Lilly’s $7M tax-abatement request advanced by City-County Council panel

The proposed tax abatement is related to a $91 million investment the company is making in a building at the Lilly Technology Center on Kentucky Avenue.

The proposed tax abatement is related to a $91 million investment the company is making in a building at the Lilly Technology Center on Kentucky Avenue.

A new study by BioCrossroads and Indiana University shows the sector’s economic impact grew about 1 percent last year, to $79 billion.

The move comes at a time drug makers, especially those that make insulin, are facing withering criticism for raising prices.

Spark Therapeutics Inc. will give Roche Holding a chance to make up ground in a field where single treatments may command more than $1 million. It also snaps up an asset that rivals like Novartis might have coveted.

Indianapolis-based Epogee LLC has developed a fat substitute to reduce the calories in sweets and other comfort foods. The new investment will allow the firm to scale up.

When the Indianapolis-based drug giant made its initial offer Dec. 20, it said it wanted to seal the deal before the J.P. Morgan Healthcare Conference, which ran Jan. 7-10 in San Francisco.

One of the three breakaway companies—ag division Corteva—has significant operations in Indianapolis. Corteva will be separately traded starting June 1.

The Bloomington-based maker of medical devices said Wednesday it would appeal the verdict of a federal jury in Indianapolis, which found the device was defectively designed. More than 4,000 patients have filed lawsuits.

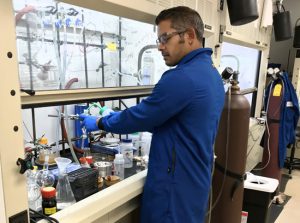

Researchers, led by Purdue chemistry professor Herman O. Sintim, are developing a series of drug compounds they say have shown promise in treating acute myeloid leukemia.

The Catalyst Award recognizes companies that excel in addressing recruitment, development and advancement of women. Today, nearly half of Lilly's senior leadership is female, up from 20 percent four years ago.

Connecticut-based Loxo Oncology, which was founded in 2013 and went public a year later, has a cancer drug in development that recently received U.S. Food and Drug Administration "breakthrough therapy" status.

Bristol-Myers and Celgene combined will have nine products with more than $1 billion in annual sales and significant potential for growth in the core disease areas of oncology, immunology and cardiovascular disease.

Developers of 16 Tech—a consortium of offices, laboratories, housing and retail space—believe the campus will become a powerful economic engine by fostering collaboration and innovation.

The decades-old system has long been criticized by experts for failing to catch problems with risky implants and medical instruments.

The escalation in per-share price—which far exceeds that of other recent deals involving Indiana public companies—reflects the unique nature of M&A in the pharmaceutical realm.

Justin Markel and Quinton Lasko are obsessed with feet and legs, technology and helping people improve their mobility. The combination led the duo to an invention designed to help athletes, although it has applications far beyond sports.

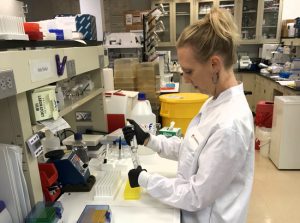

MiraVista Diagnostics, which processes more than 100,000 fungal-infection tests annually, plans to double the size of its headquarters near Indianapolis International Airport.

A few influential “serial entrepreneurs” in Indiana universities feel an itch to turn their discoveries into products and companies, over and over again.

The West Lafayette biotech firm’s stock traded as low as $1.41 last fall, following multiple setbacks and restructurings. But the stock had soared to $24 Thursday morning after news that it would be acquired by Novartis.

The deal represents a huge breakthrough for tiny Endocyte, which has about 90 employees in Indiana but has not yet launched a single product.