Indianapolis staffing firm to add 34 jobs

Network Connect LLC is hiring for positions in staffing, hiring, account management and business development.

Network Connect LLC is hiring for positions in staffing, hiring, account management and business development.

There are strategic elements in place today, including a 5G lab in downtown Indianapolis and the Indy Autonomous Challenge scheduled at Indianapolis Motor Speedway this year.

The recruiting technology company, which entered the local market with a single-employee office in 2014, began growing its Indianapolis operations after acquiring Canvas Talent Inc. in early 2019.

Casted plans to invest $425,000 and hire 62 more workers, which led the Indiana Economic Development Corp. to offer it up to $1.2 million in tax credits.

The New York-based firm plans to lease 10,655 square feet on the 15th floor of the 8888 Keystone Crossing office building in Indianapolis for its local operations.

In a memo to the Indiana Economic Development Corp. board of directors, Schellinger said he is leaving state government “with the deepest sense of gratitude and joyful satisfaction in my heart.”

Wunderkind Corp., a digital marketing company that was known as BounceX until last year, said it would co-locate its operations with SmarterHQ, which continues to maintain its own branding, at 9102 N. Meridian St.

A six-month public shuttle service will launch in Indianapolis in May and in Fishers in November. The project is backed by the Toyota Mobility Foundation and numerous other public and private partners.

Celigo, which makes software that helps companies automate business functions and IT services, already employs 17 Hoosiers who work remotely.

The Indiana Economic Development Corp. has pledged $8 million in conditional tax credits to San Francisco-based Stitch Fix, based on its hiring plans.

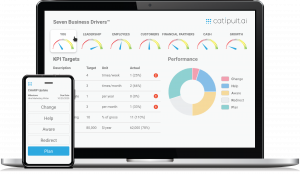

Catipult.AI, which is now located at 55 Monument Circle, said it will invest $2.6 million to expand its operations, including a move to a larger but yet-to-be determined space.

Kinetic Advantage, which helps finance inventory for independent car dealers, launched last July, but has already grown to 65 employees and is operating in 26 markets.

The state’s lead economic development agency announced Thursday that it secured 282 business relocation or expansion deals in 2020 that are expected to result as many as 31,300 new jobs.

Founded in 2013, Advanced Agrilytics provides farmers with data and strategies on seeding rates, fertility applications and in-season crop management.

The state’s pitch to keep Elanco Animal Health Inc. in Indiana for the long term began with a dinner at the Governor’s Residence two years ago.

Beyond the public company’s $100 million headquarters campus, city and state leaders expect 26 acres to be used for an expansion of White River State Park and new projects potentially with residential, retail and office uses.

The total doesn’t include the value of the land the state will give to Elanco Animal Health for the project. Even so, the combined city and state package is possibly the largest amount of tax breaks ever considered for an economic development deal in Indiana.

The state has offered at least $86 million in tax incentives, plus land for the project.

FullStack Inc. on Tuesday said it plans to add up to 21 employees by the end of 2024. The state offered the company tax incentives based on those hiring plans.

Qingyou Han, 62, and his wife, Lu Shao, 54, were ordered to pay a combined $1.6 million in restitution after pleading guilty to using more that $1 million in federal research funds for their own personal expenses.