Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowIndiana’s business tax climate placed ninth in a recent national ranking, but some Republican state legislators still have their sights set on cutting what they consider the last blemish on the state’s otherwise business-friendly tax structure: the business personal property tax.

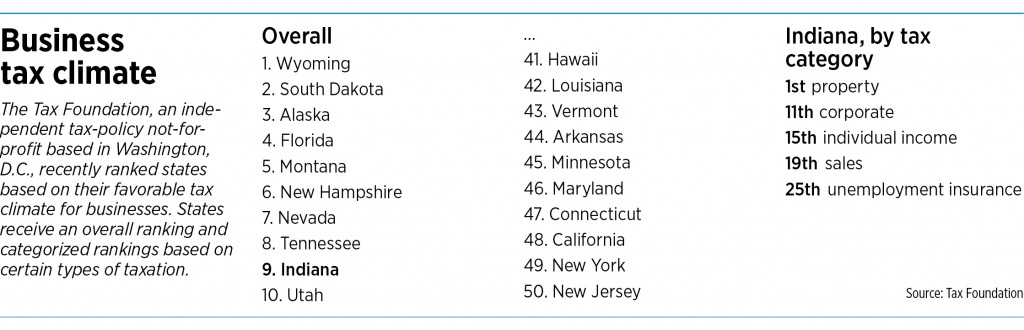

The 2022 State Business Tax Climate Index, compiled by the Washington, D.C.-based Tax Foundation, showed Indiana’s overall standing was particularly buoyed by its first-place ranking for property taxes and 11th-place placing for corporate taxes. The state came in 15th for individual income taxes, which also encompasses taxes for some businesses that aren’t corporations, 19th for sales taxes, and 25th for unemployment insurance taxes.

Indiana’s overall top 10 ranking in the Tax Foundation’s survey for the last several years has been largely applauded as a welcome improvement after the state languished lower in similar rankings in the late 1990s. The business tax climate improved as the state over the years cut the corporate income tax rate to 4.9% and eliminated the tax on inventory.

This year, Gov. Eric Holcomb and fellow Republicans in the Indiana House of Representatives have joined business groups in calling for a reduction in the business equipment property tax. But the move isn’t high on everyone’s priority list.

Senate President Pro Tem Rodric Bray, the Senate’s top Republican, didn’t include it on his list of legislative priorities. He and his caucus have taken a more conservative stance, despite the state’s burgeoning surplus, which is expected to reach $5.1 billion by the end of June. They have raised concerns about inflation and a possible slowdown in state sales tax collections when federal COVID-19 relief payments end.

Democrats, vastly outnumbered in both the House and Senate, would prefer to see more focus on workforce training, transportation assistance and child care.

Still, House Republican leaders see a need for change to stay competitive with other states.

“We’re the only one in the Midwest with that [equipment] tax,” stressed Rep. Tim Brown, R-Crawfordsville, House Ways and Means chairman.

While the state’s overall business tax climate is favorable now, Brown said it’s smart for legislators to look toward the future, as companies are going to be more technology- and computer-driven and have more equipment needs. He expects many will replace robotics and computer equipment that would be taxed under the current business personal property tax. Reducing that tax will “make Indiana more appealing,” he said.

Yet Brown acknowledged that local governments couldn’t afford to go without the tax if it were eliminated in a year or two.

“It’s going to have to be a phase-down or less reliance on that tax by local governments. I don’t know the answer to this long term,” Brown said. Because of the steady growth in assessed valuation, local governments are gaining more revenue, so “starting a slow decrease of business personal property tax could be doable.”

Some Republicans are considering cutting or phasing out the 30% depreciation floor in the business personal property tax rules. The floor requires businesses to pay a tax on at least 30% of the purchase price of machinery and equipment annually, even if equipment is several years old and no longer worth 30% of the original cost. That step would cut the property taxes businesses pay from $1.4 billion to $1.1 billion.

The phase-out of the 30% depreciation floor is one of the Indiana Chamber of Commerce’s legislative priorities this year, said Kevin Brinegar, the chamber’s president and CEO. “Our business personal property tax is one of the highest in the country,” he said. “Many states don’t have these taxes at all.”

While he acknowledged the state’s business tax climate has improved greatly, Brinegar said this tax is “the one thing that’s left and sticks out as a sore thumb.”

To him, it’s partly a fairness issue.

“Regardless of how old your equipment is or how much it has depreciated, you have to pay property taxes on at least 30% of the original value. That doesn’t make sense,” Brinegar said. “It’s something to keep the [state] property tax revenue more stable. But it’s really unfair if businesses have to pay 30% on property that’s only worth 10% of its original value.”

Rep. Greg Porter, D-Indianapolis, ranking minority member on the House Ways and Means Committee, said other priorities are more important for Indiana residents, and he questioned the value of improving business tax policies more.

“I don’t think we need to eliminate that tax,” he said. “Missouri eliminated corporate taxes in general, but now they’re trying to figure out how to pay for general services delivered to the localities.”

Porter said some other legislators stress the importance of being in the top 10 ranking for business tax climate and having a AAA bond rating. But during his years on the Ways and Means Committee, he said, he has asked what these lower taxes really generate.

“What is the return on lowering taxes? How many jobs are we creating by lowering these taxes? We never get that information,” he said.

Porter said the state needs to focus more on creating jobs in the workforce, training the workforce and making it easier for people to go to work by improving child care and transportation. “You can have a great business climate, but you have to have people to work,” he said.

Some Senate Republican leaders are skeptical, too, but for different reasons. They’ve voiced uncertainty over passing any permanent tax cuts before assessing the state’s coffers after federal pandemic relief money runs out and finding replacement income for local governments.

Sen. Travis Holdman, R-Markle, chairman of the Senate Tax and Fiscal Policy Committee, said he has encouraged fellow senators to sit tight and study the House’s proposal. “I’m not sure how we can make up those funds. When federal money dries up, it’s going to be difficult to do that,” he said. “I think we can talk about it. … But I’m uneasy about it.”

He acknowledged the importance of having a good national standing on business tax policies to attract and keep businesses here. Holdman also said businesses consider a whole package of factors, including taxes, quality of life, education and other issues.

Holdman plans to introduce another type of tax relief, though, that he said will help Indiana families. The measure would provide a 17-day “sales tax holiday” on goods purchased this summer, including school supplies, clothing and other large purchases. Sales tax revenue is up to more than 50% of overall state revenue, he said, so it seems fair to give this break to taxpayers.•

Please enable JavaScript to view this content.