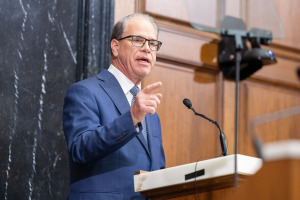

Braun replaces IEDC board with 9 new members

The sweeping move fulfills a pledge Braun made Thursday when he confirmed he planned to dismantle and reconstruct the existing board of the state’s economic development agency.

The sweeping move fulfills a pledge Braun made Thursday when he confirmed he planned to dismantle and reconstruct the existing board of the state’s economic development agency.

Gov. Mike Braun denied recent reports that he is privately discussing the idea of a 2028 run for the White House.

Ongoing negotiations in Washington, D.C., could undermine or fundamentally alter the third iteration of the Healthy Indiana Plan, otherwise known as HIP.

IBJ asked experts about Indiana’s rarely-used mayoral impeachment process and how Indianapolis would go about choosing another mayor.

More than two dozen K-12 education laws are set to take effect July 1, along with the state’s next two-year budget.

Indiana is the third most reliant state on federal cash–behind Louisiana and Mississippi according to the left-leaning Center on Budget and Policy Priorities.

Upwards of 3,000 Hoosiers attended Saturday’s protest, according to the Indiana State Police, who monitored the event from the perimeter and detained at least one participant after a scuffle with an opposing protester.

Gov. Mike Braun and Lt. Gov. Micah Beckwith are fans of the new exclusions—and so is U.S. Secretary of Health and Human Services Robert F. Kennedy Jr.

The new fiscal year begins July 1 and the agency has a plan to send the money owed once the funding is received from state budget officials.

The directive follows a grim revenue forecast earlier this year that projected the state would have $2 billion less to spend in the next two-year budget, prompting lawmakers to institute 5% agency cuts largely across the board.

The law, passed in 2023, covers public meetings held by state boards and commissions; elected school boards; county commissions; and county, city and town councils.

The Indiana Family and Social Services Administration, which manages the program, said cuts were necessary because former Gov. Eric Holcomb’s administration had grown the program without a sustainable funding source.

As Secretary of State Diego Morales takes heat for back-to-back international trips that blurred personal and professional lines, Republican hopefuls see an opportunity to challenge the embattled politician.

Previously Braun indicated that he intended to allow current board members to serve our their terms.

In a letter sent to employees Friday morning, Ivy Tech President Sue Ellspermann said state budget cuts will cost the community college more than $54 million over two years.

Mitch Roob is taking his second turn leading the Family and Social Services Administration, which has the single largest budget due to its federal funding. Previously, he led the agency under former Gov. Mitch Daniels.

About 100 Hoosiers attended the event, which featured numerous interruptions from both Beckwith and those in the audience.

Property tax tweaks and a new online portal were among this year’s legislative victories for Hoosier farmers.

The nearly five-minute ad shows Secretary of State Diego Morales visiting Marion County election sites in 2024 and includes footage of public employees and volunteers.

In a forecast revealed during a Tuesday commission meeting, lottery revenues were expected to end the 2025 fiscal year on June 30 down by almost 4%.