield—by far the highest of any publicly traded firm in Indiana—a reflection of the cold shoulder investors are giving retail real estate companies as internet sales soar higher.

David Simon, CEO of Indianapolis-based Simon Property Group Inc., says a “significant number” of tenants are underreporting sales, costing the nation’s largest mall owner a lot of money.

Shopping center giant Simon Property Group Inc. on Friday reported a strong first quarter that exceeded analyst predictions.

The rebound taking shape in parts of the retail industry eluded the owner of the Saks Fifth Avenue and Lord & Taylor department stores, which failed over the holiday season to reverse a decline in same-store sales.

Brookfield Property’s deal to take over shopping center landlord GGP Inc. isn’t winning over Wall Street analysts, nor is it scoring points with investors in retail real estate stocks, including Indianapolis-based Simon Property Group.

GGP Inc., known as General Growth Properties until changing the name a year ago, is the second-largest U.S. shopping mall owner behind Indianapolis-based Simon Property Group.

Andrew Juster joined the Indianapolis-based company in 1989 when it was known as Melvin Simon & Associates.

The collapse of Toys “R” Us Inc. is yet another blow for landlords—including Indianapolis-based Simon Property Group—who now will have gaping holes of suburban retail space up for grabs. And few tenants would want them.

The very first enclosed shopping center developed by mall giant Melvin Simon & Associates is shutting down at the end of the month. The looming closure of anchor tenant Carson’s was the last straw for the struggling property.

Starbucks Corp. Chairman Howard Schultz said he sees a blessing in all the retail vacancies across the United States—landlords are beginning to reduce rents.

The Indianapolis-based mall owner broke a record in 2017 in a metric for operational performance, but its CEO admitted to analysts on Wednesday that it needs to boost occupancy at its properties.

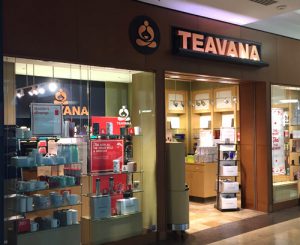

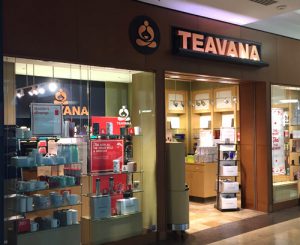

The Indianapolis-based mall owner had sued Starbucks, attempting to stop the coffee giant from closing dozens of Teavana locations at its properties.

The Indianapolis-based retail real estate giant is spending $1 billion annually to upgrade its high-end properties, including adding splashy non-retail features like housing and hotels.

The company said it hasn’t lost faith in brick-and-mortar retail but now is broadening its development focus in a quest to continue increasing the value of its real estate holdings.

A Marion Superior Court judge has granted the Indianapolis-based mall giant’s request for a temporary injunction, at least for now preventing Starbucks from closing 77 Teavana stores in its properties nationwide.

GGP, formerly known as General Growth Properties, is the second-largest shopping mall company behind Indianapolis-based Simon Property Group. Simon tried to acquire GGP in 2010.

Shares in the Indianapolis-based shopping mall owner slid Friday morning despite a mostly positive quarterly financial report. A negative quarterly report from J.C. Penney was the likely factor.