A 33-year-old Simon becomes force inside family company

Eli Simon, whose grandfather and great-uncles founded Simon Property Group more than a half-century ago, is quietly emerging as a key executive in the retail real estate empire.

Eli Simon, whose grandfather and great-uncles founded Simon Property Group more than a half-century ago, is quietly emerging as a key executive in the retail real estate empire.

The fate of a Steak n Shake that has been a fixture in Nora for more than 40 years may rest on how much slack a local judge will give the Indianapolis-based company. But a court ruling against the company could clear the way for a new Crew Carwash.

Eli Lilly and Co. included in its proxy statement an intricate graphic breaking down the presence of women and minorities in its overall workforce and in management.

The latest salvo was fired by Keith Stucker, an Indianapolis investment adviser who started Pier 48 with Fred Knipscheer, a former hockey player who entered the restaurant business more than a decade ago.

Protective Insurance Corp. soon will disappear from Indiana’s public company rolls, and part of the reason is Steve Shapiro, a guy you probably have never heard of.

The trustee liquidating the grocery chain this month asked the court to close the case, saying he had wrapped up the process of selling off assets and turning proceeds over to creditors.

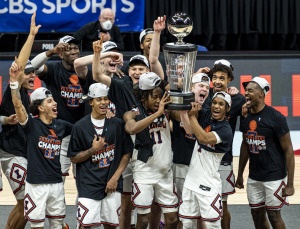

IBJ columnist and investigative reporter Greg Andrews explains why the rights to March Madness are so valuable even as the media landscape changes quickly. And he tells host Mason King why it’s unlikely that the NCAA or its broadcast partners will want to renegotiate the deal—which runs through 2032.

The past year has been awful for Carmel-based Invesque, as COVID-19 hurt the full gamut of its health care real estate portfolio, from nursing homes and office buildings to memory-care and assisted-living centers.

If you follow the daily drumbeat of news emanating out of Lilly Corporate Center, you might not grasp how phenomenally well the company is poised to perform in the coming years.

The IBJ is a weekly business journal, not a common daily. Calibrate accordingly.

A nontraditional way to take companies public is booming on Wall Street, leading to an unprecedented explosion of deals.

Joe Biden took the oath of office just before noon Wednesday during a ceremony at the U.S. Capitol. The presidential oath was administered by U.S. Supreme Court Chief Justice John Roberts.

President Trump declined to participate in any of the symbolic passing-of-the-torch traditions surrounding the peaceful transition of power, including inviting the Joe and Jill Biden to the White House for a get-to-know-you visit. But he did leave a note.

The chain nearly broke even in the latest quarter it reported, no small feat after losing a combined $29 million in 2018 and 2019.

Managing Editor Lesley Weidenbener has been elevated to the top spot in the newsroom, while Editor Greg Andrews transitions to a role focusing on investigative reporting for IBJ while continuing to write a column.

Biglari Holdings’ Sardar Biglari is pushing for reforms at Cracker Barrel Old Country Store even as Biglari restaurant Steak n Shake teeters.

Spices, yarn, fitness equipment and the Nintendo Switch are among the products that remain hard to find during the pandemic.

Despite pressure from frustrated families, some schools don’t plan to refund room and board fees, either, even if students aren’t staying in dorms or eating in cafeterias.

Even though the S&P 500 is near a record high, just 15 of 55 Indiana public companies tracked by IBJ are up for the year.

British retailer JD Sports Fashion has had the Midas touch elsewhere in the world. Now, two years after gaining a foothold in the United States by buying Indianapolis-based Finish Line Inc. for $558 million, it’s beginning to show the same winning ways in this country. “I think you would have to say it has been a […]