Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

What’s next for the two city blocks that are now Circle Centre mall could start coming into focus over the next year.

Circle Centre Development Co.—which owns much of the mall, though not the land underneath it—announced this week that it has asked five design groups to submit ideas for reimagining the space in the core of downtown.

The firm said it’s also looking to partner with a developer for what will likely be a massive revamp of the 1-million-square-foot campus.

Circle Centre Development, which has 17 owners, all companies with some ties to Indianapolis, is keeping mum about precisely what it has asked the design groups to do, how much it might be willing to spend on the project, and how much of the mall structure might remain in a revamp.

But experts say it’s been clear for a while that the mall—opened in 1995—doesn’t serve the needs of today’s consumers and that a successful revamp must include broader uses, which would likely include housing.

“The ownership group has had ongoing conversations for several years, as it relates to potential redevelopment options for the mall,” said Adam Collins, an attorney who represents the ownership group. “The pandemic just made it simpler for everybody to decide that now is the time to really focus on those redevelopment efforts.”

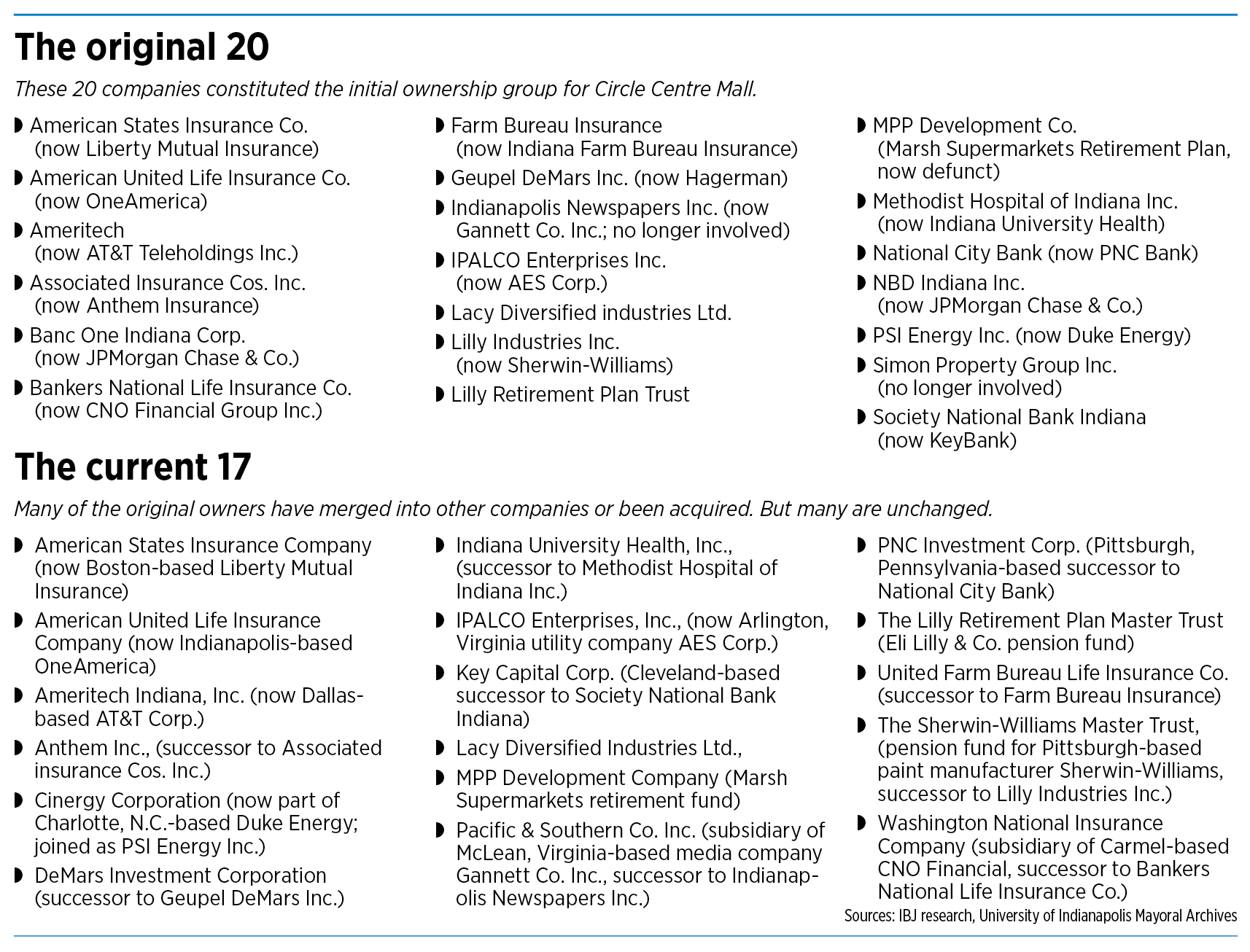

The owners’ move to seek ideas for the space comes after Indianapolis-based Simon Property Group Inc., one of the original mall investors and until recently manager of the space, sold its 15% share to the remaining owners late last year. Through Collins, a partner at Indianapolis firm Wallack Somers & Haas, the remaining owners said the sale helped clear the decks for rethinking the space.

Collins said the reimagining process is still in early stages, with the ownership team set to examine ideas through the end of the year. Final decisions will be dependent on securing a development partner, he said.

“The plan is to have a separate development partner who has significant experience in both adaptive reuse and in structures similar to the mall come in and be a part of that process,” Collins said.

“The timeline will be driven by the participation we get,” he said. “But the ownership group is focused on seeing Circle Centre transition as quickly as possible. Some of that will be determined by, ultimately, what the market tells us.”

Complicated structure

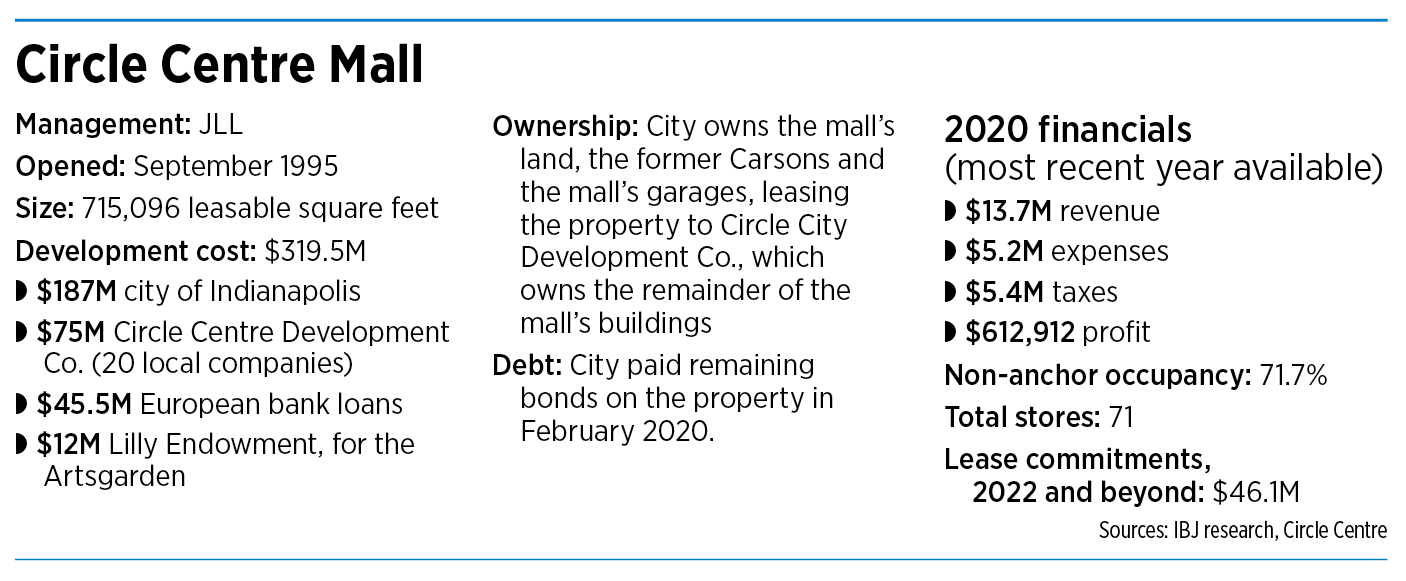

The mall’s ownership and structure are complicated, the result of a public-private partnership that got the project built after years of problems.

Former Mayor Bill Hudnut and his successor, Mayor Steve Goldsmith, crafted the deal that led more than a dozen Indianapolis companies, including Simon, to invest in the mall.

The number of companies swelled to 20 shortly before the mall opened, with the group contributing about $75 million to the project. Today, 17 businesses are involved in the ownership group, but it’s not clear how many are original owners.

The mall was developed by fusing a number of existing buildings and facades with new structures. Circle Centre Development owns many of the buildings, including all the sections built specifically for the mall.

But the land is owned by the city and leased to the ownership group through an agreement with the Department of Metropolitan Development. In addition, the city owns the northeastern-most building in the complex, where Carsons was located, and has leased it to Circle Centre Development through a separate agreement.

Some spaces, like the buildings that house St. Elmo Steakhouse and the Le Meridien hotel, are owned by their respective parent companies. The city also owns the parking garages at Circle Centre; they are managed by locally based Denison Parking.

Because the city owns the land and helped underwrite more than half of the original project, it has a vested interest in its redevelopment. But it has little control, outside the normal zoning and design approvals needed for any downtown project. The ownership structure and property agreements give Circle Centre Development extensive leeway in determining how the buildings are used.

Even so, Collins acknowledged the city will play a significant role in repositioning the mall. That role will likely include another investment, probably funded through revenue from the city’s downtown tax-increment-financing district.

Portia Bailey-Bernard, vice president of Indianapolis economic development at the Indy Chamber, said that, while the city is taking a back seat to Circle Centre Development on plans, the Hogsett administration still is likely to advocate for a residential component to the project.

That’s also likely to include a demand for supportive retail and additional amenities—making for a project Bailey-Bernard said is likely different from what it would have been before the pandemic, which perhaps would have included a stronger focus on office space.

“With the shortage we’ve seen in our housing supply, we can’t have enough residential in our downtown space,” she said. “And so my conversations with the city and [Department of Metropolitan Development] are in support of more residential in our downtown core.”

Plenty of ideas

Community leaders have been privately—and sometimes publicly—debating and brainstorming ideas for the mall space for more than a decade, since Nordstrom in 2011 became the first of two anchors to leave. Over the years, more stores followed, but the biggest blow came in 2018 when Carsons left, leaving 145,000 square feet empty.

Since then, Simon has worked to find new uses for the mall spaces—both inside and outside. The Indianapolis Star moved into the Nordstrom space. A coworking space is headed for a first-floor former restaurant spot. A technical college taught classes for a while on the fourth floor. And many more restaurants and bars now ring the outside of the buildings.

But the Carson space has proven especially difficult to fill. It remains vacant.

Ideas for mall reuse have ranged from smaller renovations to create new office and entertainment spaces, to large-scale revamps that include the demolition of large sections of the mall to make way for high-rise multifamily properties, hotels and other commercial uses.

John Talbott, director of the Center for Education and Research in Retailing at the Indiana University Kelley School of Business, said tearing down part of the structure is complicated by the existing restaurants and parking garages, the latter of which are expensive to build.

But Talbott added there are opportunities for another downtown grocery to take over part of the mall, or maybe one of the new brick-and-mortar Amazon stores, as well as apartments and offices.

“They really could make it a mixed-use experience center that can fit into the downtown area,” he said. “This is a place that, with a bit of adaption and creativity and some capital, can be redeployed for this particular decade and the upcoming ones.”

Sherry Seiwert, president of Downtown Indy Inc., said the property presents a “great real estate opportunity” in downtown’s core, particularly if the ground-floor retail can be salvaged while upper floors are repurposed. But she said razing part of the property—probably the southern portion, between Maryland and Georgia streets, which was purpose-built for Circle Centre—could also work.

“There’s so many assets that exist there that I don’t think we will have difficulty finding reuses [for],” she said.

Mayor Joe Hogsett’s chief of staff, Taylor Schaffer, said the owners should expect plenty of options from the participating design firms, which include local and out-of-state organizations.

The groups pitching ideas include:

◗ a partnership of Indianapolis-based firms Ratio Design and Meticulous Design + Architecture;

◗ Indianapolis-based CSO;

◗ a partnership of Indianapolis-based Woolpert and Miami-based Arquitectonica;

◗ Fort Lauderdale, Florida-based Dorsky + Yue International Architecture; and

◗ the Ball State University College of Architecture and Planning, in Muncie.

“I think it’s notable that the development group’s initial step was to bring on a variety of architecture firms, some local and some with experience here and to imagine what the footprint could look like,” Schaffer said. “I think that is probably indicative of where they are in terms of really reimagining that space.”

Collins said the owners are allowing the designers to take the lead, but noted that the facility’s operations would need to be “financially sustainable,” regardless of what direction they take.

Even so, he said, the owners “are actively looking at potential redevelopment that will provide a continued catalytic and transformative effect on downtown Indianapolis.”

Ownership shifts

The recent withdrawal of Simon, which was a driving force behind the mall’s development, was “a mutual decision made by the owners to benefit Circle Center Development Co.,” Collins said. He declined to elaborate about who proposed that the company step aside or how much Simon was compensated.

Simon did not respond to emailed questions about its decision to leave the ownership group.

At the time called Melvin Simon and Associates, Simon developed the mall and managed the property until last April, when it handed the reins to the Indianapolis office of Chicago-based JLL.

Mike Wells, president of Carmel-based REI Real Estate Services, said he wasn’t alarmed or surprised to hear about Simon’s exit. The mall has historically underperformed compared to the rest of the company’s portfolio, Wells said, noting that a change from a mall to something else might not have been a direction in which Simon had interest.

He said the change is a “good thing,” and that he hopes it’s a sign the ownership group is “trying to understand what the market is looking for.”

Wells said that, because mall ownership might still consist of corporations with ties to Indianapolis—the original group included the Eli Lilly and Co. retirement fund, the parent of Indianapolis Power & Light (now AES Indiana), Lacy Diversified Industries Ltd. and several locally based insurance and banking institutions that have since been gobbled up by larger companies—they might feel more of a sense of local corporate citizenship than Simon, which manages properties all over the world.

The remaining owners will “now be able to control their own fate and decide … exactly what they want to try to do and how they want to invest,” he said.

They might be more attuned to “the bigger picture of downtown Indianapolis and the city itself and will be more likely to do something that’s advantageous, even though it may not have a double-digit return at the end of the day,” he added.

Goldsmith, who was mayor when the mall opened, told IBJ he believes the mall “survived well beyond original expectations” given the massive changes in the retail landscape, including the advent of online shopping.

But to allow the property to move to a new phase, he said, consolidating ownership even further could go a long way.

“The ownership structure was necessary at the time—the only way to get the project financed and built,” he said. “But the number of owners, some now not even local, presents obstacles to reimagining the future. New ownership is an important step forward.”

Collins declined to specifically say whether the ownership group plans to remain involved in the project once a developer is selected, but he indicated there’s an appetite for continued involvement.

Talbott said the fact that the ownership group is seeking a partner indicates the owners want help financing whatever comes next.

Incentives guaranteed?

The mall has not been particularly lucrative in recent years. From 2018 to 2020—the most recent years available—it had $2.9 million in profit, despite seeing a decline in occupancy and sales per square foot, according to annual reports on the property filed with the city.

In 2020, as the pandemic decimated in-person retail, sales per square foot were about $184, after several consecutive years of sales in the low $300s. Compare that to 2007, when annual sales were about $406 per square foot.

In fact, the city itself (which financed $187 million in bonds for the project, which were paid off in 2020) has reaped far more from the property than the owners in recent years. The mall has generated $69 million since 2015.

“This has been an incredibly important asset, both for the ownership group and for the city, for the last 30 years,” Talbott said. “I think all parties are committed to seeing that that continues.”

City officials said they expect any redevelopment will be accompanied by incentives. That’s likely to come in the form of tax-increment financing—the tool the city uses most often for big developments.

“Anytime there are incentives on the table, we want to ensure that we are leveraging those in a way that is going to have the most impact possible on behalf of both the property that we’re focused on transforming but also for the benefit of taxpayers,” Schaffer said.

The Indy Chamber’s Bailey-Bernard said she is all but certain taxpayer dollars will be allocated for the mall like they were in the 1990s, but it’s too early to tell how much.

“As with all developments,” she said, “it just really depends on where the gap is and where the need is, for the city and or the state to step in and provide those incentives.”•

Please enable JavaScript to view this content.

Kinda strange to refer to the L. S. Ayres building as “the Carson space”, considering the original landmark occupant was there for a century and Carson Pirie Scott was a tenant in part of the space for a decade.

No need to tear any part down. Keep and expand restaurants all around periphery of mall. Convert 1-2 floors to high-end apartments; 1-2 floors high-end boutique hotel. Keep and expand entertainment options on 4th floor, and keep food court. And a Target or similar in Carson’s spot. Lots of potential in CC Mall redevelopment.

Really like the idea for the Carson’s spot, it’s clearly needed for downtown residents and visitors. Also agree lots of potential for the Mall’s redevelopment.

High-rise living!!!!! With plenty of retail, restaurants,and entertainment!!!!! Plenty!!!

The only way to accomplish that would be to demolish portions of the mall, as it was not built with adequate footers for high-rise development. Which is a shame, because the original renderings of the mall showed a mixed-use development with several anchor high-rises. Why doesn’t IBJ reprint the original renderings so they can be used as a baseline comparison against any new proposal?

Just no windows….LOL

Whether it’s apartments or a hotel, how do you bring in windows and daylight. City views? More challenging space than meets the eye.

You would bring in windows by adding windows, though some of the views may not be that great. But, modern urban malls/department stores have been redeveloped into residential units before, Pittsburgh offers one example with Piatt Place condominiums.

In fact, for residential units, the developers would legally be required to add windows to meet the building code.

The floor plates are too large for residential conversion. Demo and rebuild with smaller floor plates is the only way to get the proper depth for an apartment or condo.

This is the perfect opportunity for Indy to do something major and creative.Indy lacks more live entertainment.There needs to be more to do downtown after visitors attend conventions and sporting events, than just your typical sports bar or steakhouse.Houston redeveloped their old post office downtown: Houston Post its called.Indy could do a similar concept.Also Indy should think BIG,like a really nice aquarium or aquarium restaurant like in Nashville or Houston.I would also like to see something like an Area 15 in Las Vegas.Some adult Entertainment and premier night club is also needed, considering the NBA ALLSTAR game attracts celebrities.I know Indiana is conservative but many visitors look for adult entertainment and for a city Indys size and all the events that comes here,we are seriously lagging in that department for a major city.

Hope this is redeveloped better than Union Station was. Remember the original downtown mall?

Maybe they could reactivate some of the old facades/entries along Washington Street. Maybe they could also do it without taxpayer subsidies. Maybe.

The aquarium idea mentioned above would be incredible. This area definitely needs something different than more sports bars, steak houses, or generic housing. This would be a great opportunity to build a sizeable remote work location — a place to rent monitors and engage with other people that work from home or work remote. Use this massive, central space to build community and increase meaningful connections between the residents of downtown Indy!!

Please – let’s stop and think. Why did the original Circle Centre mall decline? While Covid exacerbated the situation, the decline began well before Covid (think Nordstrom closure), so let’s not use that excuse. Why did stores close up? Too few customers? Why did people (that spend money) stop coming to the Mall? What about Washington Square, Lafayette Square, and increasingly, Castleton. The Fashion Mall seems to be doing OK, though…

The trend towards online shopping and decline in brick and mortar establishments can be in part offset by more mixed use, I’d agree. However, I don’t think that comprehends the elephant in the room – safety and security [which is a common denominator for Washington Square, Lafayette Square, and the current declining of Castleton]. Going shopping, dining, to a club to see live entertainment, or residing in an area isn’t terribly attractive if you are concerned about safety and security. From a marketing perspective, that doesn’t spell success.

I think the view is it hasn’t gotten better, statistics say it is worse. So I wonder how any “revival” will fare without that fundamentally changing?

Are you, as a taxpayer, willing to spend the money on more police officers and towards the construction of a low barrier shelter for the downtown homeless population? I know I would.

The legislators of the state of Indiana, for all their complaining about the safety and security of Indianapolis, are more interested in things like imposing restrictions on bail nonprofits that don’t exist for regular bail bondsmen.

The current influx of money using to hire a few more police is coming from Washington DC but still isn’t enough.

Joe B – as someone who has run a private enterprise, I’d bet I could look thru the city’s budget and come up with plenty of monies for additional policing and even some shelter for homeless by cutting some of the ridiculous unproductive staffing that I see at the City-County building, as well as “feel good but not effective” programs. Of course, I’d actually expect the policing to address those who break laws, not just continue to release them back into society. How many times do we see that an “alleged” criminal is a SERIAL repeat offender [btw – I love it when they use “alleged” when they have caught the criminal in the act – for example the driver in the Waukesha parade massacre].

I think that victims of individuals “released on bail” or in situations where the bail was set ridiculously low [Waukesha, again], or individuals where were set free based on DA’s not prosecuting the laws as written should be able to successfully sue the h*ll out of anyone and everyone involved in putting that individual back into society. I’d love to see criminal prosecutions in the egregious cases, but that will never happen. Clearly those doing the releasing aren’t real concerned about the public when they work on the releases of violent and/or serial repeat offenders – maybe some financial pain for their poor judgements will alter their views.

Be more specific. And I disagree that government should just be run the same way as a private business in all cases. It’s all well and good to run things lean, but the profit motive should be absent from many government services.

I agree that a “profit motive” is inappropriate for government. [And for the record, I think it is sometimes abused in private enterprise. While no doubt perceived as anachronistic in the context of modern wokeness, the notion of 7 deadly sins is in fact still alive and well in human nature – and Greed is one of the seven.]

I think what is most problematic in bureaucratic government organizations is (1) no real individual accountability for performance/behaviors, which in itself is then protected by the reality that the particular governmental organization is a true monopoly. For example, a DPW can be incompetent and inefficient because they have no competition – there is no alternative no matter how poorly they perform. The IRS, despite their sizeable budgets still has unbelievably antiquated IT systems [by recent accounts, 15 years or more since the last upgrade] that a private enterprise would be skewered for, yet they are apparently content to muddle along. My Federal returns have been hacked, as well as those of another family member. Hacking is unfortunately not uncommon, but clearly the IRS could/should have anticipated the scope of the problem and acted much sooner and more effectively in addressing it.

Recall the numerous recent (and not so recent) investigations where they found an incredible number of cases where Federal employees at many US Govt agencies were accessing porn using their govt supplied computers while ON THE JOB, including the SEC, the EPA, the Departments of Transportation, Justice, Interior, Labor, Commerce, Energy, Health and Human Services, as well as the Postal Service, NASA, the Ex-Im Bank, and the Social Security Administration. One of the EPA employees stated they had accessed porn “up to 6 hours a day for several years”. In the Office of Water for the EPA, one employee was “suspended for 5 days” (no word on whether it was paid or unpaid suspension). When contacted, agencies stated “… penalties for computer misuse, including the viewing of pornography, are flexible and can include written reprimand.” Wow – how harsh. In a private company, they would have been terminated without question once that came to light. No appropriate accountability, and no option for the “customer” (citizen) to show our displeasure by opting for another provider of the service. If you want to see for yourself, just search “which government agencies were found to have employees accessing pornography during working hours” – it was stunning. Why weren’t sites blocked on government systems – private industry makes considerable efforts to block access (or else they are accused of having a hostile workplace for insufficient efforts). Do you believe there was appropriate accountability for those government employees? I don’t, or it wouldn’t be so widespread over such a long period of time.

I don’t disagree with any of that and thank you for drilling down there. I don’t have an issue with government employing people and giving them a living provided they are productive employees. Obviously there are cases in which … they aren’t, to put it mildly.

It feels as though the patronage part of these jobs became an issue, so workers were isolated from that so we wouldn’t lose all institutional knowledge every four years … but that obviously has gone too far to where workers can loaf.

I think part of the issue is how we fund government and how the mission gets … muddled. I’m sure that is has to be demoralizing to come up with budget proposals to do what you truly think is best for the American people … only for Congress to send back what they have funded, which might be the things that don’t help anyone but specific Congresspeople (aka pork).

I also wouldn’t want any part of the lift it has to be to implement any system as massive as to what’s used in the government in, say, the IRS. Between the requirements and the procurement hurdles (which are likely there because of previous abuse), anything has to be obsolete before it even gets implemented. Sure, you can speed up that implementation cycle, but that would require even more people whose job is just to continually update the systems.

I guess that’s by I feel that private business experience might be useful, but there has to be recognition that succeeding in government may require different skills and different approaches than a private business would use.

Very valid point. That has been a huge concern, about downtown, of many people I know.

Indianapolis has claimed to be the amateur sports capital- let’s build on that and the fact that the NBA just moved their e-sports here. Build e- sports arenas, bring in NFL and NCAA teams, set up tournaments all year long.

With e-sports and legalized marijuana (yes, I know it isn’t yet legalized in Indiana, but somehow it seems pretty prevalent – must be those inter-state trips…), I can’t figure out why workforce participation for 18-35 year old males is at all time lows…. On the plus side, if we have the e-sports arenas hosting tournaments, maybe we’ll increase the amount of times many of those 18-35 year-olds leave their parents’ basements… Who would have thought we’d pay to watch people play video games – is this a great country, or what?

Just a matter of time before a casino becomes part of the discussion.

Unique opportunity, with the assemblage of such are high profile site, live, work and play should be the drivers. It could be collaborative space on steroids, but what will be the public price? Is it another community investment? 1995 to 2020, 25 year economic life. Union Station 1984 to 1993, 8 year economic life, this fact should be on the mind of any investment decesion.