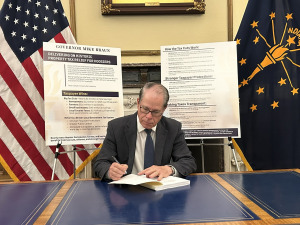

Braun signs orders calling for state water management plan, Rare Earth Recovery Council

Gov. Mike Braun’s new executive orders require the state to develop a statewide water inventory and management plan, and establish a body that will spearhead efforts to reclaim rare earth elements from legacy coal byproducts.